MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

The sentiment in the cryptocurrency and decentralized finance communities has been shifting and evolving. In addition, the sector is getting more monitored and, obviously, more organized. US President Joe Biden signed an Executive Order a few weeks ago to expedite and focus regulatory monitoring of the $3 trillion business.

The directive would encourage the government to investigate the dangers and benefits of cryptocurrencies, with a special emphasis on consumer protection, financial stability, criminal activity, US competitiveness, financial inclusion, and responsible innovation. While the effects of this order have yet to be seen, this moment serves to lay the groundwork for greater clarity, predictability, security, and stability in decentralized finance (DeFi).

Clarity on how DeFi and crypto should operate is critical, as it is in any industry. Regulatory control by the US government will be beneficial in the long run and should be welcomed by DeFi participants and organizations.

Meanwhile, there are numerous indications that the DeFi and crypto ecosystems are brimming with talent, creativity, enthusiasm, and capital eager to engage. Denver recently hosted one of the epidemic era's largest Ethereum conferences and hackathons. Over the course of nine days in February, more than 12,000 individuals attended ETHDenver to share ideas, construct and disclose new protocols, curate investments, and socialize.

During the conference, word spread that a group of talented teenagers in their late teens and early twenties had established a hacker house in Denver. Some of the world's most talented, sharpest, and youngest hackers were on hand to welcome venture capitalists. Admission to a conversation on the ground cost $3,000 per person. Events like ETHDenver, as well as approaching regulatory participation and monitoring, point to a promising year ahead in the crypto business.

Talent meets creativity meets money

Denver's ecosystem of players, investors, and builders was diverse and exciting. Culture and industry are growing stronger and deeper. It's a bright indication of life in the sector when thirsty venture capitalists (VC) pay $3,000 only to talk to the best 19-year-olds in the country. Denver demonstrated that the space is no longer as marginal as it once was.

These young people are leaving top schools in some cases to join DeFi teams or develop protocols and solutions, and there is plenty of investment cash available to give a runway for major ideas, tools, and decentralized applications.

Meanwhile, members of the original wave of cryptocurrency have matured into the so-called old guard, giving stability, caution, and expertise to usher in projects, decentralized autonomous organizations, and protocols. The legions of crypto warriors whose excitement for investing, discussing, and participating in the field continues to provide the lifeblood for DeFi continue to support and energize the VCs, gigabrains, and old guard.

