Tornado Cash Developers Accused of Assisting Hackers in Laundering $1 Billion, Including Notorious North Korean Attacks

Blockchain Association Submits Amicus Brief Supporting Coin Center's Lawsuit Against U.S. Treasury Regarding Tornado Cash Sanctions

As the SEC moves in on Tornado Cash, Coinbase is fighting back

This month, the Office of Foreign Assets Control (OFAC) of the U.S. Treasury imposed sanctions on Tornado Cash. This was OFAC's first action against a decentralized finance (DeFi) mixer, and it could be a turning point for how DeFi is regulated.

If people in the industry are used to living outside of the rule of law, it may not be surprising that they aren't ready to respond or prepare for new rules. But DeFi won't be able to reach its full potential if its leaders don't face the fact that regulations in this area will only get stricter. Now, the only way forward is to take steps to work with regulators.

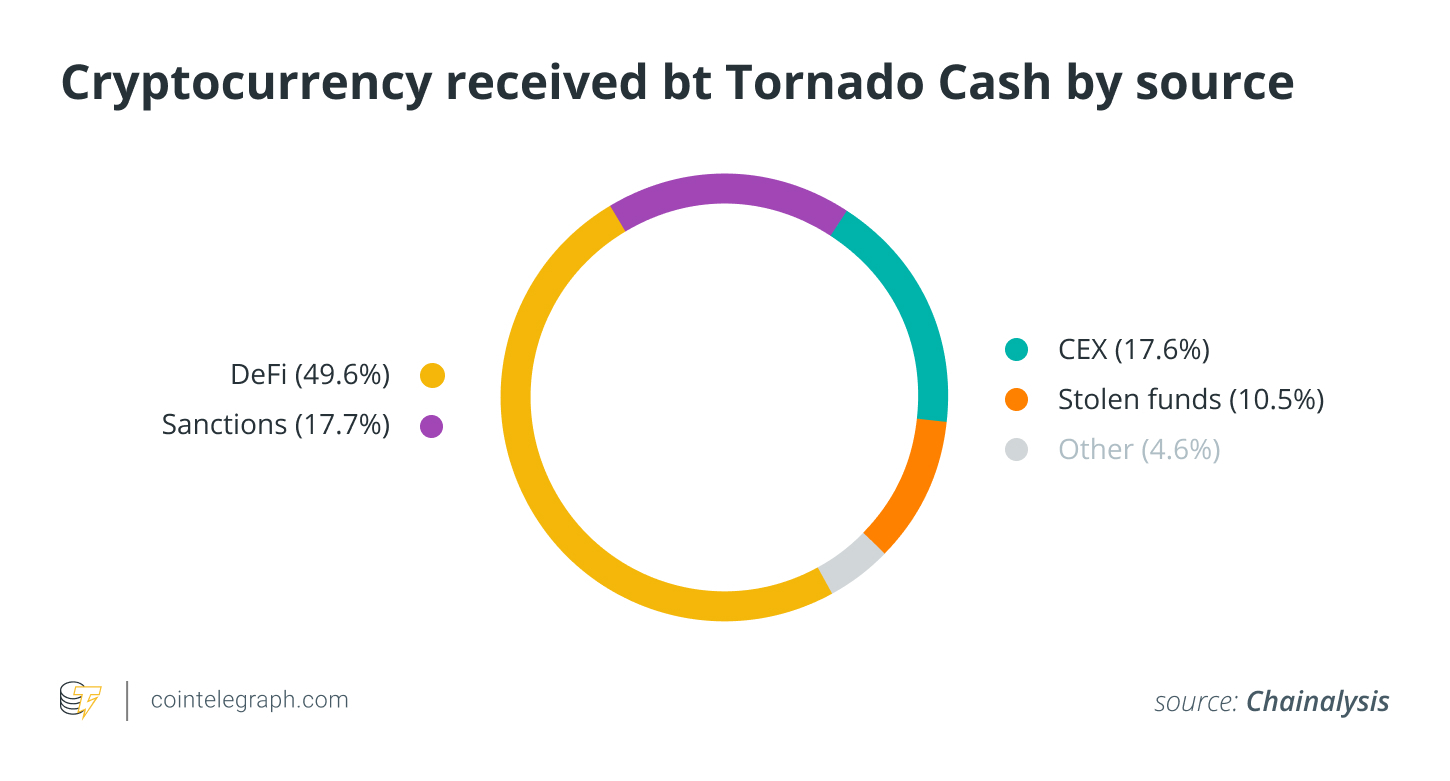

On August 8, OFAC went after Tornado Cash for handling transactions worth more than $1.5 billion on behalf of criminals, including cybercriminals from North Korea. The action has serious consequences: US people and businesses, including crypto exchanges and banks, are now not allowed to do business with Tornado Cash addresses.

This will make it harder for criminals to use the service, which has become a big part of cybercrime, to wash money. But OFAC's action against Tornado Cash makes it clear to everyone in the space that DeFi is now in the regulators' sights and won't be able to avoid regulation.

From what we know about the past, it is clear that regulatory scrutiny will only get tighter in the future. Most "DeFi think" tends to ignore or brush this fact under the rug, but this needs to be rethought. Regulators' motives are not malevolent. They are just walking a very thin line between stopping crime and destroying DeFi's good potential.

This is shown by a Financial Action Task Force (FATF) report that came out earlier this year. It said that cross-chain bridges are helping DeFi grow, but they are also making it easier for criminals to swap money, which creates money laundering risks. The bad things are about the crime, not the technology or what it could be used for.

If DeFi developers and other people in the ecosystem want their projects to be successful, they should think about working with regulators on compliance issues.

Concerningly, many DeFi developers and other people in the ecosystem have just shrugged and said that DeFi can't be regulated because that's how it works. The argument goes that DeFi can't be regulated because rules have to be put on centralized intermediaries and that's not possible. So, many DeFi projects haven't tried to follow the rules because they think they are safe from regulators.

