U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

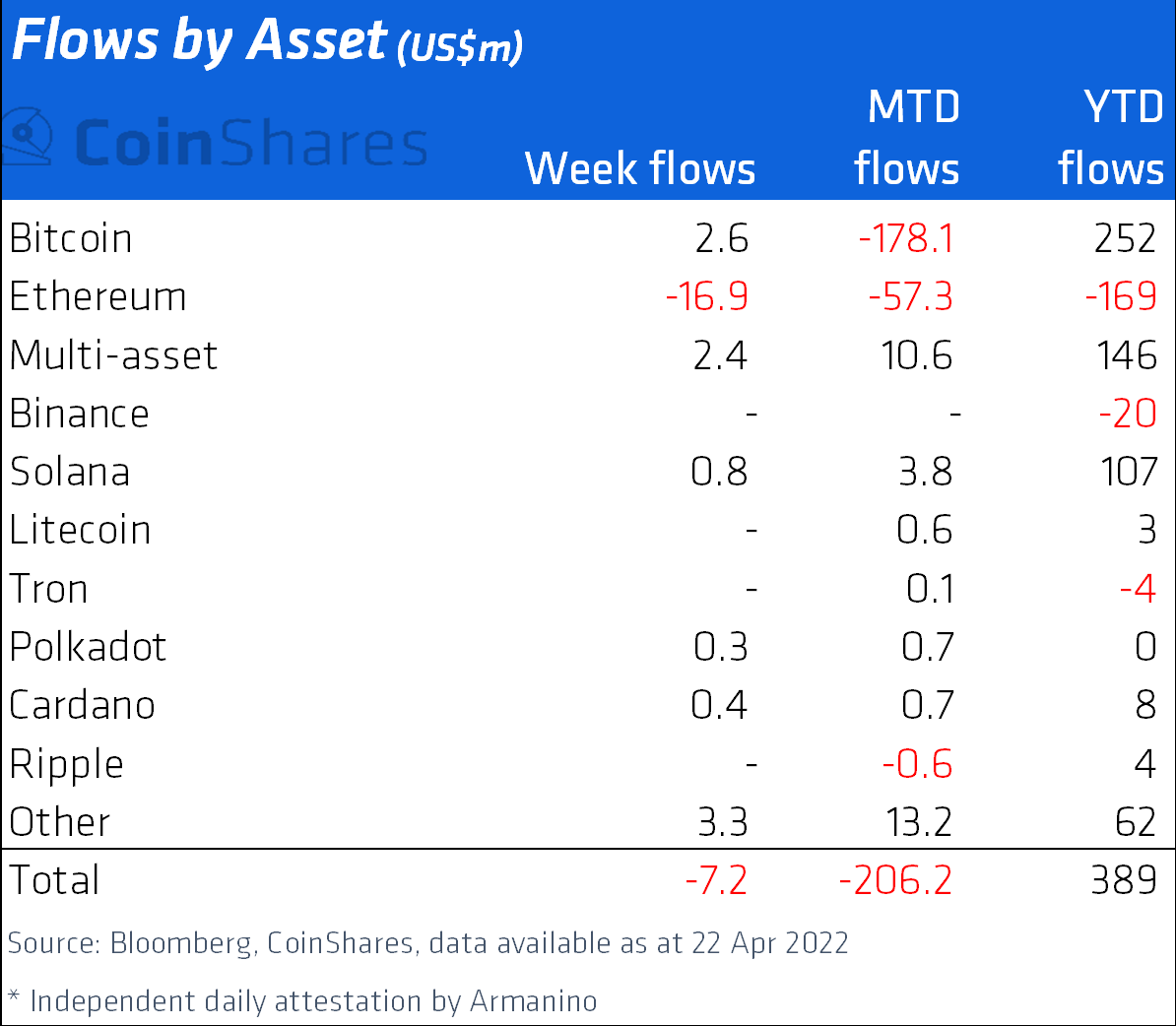

During the week ending April 22, CoinShares' Digital Asset Fund Flows report shows that investors bought $3.5 million worth of Avalanche (AVAX), Solana (SOL), Terra (LUNA), and Algorand (ALGO) funds, while they sold $16.9 million worth of Ether funds.

It's the third week in a row that Ethereum products have lost money, bringing the total over that time to $59.3 million. That's about a third of the $169 million that the second-largest blockchain has lost so far this year.

Investors also seemed to like digital gold last week, even though they've been a little wary recently. Bitcoin (BTC) products brought in $2.6 million in new money.

Over the last 10 weeks, only $68.5 million has been invested in Ethereum products. This could be a sign that institutions aren't as excited about the main blockchain as they used to be.

Solana's use of decentralized applications (dApps) has increased in the last 7 days, according to data from DappRadar. This is because layer 1 blockchains have become more popular recently. Users of the crypto exchange Orca have increased by almost 43% this week, and automated market maker Raydium has seen a 15.5% increase, with more than $1.5 billion worth of trades made through its app in just a few days!

When it comes to Avalanche's dApp usage, the numbers haven't changed over the last few days. However, the blockchains' investments in incentive programs and millions of dollars spent luring developers to the platform have traders excited about the future of AVAX.

Analysts say that Bitcoin saw its first inflows in two weeks, with $2.6 million coming in for the first time in two weeks. The analysts say that Bitcoin's outflows for the month are still $178 million, though.

Over the last three weeks, $219 million has been taken out of the market. That number dropped to just 7.2 million last week, a stark contrast to the $134 million that was taken out of the market in the first week of April.

This is even though there have been a lot of outflows recently. Analysts say that year to date, there have been $389 million worth of crypto assets bought.

Related video