Ripple's Acquisition of Crypto-Focused Chartered Trust Company Fortress Trust

SEC's Response to Challenge Groundbreaking XRP Ruling

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

The Securities and Exchange Commission (SEC) decided to establish two additional offices this autumn to offer specialist support to the seven offices already in charge of reviewing issuer filings due to the surge in filings from cryptocurrency issuers in the United States.

The SEC announced plans to add two offices — an Office of Crypto Assets and an Office of Industrial Applications and Services — solely dedicated to dealing with crypto assets and industrial applications and services, respectively, under the Division of Corporation Finance's Disclosure Review Program (DRP).

Renee Jones, director of the Division of Corporation Finance, provided insight into the change:

“The creation of these new offices will enable the DRP to enhance its focus in the areas of crypto assets, financial institutions, life sciences, and industrial applications and services and facilitate our ability to meet our mission.”

The Office of Crypto Assets will take over DRP's effort to examine crypto filings, allowing the department to devote its resources "to address the specific and emerging filing review challenges relating to crypto assets," according to the release.

Contrarily, the Office of Industrial Applications and Services will be organized to take over the Office of Life Sciences' non-pharmaceutical, non-biotechnological, and non-medical products.

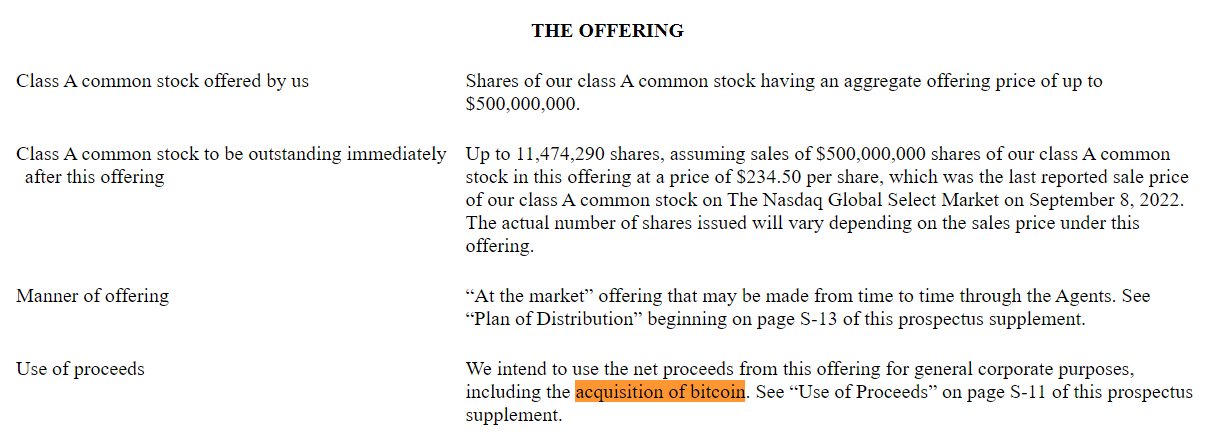

MicroStrategy recently declared its intention to sell $500,000,000 worth of class A shares and reinvest the proceeds "for general company objectives, including the acquisition of Bitcoin," according to an SEC filing.

About 129,699 Bitcoin (BTC) are held by MicroStrategy, and they were acquired over a period of time for a total of $3.977 billion. According to data from Bitcoin Treasuries, the company's BTC reserves have lost almost $1 billion as a result of the failure of cryptocurrency prices to rebound.

=========