SEC's Response to Challenge Groundbreaking XRP Ruling

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Coinbase's Pursuit of Regulatory Clarity Shapes its Global Expansion Strategy

Attractive valuations?

Litecoin, like most altcoins, has seen a massive price increase. It soared from $125 to over $400 near the start of 2021 before falling to where it is currently, trading below even its early-2021 levels of $144.

There does appear to be a light at the end of the tunnel, though.

Litecoin appears to be forming a descending wedge on the charts, and a break above the upper resistance trendline might trigger a strong surge. That is, assuming the market as a whole behaves correctly. It is, in reality, well-positioned, with the RSI at 50 and a close only millimetres above the 50-day moving average.

Fundamentally, it appears to be a good contender for a comeback. The BitMEX basis ratio of LTC has been somewhat favorable. This implied that Futures had a price advantage over spot prices. It goes on to say that futures traders and investors have remained positive about the altcoin's prospects thus far.

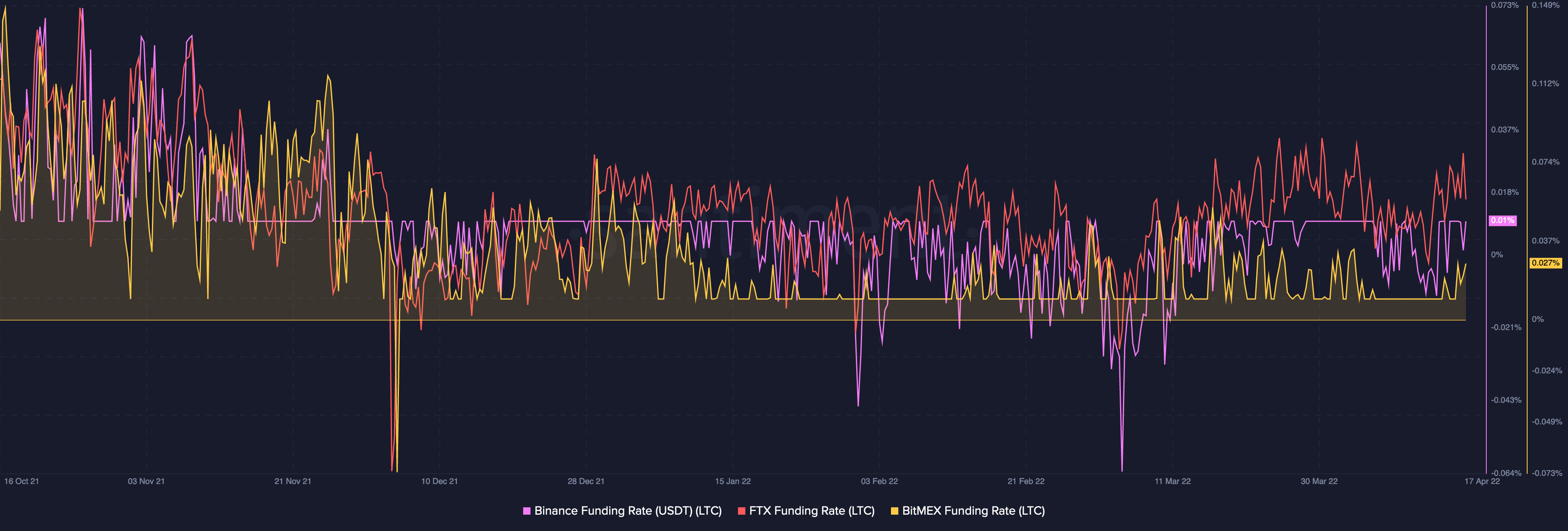

Litecoin's perpetual futures financing rates have remained positive on exchanges including Binance, BitMEX, and FTX, confirming the previous conclusion.

This suggests that long-term derivatives traders are willing to pay the difference in order to keep their positions open.

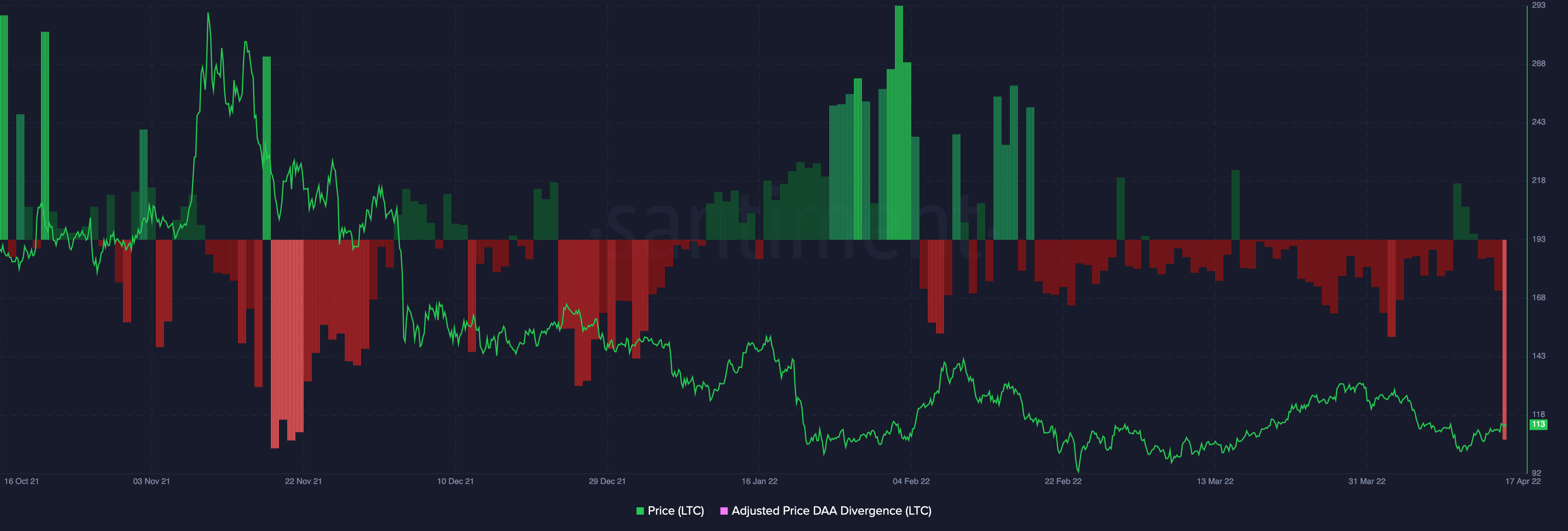

Litecoin’s on-chain Daily Active Addresses have remain fairly steady too, despite the fall in prices since November of last year. This is a sign that users on the network still trust and have faith in it over the long run.

Concerning signals

However, not everything appears to be going well for this altcoin. On the chart, Santiment's Adjusted Price DAA Divergence tool flashed a big sell signal.

A short-term correction may be expected based on the magnitude of the most recent red bar on the chart.

Ergo, the overall picture seems quite optimistic for Litecoin going ahead. A gradual accumulation as you go along, with buying the dips, could be the best strategy for this altcoin.

=========

Related Video: