U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

Since the launch of Tether, stablecoins have been around in the cryptocurrency world. There haven't been any notable stablecoins in the Cardano ecosystem until recently, though. In a tweet, Cardano founder Charles Hoskinson said that stablecoins will be coming to the Cardano blockchain. Hoskinson is also the co-founder of Ethereum.

It was a quote tweet from the WingRiders Twitter account. Mr. Hoskinson used that tweet as the text for his own tweet.

Wingriders is one of the most exciting DEXes to launch on Cardano and now they are bringing stablecoins! https://t.co/Rpsl9znhyl

— Charles Hoskinson (@IOHK_Charles) April 12, 2022

With the help of the Milkomeda Foundation, WingRiders will be able to offer two stablecoins that are very popular on the Cardano mainnet blockchain.

The two protocols will use the Milkomeda Bridge sidechain, which was built by dcSpark, and its Ethereum Virtual Machine (EVM) to make it possible to trade stablecoins like Tether and USDC on Cardano for the first time. The stablecoins are meant to be safe assets for people who want to keep their money safe when the market is unstable.

Tether (USDT) and USDC stablecoins will work on Cardano in a way that makes sense.

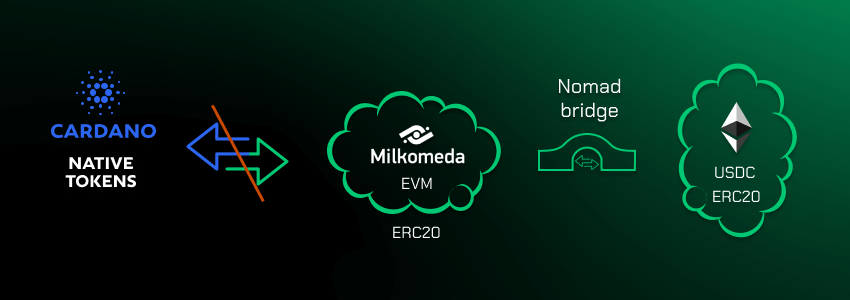

When people move their Ethereum-based ERC-20 tokens to the Milkomeda sidechain, they use Metamask and the Nomad bridge to do it (audited by Quantstamp). EVMs are used to run Milkomeda, which is a Cardano side chain. The ERC20 tokens that the user has are run by Milkomeda (for example on their Flint wallet or again using Metamask).

A gateway will lock these ERC-20 tokens, which will then be made into Cardano tokens on the Cardano blockchain. The Flint wallet can be used to do this, as well.

Smart contracts will be used to move wrapped versions of the USDT and the USDC around the world.

As soon as an ERC-20 version of a stablecoin is added to the Cardano network, a wrapped version of the stablecoin will be released.

Wrapped tokens are digital assets that have the same value as the real thing they are linked to. In this case, the original digital asset is put in a wrapper, which is like a digital vault. This allows the wrapped version to be made on a different blockchain.

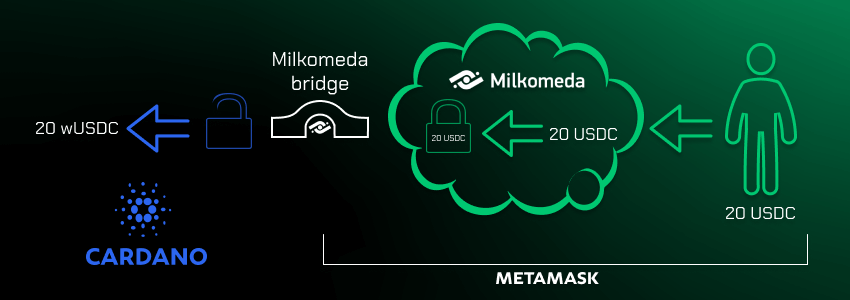

It will be used to move ERC-20 tokens to the Cardano chain. There is a smart contract in place when ERC-20 tokens arrive at the bridge. They are then locked inside. The mapping protocol will give out 20 pre-made USDC tokens while this is going on. These tokens will be kept on the Cardano blockchain.

These tokens will be linked to the smart contract that holds the ERC-20 tokens that are locked. They will be linked to the contract. In the next step, you send the ERC-20 tokens that have been wrapped to the Flint wallet. WingRiders DEX users will then be able to trade or provide liquidity with the tokens that have been wrapped in the WingRiders DEX.

How will stablecoins change the ecosystem of Cardano?

People who make cryptocurrencies called "stablecoins" want them to be a price-stable way to exchange money, and they usually have some kind of reserve asset to back them up. Tether (USDT) and USDC are stablecoins that are backed by a reserve of US dollars. Tether Limited, which is owned by Bitfinex, manages the USDT reserves, while Circle manages the USDC reserves.

It is one of the most common uses for stablecoins because they don't fluctuate as much. There are a lot of ways stablecoins can be used by traders. They can trade other cryptocurrencies, stake to earn a yield on their holdings, add liquidity to a DeFi protocol like a DEX, and more.

It can help to build out the ecosystem of stablecoins on the Cardano blockchain, which could encourage more developers to build or move their protocols to the network. The stablecoins can also be used as a store of value on the Cardano blockchain because they are very stable.

Stablecoins can also be a way for new investors to get into the Defi market more quickly.