SEC's Response to Challenge Groundbreaking XRP Ruling

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Coinbase's Pursuit of Regulatory Clarity Shapes its Global Expansion Strategy

After bottoming out at $16.73 on April 11th, DOT bears took a break before going on an overall bullish performance. In fact, it has risen by about 10% since Monday, and is currently trading at $18.37.

However, that recovery might be cut short by strong resistance near the $18.73-price level.

The 0.5 Fibonacci retracement line intersects the $18.73 resistance level directly. Because of recent support and resistance retests during the last three months, the likelihood of DOT meeting resistance at that level is high.

If the market's forecasts are correct, there might be another pullback. Such a result would almost certainly lead to support near the 0.618 Fibonacci level, which also happens to be the $17.64 price level. Evaluating its most recent performance may also assist us in predicting where the price will go.

What can on-chain metrics tell us?

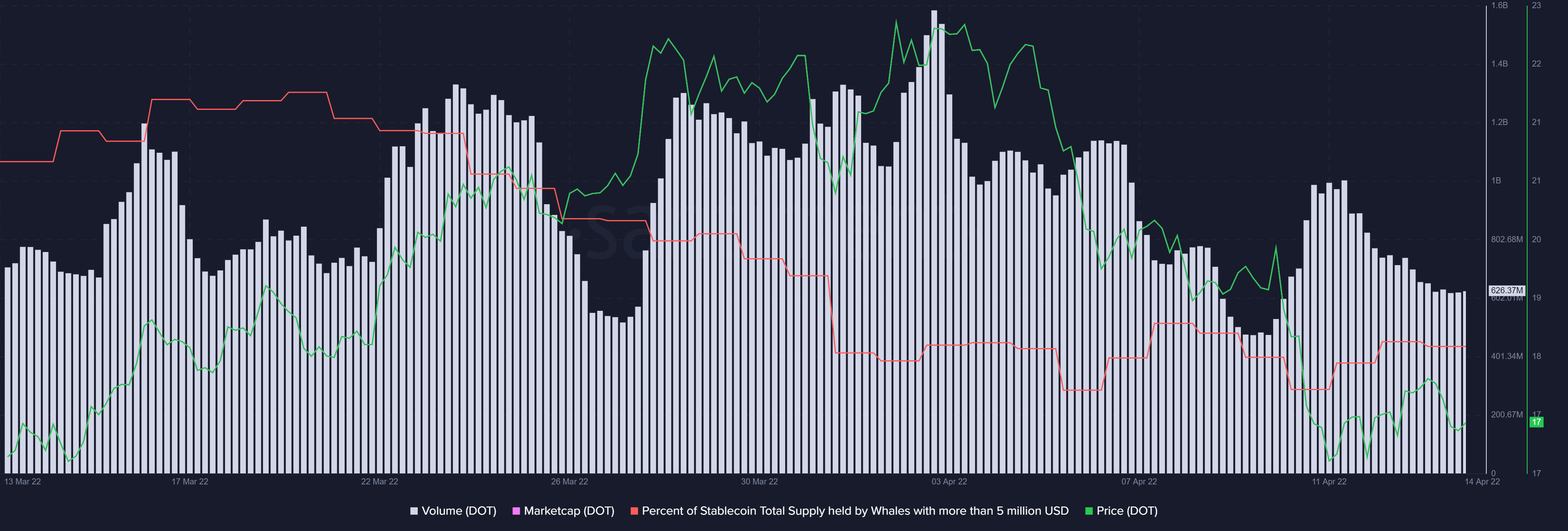

DOT's most recent decline lacked enough impetus to take it to sub-$16 lows. Its on-chain volume appeared to show an increase starting on April 10th, a day before the cryptocurrency began its latest rise. It was followed by an increase in the quantity of whales, which increased from 51.87 percent to 52.04 percent.

This coincided with an increase in volume and buying pressure, resulting in the recent upswing.

Following the 11-12 April volume rise, the DOT's on-chain volume indicator shows a decrease in volume. It is still above the recent low and may support the retracement at the next Fibonacci level, despite the fact that it has tapered down. The expectation is backed up by a modest decline in the percentage of whales held. In fact, it is still significantly more than it was previous to the price increase last week.

Because they suggest lessened buying pressure, the supply held by whales and volume measures match with the likelihood of a downturn. The fact that they haven't sunk to their March lows, though, suggests that the price won't fall to those levels in the near future.