First Mover Asia: Bitcoin Holds Firm Below $30K as Sam Bankman-Fried Returns to Incarceration

First Mover Asia: Bitcoin Demonstrates Resistance to CPI Effects

First Mover Asia: BTC and ETH Maintain Stability, While COMP and AAVE Experience Losses

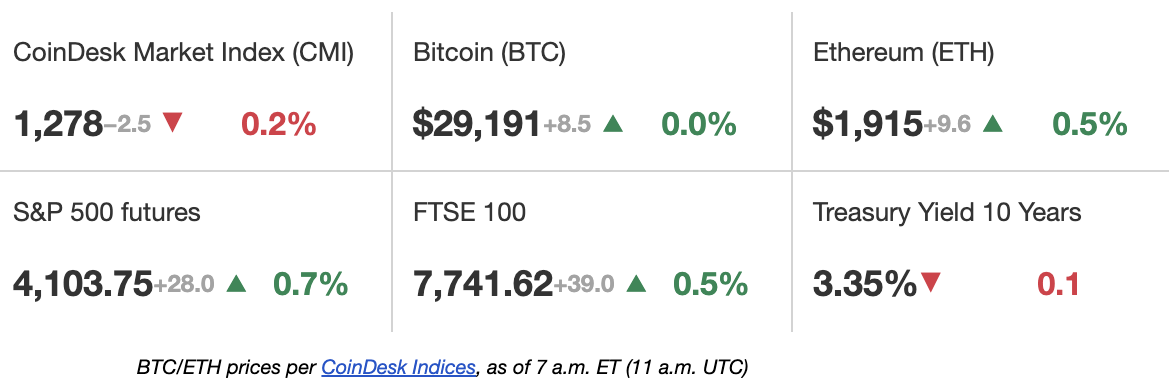

Latest Prices

Top Stories

Pepecoin (PEPE), a recently-launched token based on the infamous "pepe the frog" meme, has already achieved a staggering $1 billion market capitalization. According to data provided by CoinGeko, the token's value surged by 70% over the past 24 hours, hitting an all-time high. This impressive rally has not only put PEPE in the spotlight but also triggered a surge in trading activity for other meme tokens on decentralized exchanges. For instance, WOJAK and PEEPO have skyrocketed by more than 600% in just a week. Meanwhile, established meme tokens such as dogecoin (DOGE) and shiba inu (SHIB) have failed to replicate these extraordinary gains and are currently trading in the negative territory for the week.

The Financial Conduct Authority (FCA), the financial regulator in the United Kingdom, has intensified its efforts to combat illegal cryptocurrency ATMs. In partnership with local law enforcement agencies, the FCA has conducted inspections of several locations in Exeter, Nottingham, and Sheffield. These machines, which convert fiat currency into cryptocurrency, pose a significant threat to money laundering, and are required by law to be registered with the FCA. However, the regulator announced on Friday that none of these devices were registered. “Crypto ATMs operating without FCA registration are illegal,” said Therese Chambers, the FCA’s Executive Director of Enforcement and Market Oversight. “We will act to stop illegal activity.”

Coinbase, a popular cryptocurrency exchange, has reported impressive financial results for the first quarter of the year. According to FactSet, the company generated $773 million in revenue, surpassing the estimated $655 million and representing a substantial increase from the previous quarter's revenue of $629 million. Additionally, Coinbase reported an adjusted loss of $0.34 per share, significantly better than the estimated loss of $1.45 per share, and an improvement from the Q4 loss of $2.45 per share. Although trading volume for the quarter came in at $145 billion, slightly below analysts' estimates of $147.7 million, trading volume was still robust, given the previous quarter's volume of roughly $146 billion. As a result of the impressive financial results, shares of Coinbase experienced an 8% increase to $53 in after-hours trading on Thursday. For the year, shares are up approximately 40%, which is in line with Bitcoin's year-to-date surge of roughly 74%.

Chart of the Day

- The presented chart displays the weekly price movements of gold dating back to May 2017.

- The price of gold is poised to surpass its three-year trading range amidst a multitude of uncertainties, such as the U.S. debt ceiling dilemma, instability in the banking sector, and concerns of an impending recession.

- Amidst numerous uncertainties, such as concerns surrounding the U.S. debt ceiling, instability in the banking sector, and fears of a recession, the value of gold appears to be poised to break out of its three-year trading range. As investors seek out safe haven assets to protect against market volatility and economic uncertainty, the demand for gold is likely to increase, potentially driving its value even higher.

- Matrixport has suggested that a potential breakout in the gold market could have a positive impact on the value of bitcoin. As the two assets are often considered alternative investments to traditional stocks and bonds, a rise in demand for gold may also signal increased demand for bitcoin, as investors look to diversify their portfolios and hedge against market volatility.

- "Gold has been leading Bitcoin since November 2022 and both assets appear to be correlated," Markus Thielen, research and strategy head at Matrixport and the author of Crypto Titans said in a weekly report.

- "Bitcoin will likely fly higher under the wing of gold as the yellow metal makes new all-time highs," Thielen added.

Trending Posts

Source Coindesk