NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Latest Prices

Top Stories

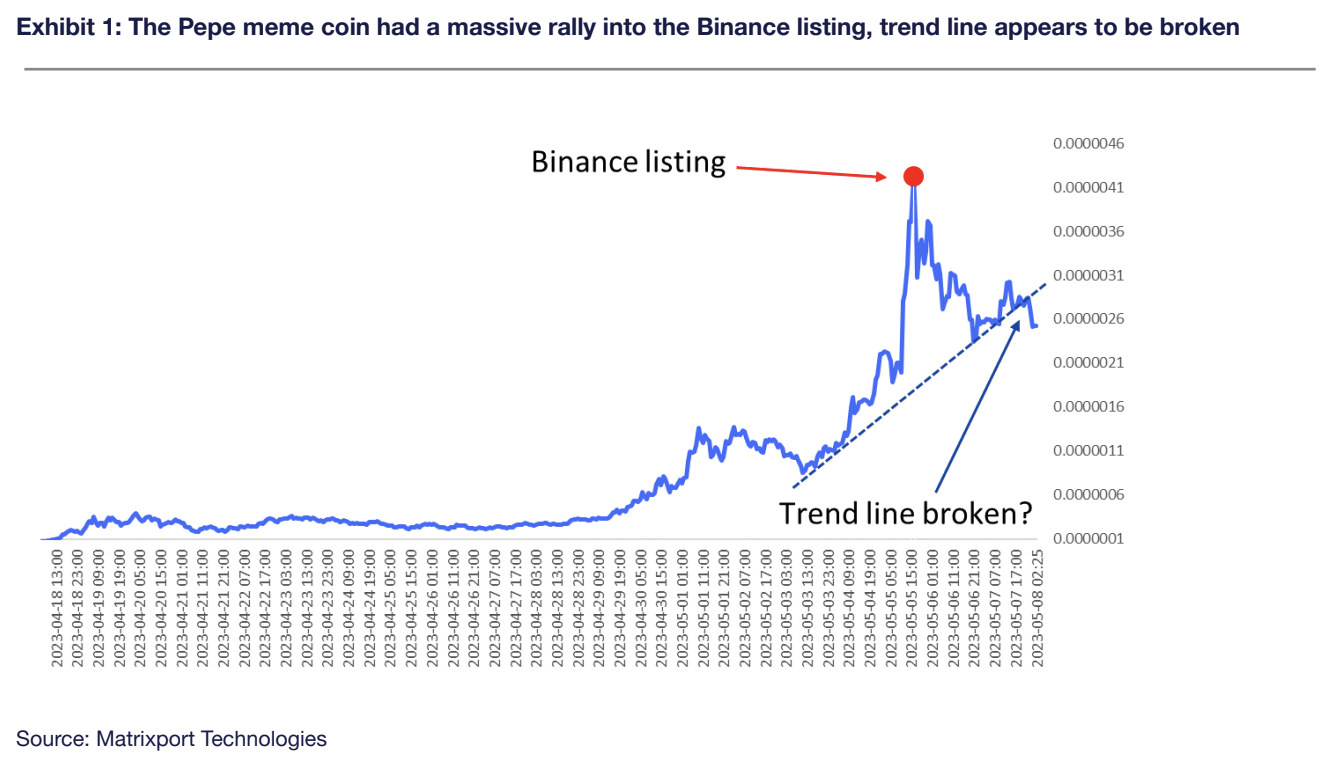

Pepecoin (PEPE) experienced a surge in its value after being listed on Binance, the world's largest cryptocurrency exchange by trading volume. However, this bullish trend has now come to an end. As of the latest update, the frog-themed cryptocurrency is trading at approximately $0.0000022, with its record high of $0.00000431 being recorded just 40 minutes after the Binance listing. The price decline in PEPE is likely due to a decrease in the volume of news surrounding the token, as noted by Markus Thielen, an expert from crypto services provider Matrixport. In a note to clients, Thielen explained that the declining buzz around Pepe has resulted in a subsequent downturn in its price. Additionally, it is speculated that early investors selling their holdings for profit may have contributed to the significant pullback in PEPE, according to CoinDesk's Shaurya Malwa.

Despite ongoing macroeconomic uncertainty, expectations for volatility in the leading cryptocurrencies, Bitcoin and Ether, are diminishing. Over the weekend, the Ether Implied Volatility Index (ETH DVOL) on the Deribit crypto exchange reached a record low of 51, extending a six-month trend of decline. Griffin Ardern, a volatility trader at crypto asset management firm Blofin, attributes the drop in implied volatility to a consistent selling of options by structured products. “Many sellers of these options are exchanges and third-party asset management institutions, and their customers are mainly groups that want to obtain fixed income, such as miners and whale groups,” Ardner told CoinDesk, explaining the unusually low volatility. Per some observers, now is the time to buy volatility, particularly in the ether market.

The Aave community has recently voted in favor of deploying their version 3 (V3) protocol on the Ethereum layer 2 ecosystem known as the Metis Network. This strategic move is expected to increase liquidity on both platforms, as well as offer liquidity mining incentives to Aave users. As part of this initiative, Metis will be providing 100,000 native METIS tokens to Aave users as part of their liquidity mining program, which will be distributed over a six-month period. At the time of writing, AAVE and METIS have experienced a decline of 4.5% and 3.5%, respectively.

Chart of the Day

- Bitcoin's price has experienced a notable downturn, breaking out of its triangular consolidation pattern and plunging below the widely-tracked 50-day simple moving average (SMA). This development could signal a bearish trend for the cryptocurrency in the short term. Traders and analysts will likely keep a close eye on the SMA as a key level of support and resistance in the coming days and weeks.

- Per analysts, the breakdown of the SMA support might yield a deeper sell-off.

Trending Posts

First Mover Americas: PEPE Meme Coin Achieves $1 Billion Market Cap Milestone

Pepecoin's Astonishing Surge Transforms Modest Investment into Nearly 5,000,000% Memecoin Returns

Source Coindesk