CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

Coinbase-Backed Insurance Disruptor OpenCover Launches on Layer 2 Blockchain

DeFi and Credit Risk

- Abracadabra is introducing measures to safeguard against a potential bad debt scenario arising from an $18 million loan extended to Michael Egarov, the founder of Curve Finance.

- If approved, the protocol will automatically liquidate the position by selling CRV tokens unless more collateral is added, which would further exert selling pressure on an already strained CRV market.

Amidst the frenzy of decentralized finance (DeFi) protocols striving to shield themselves from the perils of a substantial loan linked to crv (CRV) tokens, one platform is advocating for a bold and decisive approach – implementing an exponential surge in interest rates on the loan to swiftly liquidate the position.

Abracadabra Finance has put forth a bold proposition today, proposing the implementation of exorbitant interest rates on two distinct liquidity pools, which they whimsically refer to as "cauldrons." These pools consist of CRV tokens belonging to none other than Michael Egarov, the esteemed founder of Curve Finance.

Egarov has withdrawn $18 million from Abracadabra at the prevailing rate of 18%. However, the protocol proposed on Wednesday aims to increase this rate to 200%, essentially forcing him out. The intention behind this move is to minimize Abracadabra's overall crv exposure to a mere $5 million worth of tokens.

“Given the current outstanding principal is $18M, the base rate would be 200%. At this interest rate, the loan would be fully covered within 6 months. As the principal is repaid, the base rate would decrease,” the proposal read.

The hike doesn't involve a sudden increase in interest rates; rather, it is a progressive rate that commences at 200% and gradually decreases as the loan is repaid through the automatic sale of CRV tokens. By employing this approach, developers anticipate the loan to be fully settled within six months, and all generated profits will be directed towards the Abracabadra treasury.

“We believe this solution will reduce negative externalities associated with such positions compared to a simple interest rate hike,” developers wrote in the proposal.

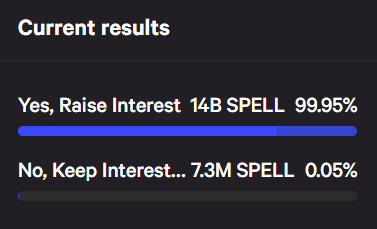

According to governance data, an astounding 99.95% of the Abracadabra community has given their resounding support to the proposal as of Wednesday, 13:00 UTC.

Governance vote showing a majority of members are for the proposal as of Wednesday. (Abracabadra DAO)

Additional concerns were previously brought up in a June post by a community member named "0xthespaniard." In the post, it was mentioned that while the 18% interest imposed on the significant loan substantially contributes to the protocol's profitability, the platform, in the end, encounters asymmetric downside risk.

“There are several indications that a liquidation would prove to be fatal to the Abracadabra protocol,” 0xthespaniard warned at the time. “According to Curve’s own DEX front-end, a 10M CRV swap (equivalent to approximately $6.7M at spot prices) is expected to cause a 30% price impact on Curve’s own DEX.”

“The gigabrains over at (risk management firm) Gauntlet conducted their own simulations and are estimating that the markets would struggle to support even a $6M liquidation," he added. "It seems incredibly unlikely that Abracadabra would be able to liquidate the full CRV position without incurring significant amounts of bad debt."

Curve Finance, a major platform for swapping stablecoins, experienced a significant exploit on Sunday, causing a sharp decline in the value of the CRV token and jeopardizing a substantial $168 million fund belonging to its founder, Michael Egorov, with the possibility of being liquidated.

This situation has led to bearish sentiment surrounding the tokens among traders, coupled with apprehensions that the liquidated assets might be sold in a market already experiencing declining prices. The significant liquidation of this position could exert pressure on other DeFi protocols since CRV serves as a trading pair and stability mechanism in trading pools throughout the ecosystem.