MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

SEC Finds 'No Grounds' to Deny Conversion of Bitcoin ETF, Grayscale Says

Conclusion

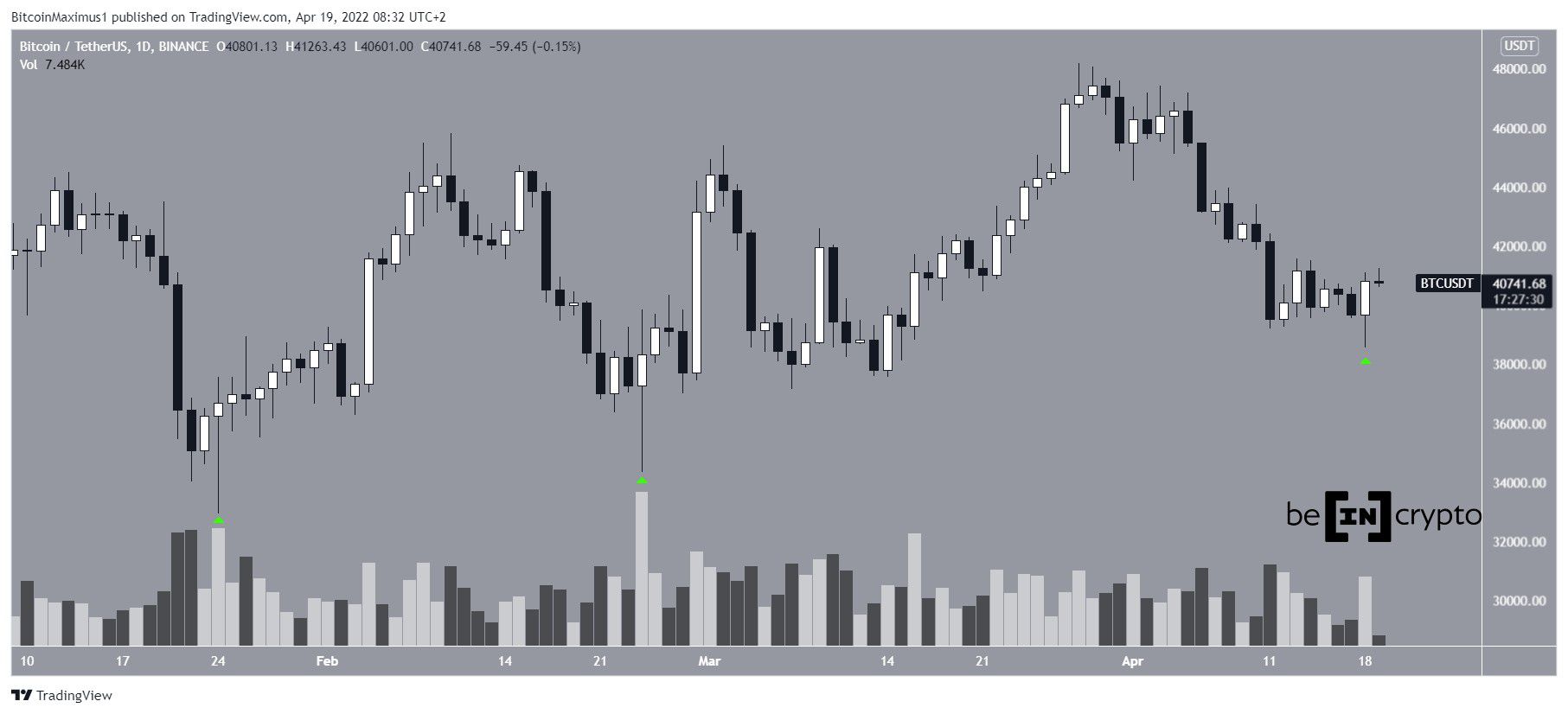

- A bullish engulfing candlestick was made by Bitcoin on April 19.

- BTC is trading above a support line that goes up.

- Some people don't want to go from the $43,380 to the $44,510.

However, Bitcoin's price surged back and formed a bullish engulfing candlestick on April 18th. Candlestick pattern in which the previous day's decline is reversed in the following day's movement. In addition, the pattern contained a lengthy lower wick, which is seen as a sign of strong purchasing pressure.

Candlestick patterns from Jan. 24 and Feb. 24 are strikingly comparable to the current price action (green icons). Prices rose significantly in both cases. The volume of all three was also higher than typical.

Short-term BTC rise.

Price has been advancing above an ascending support line since Jan. 24th, according to a deeper look at the daily chart. This hypothesis has been proven time and time again. BTC was briefly below the line after the aforementioned wick lows, but it was quickly retrieved.

Despite the price activity appearing positive, technical indicators are firmly negative at this point in time. As of April 2, the Relative Strength Index (RSI) has fallen below 50 for the first time since April 2.

Additionally, the MACD is in negative territory and decreasing. Both of these are taken as indicators of a downward trend.

It's a little more upbeat on the six-hour chart.

In part, this is due to RSI's breakout from resistance and subsequent positive divergence, which is the primary reason for the market's recent surge in price (green line).

Nearest resistance is expected between $43,480 and $44,510 if the current price recovery continues. 0.5-0.618 fib retracement resistance levels and a declining resistance line (dotted) have produced this resistance zone, which has been in place since March 28.

Analysis of wave counts.

According to the wave count, Bitcoin appears to be nearing the bottom of a C wave (red). Yellow denotes the number of sub-waves.

Between $37,000 and $37,250 is a good place to look for the bottom of this move. In this case, waves A and C would have a 1:1 ratio, and this is a projection of sub-wave one's length (yellow).

As of this writing, the alternate count indicates that wave C is over. However, this is less likely to happen because there are no proportions between the waves.

However, the long-term wave count shows that a rise above $50,000 is likely in the near future.

Related Video: