Bitcoin Bulls Encounter Headwinds as Monthly Stochastic Indicator Trends Downward: Analyst

Bitcoin's Most Oversold Levels Since Covid Crash Indicated by Key Metrics

Bitcoin and U.S. Real Yields Forge Strongest Inverse Link Since April

Bitcoin's value plummeted during Thursday's trading session, as investors appeared to disregard optimistic inflation and employment figures that had previously fueled the cryptocurrency's upward momentum in recent months.

At present, investors appear to be prioritizing concerns over banking and broader macroeconomic uncertainties, over other potential factors impacting the market.

Thursday saw a 0.2% month-over-month increase in Producer Prices (PPI), surpassing the consensus forecast of a 0.3% rise. However, Initial Jobless Claims in the United States rose to 264,000 for the week ending May 6, which is the highest figure since October and exceeded expectations of 245,000.

In the present economic climate, weaker employment data has tended to benefit risk-on asset prices, indicating a potential slowdown in the robust job market and a possible end to the much-criticized interest rate hikes by the Federal Open Market Committee (FOMC). However, worries about high employment levels fueling strong economic expansion and inflation have occasionally put pressure on asset markets.

Although there is seemingly positive economic news, the short-term sentiment in the crypto markets has displayed indications of uncertainty.

CoinCryptoUs's Bitcoin Trend Indicator has shifted from an "uptrend" to a "neutral" stance, indicating a decline in bullish sentiment. The BTI's approach incorporates the analysis of moving averages (MA), primarily their proximity to each other, particularly when one intersects above or below the other.

Bitcoin's recent price action reveals a bearish trend as its shorter-term moving averages have crossed below the longer-term ones. The 2-day and 10-day moving averages, as well as the 5-day and 20-day moving averages, all indicate a downtrend in the bitcoin markets. Consequently, this has led to the indicator shifting to a neutral stance.

The recent downtrend in the market is accompanied by an increase in short-term holders who are incurring losses and consequently transferring their coins to exchanges.

An increase in the movement of coins towards exchanges is typically an indication of a bearish market sentiment, as it suggests that investors are trying to sell their assets. In this case, short-term holding refers to BTC holdings that have been held for less than 155 days.

Over the recent period, short-term bitcoin investors have moved 14,800 BTC to exchanges, while long-term investors have transferred only 523 BTC. Interestingly, the amount of BTC being transferred by long-term investors who are incurring losses has seen a decrease.

The market sentiment among investors with varying time horizons has diverged, which is a common occurrence. Presently, it seems that the bearish outlook of short-term investors is shaping the overall market narrative.

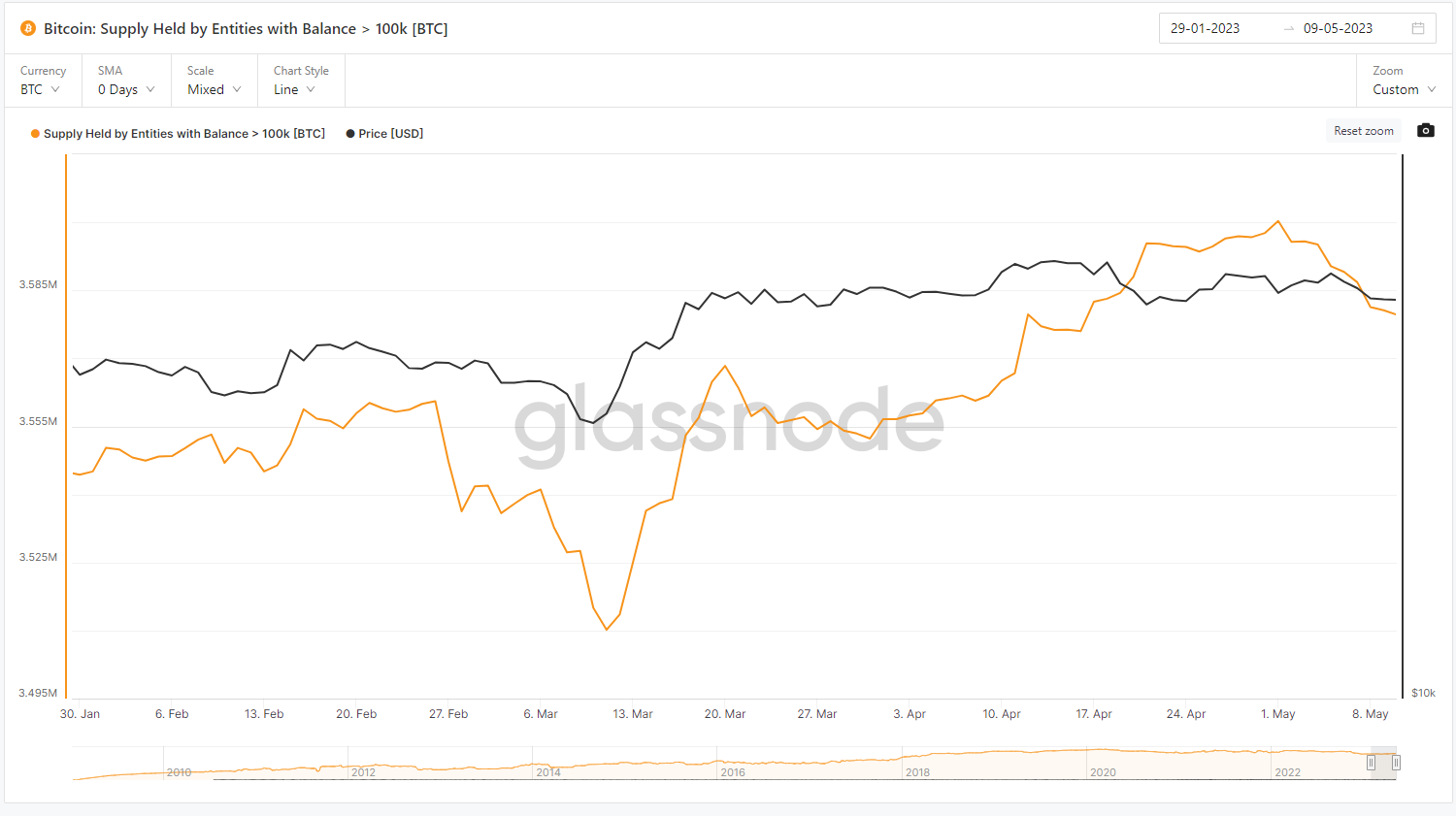

Another group that deserves close attention are whales, which refers to individuals or entities that hold more than 1,000 BTC.

Taken as a whole, whales are withdrawing coins from exchanges, indicating a bullish trend. However, among whales holding at least 100,000 bitcoin, their total supply increased by 2.5% from March to May but has been decreasing since May 1st.

The recent convergence of multiple factors has amplified the level of uncertainty in financial markets. Despite the resolute stance of long-term investors, it is crucial to keep a close eye on the behavior of short-term investors, particularly those who hold significant overall positions.

Source Coindesk