For some, the thought of putting on a convincing front of following the rules has been enough comfort. But Tornado Cash shows that this is not true. The mixer said over and over that it was following OFAC sanctions, but the U.S. Treasury said in a statement about Tornado Cash that it "repeatedly failed to impose effective controls designed to stop it from laundering funds for malicious cyber actors on a regular basis and without basic measures to address its risks." No longer will window dressing do. Compliance protocols must now be very thorough.

Some people in the industry are aware of this fact, and a few DeFi projects have already started to put in place compliance controls in preparation for regulation. But this kind of planning is not very common, which is bad news for anyone who wants to see a competitive DeFi ecosystem in the future.

POV: it’s the year 2076 and the government is closing in on your 26 acre property in Montana after it was discovered someone on crypto twitter sent you .10 Eth from tornado cash 53 years ago pic.twitter.com/YWWAJGHizY

— John W. Rich Kid (Wendy’s Fry Cook) (@JohnWRichKid) August 13, 2022

The fact that regulators and the industry don't seem to be on the same page could be because of the threat of institutionalization. DeFi started out in a rebellious and off-the-grid way, but the fact that regulators are now paying attention to the space suggests that they and their friends in the big finance and investment industries see an opportunity.

Due to their interest, DeFi will now have to become a part of the mainstream. Institutions that are heavily regulated see compliance as a requirement for joining the DeFi space, and they won't fully join the space until they're sure it can work with regulation.

Investors are also interested in frameworks that protect their reputations and keep them safe from risks. No investor will want to put money into a DeFi project that gets blocked for letting people like North Korea do business with it. In this model, DeFi projects that don't take into account these regulatory concerns have a short shelf life.

The story of Tornado Cash has shown that the costs of not taking regulations into account when making DeFi are now too high to ignore. Compliance activities always have costs, but as institutionalization of DeFi becomes more likely, those who actively look to embrace regulatory compliance as they build out the DeFi ecosystem will grow while others fall by the wayside.

=========