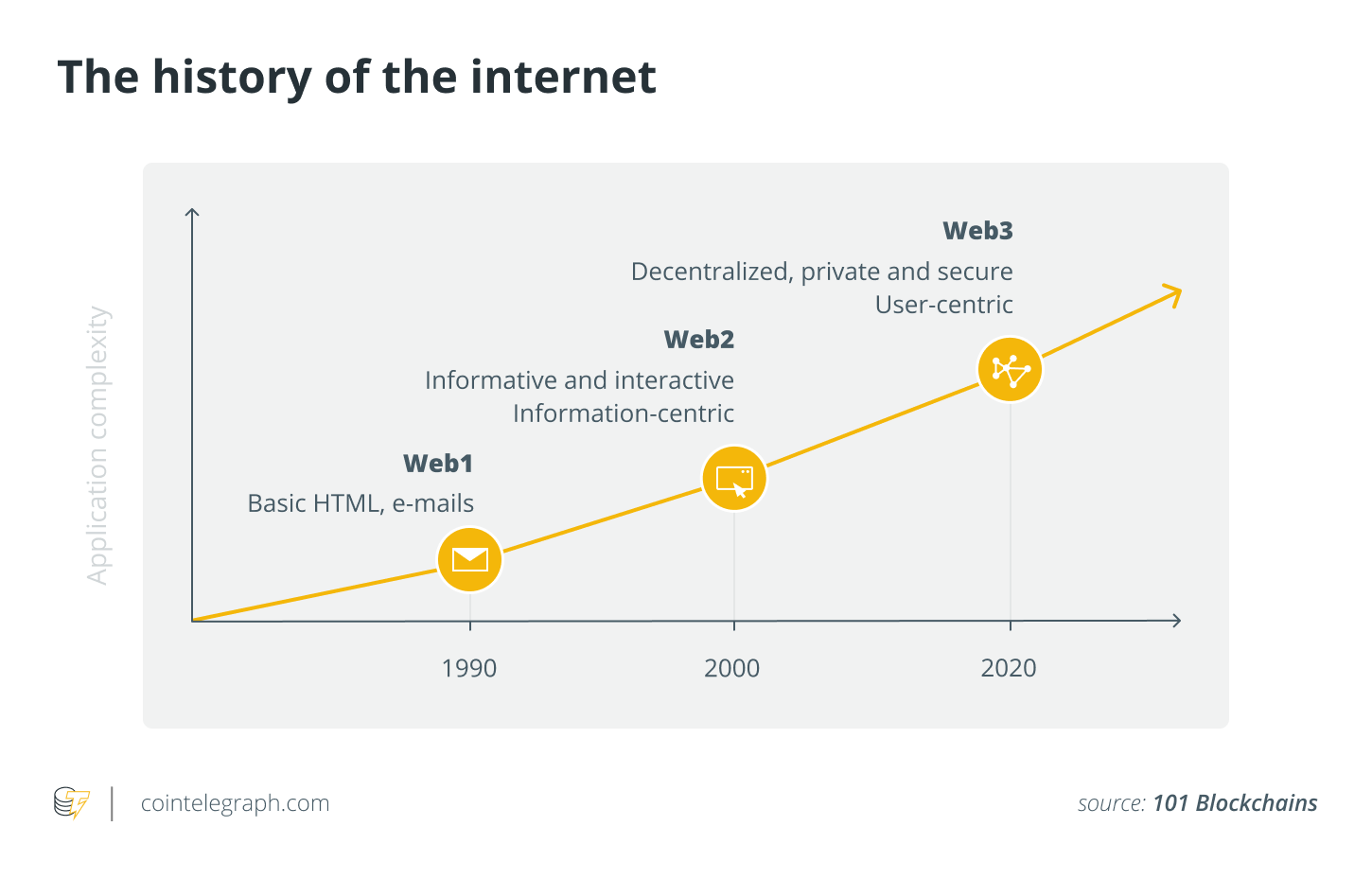

There is a mixing going on that is building a healthier environment with brilliant ideas, talent, money, and passion that will ensure the industry's longevity as Web3 matures and evolves.

The battle for talent escalates

One topic of conversation in Denver was how everyone is hiring and struggling to keep a pipeline of bright, experienced, and motivated developers, engineers, and technical experts. That tendency is likely to continue as the general world becomes more interested in crypto and DeFi.

Web2 talent from companies like Facebook, Apple, Amazon, Netflix, and Google is likely to be drawn into Web3 – which is a positive thing.

Traditional technology businesses have a wealth of experience and know-how that can and should be used to develop DeFi protocols, services, and systems, thereby decentralizing finance. Not everyone will be amenable to the danger or uncertainty of the crypto world, but as Web3 firms continue to receive huge investments that allow plenty of runway and breathing room to build stability and comfort, that perception of risk is diminishing.

Web3 is gaining traction, and it appears that we are nearing a tipping point in terms of more stable workforce recruitment and retention.

A bear market provides space for top builders

Anyone who has been following the TradFi and DeFi markets in recent weeks and months is aware of the whipsaw volatility in pricing and tokens. Entire markets have gone up and down for a variety of reasons, and this could continue for the next year or more. This situation is most likely one of the numerous reasons why the United States government is eager to analyze (and regulate) the industry.

True crypto builders, on the other hand, do not retreat in bear markets; rather, they thrive. A bear crypto market can be more productive, particularly for teams that value good ideas and creativity. Bull markets are more consumer- or trader-centric, and noise may frequently drown out or impair genuine gains.

During bad markets, good ideas in the developer community tend to come to the surface, receiving greater air time, visibility, reflection, and development. The DeFi space is becoming more academic in terms of team building and recruitment, and this brainpower will be crucial as it focuses on new ideas and solutions to old challenges.

======

Related Video: