U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

ETH devs connect in Amsterdam

The Ethereum Foundation's Devconnect – a week-long event for Ethereum developers – came to a close this past Monday (EF). The conference in Amsterdam coincided with 4/20 (April 20, allegedly a working holiday in Ethereum-land), but it was the expert sessions on everything from maximal extractable value (ooh) to applied zero-knowledge technologies that drew the crowds (ahh).

From Ethereum co-founder Vitalik Buterin to pseudonymous crypto-sage Hasu, the Devconnect agenda was jam-packed with discussions and presentations.

The meeting also coincided with the publication of the Ethereum Foundation's 2022 annual report, which was the first time the organization had made a financial summary public.

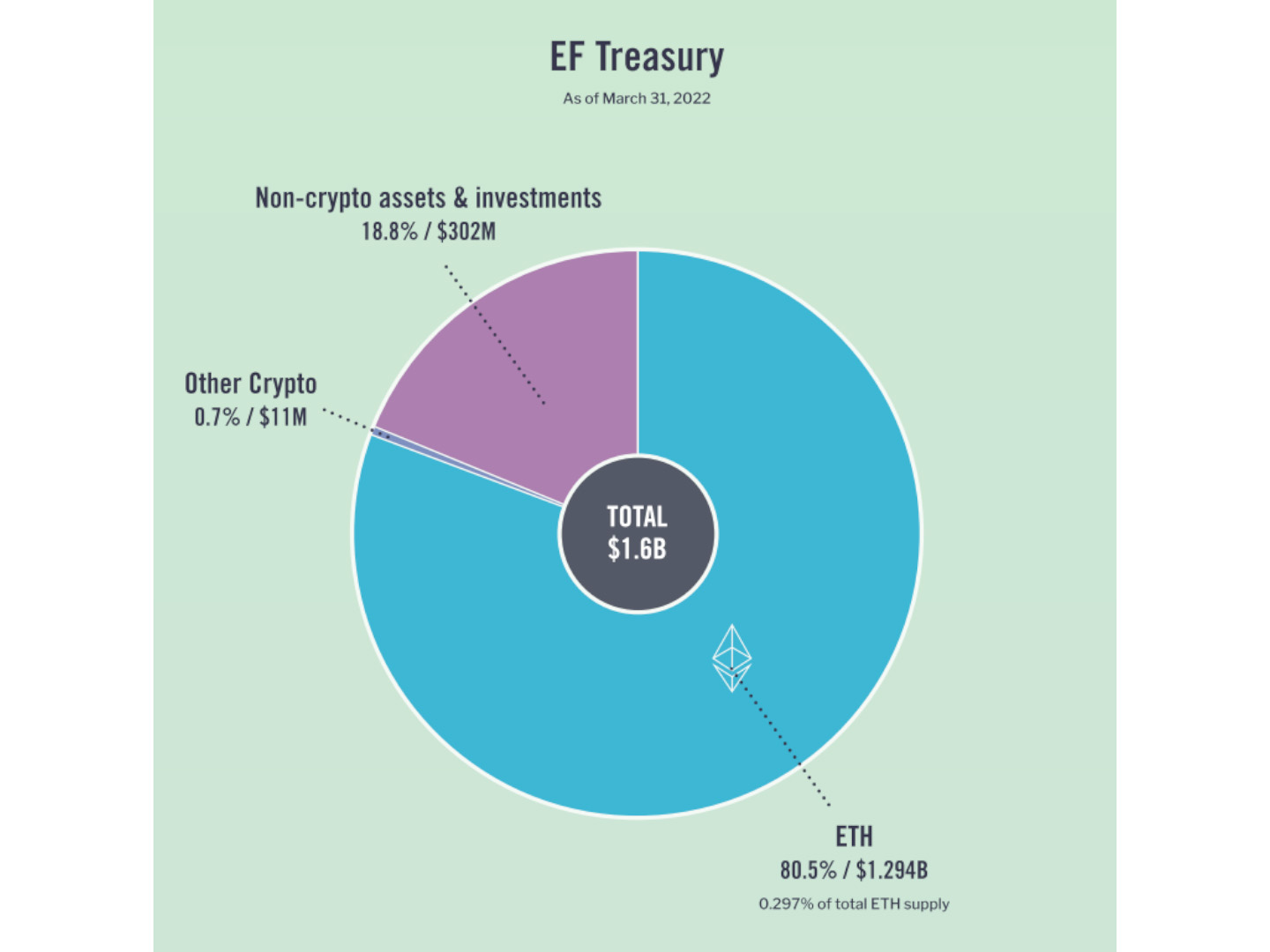

The non-profit custodian of the Ethereum ecosystem revealed in the report that it owns about 0.3 percent of all ether (ETH). While there has been a lot of coverage of this amount, if you ever needed to know how much ETH was in the EF's treasury, you could have just looked up the EF's Ethereum address yourself.

What's more noteworthy is that the EF announced that it has $300 million in non-crypto investments in addition to $1.3 billion in ETH and $11 million in other cryptocurrencies.

Ethereum Foundation Treasury as of March 31, 2022 (Ethereum Foundation) (Ethereum Foundation)

Fiat to the moon?

While it's easy to mock the Ethereum Foundation for keeping part of its wealth in cold, hard, government-issued currency, I disagree with Twitter opponents who argue that this shows the EF doesn't believe in ETH as a legitimate store of value.

It's not anti-Ethereum to acknowledge that ETH still has a lot of volatility, so having some fiat on hand to invest and pay bills makes sense on a practical level.

The Ethereum Foundation, on the other hand, hasn't always been so wealthy. In her recently published (and quite entertaining) history of Ethereum, "The Cryptopians," crypto journalist Laura Shin chronicled the Ethereum Foundation's tumultuous financial background.

The Ethereum Foundation, a Swiss non-profit organization, was founded in 2014 to oversee the first ETH token distribution and serve as the official hub for Ethereum ecosystem growth.

According to crypto research firm Messari, over 3 million ETH (or 5% of the initial ETH supply) went to a long-term EF endowment, but a considerable chunk of that ETH was sold in Ethereum's early years to keep the young project viable, as Shin observes in her book.

The Ethereum Foundation was purportedly plagued by financial mismanagement throughout its early history, to the point where the entire project was nearly jeopardized.

While $300 million is a lot of money, a well-diversified investment portfolio might go a long way toward helping the EF (and perhaps Ethereum as a whole) survive the storm if the price of ETH drops dramatically.

Following the money

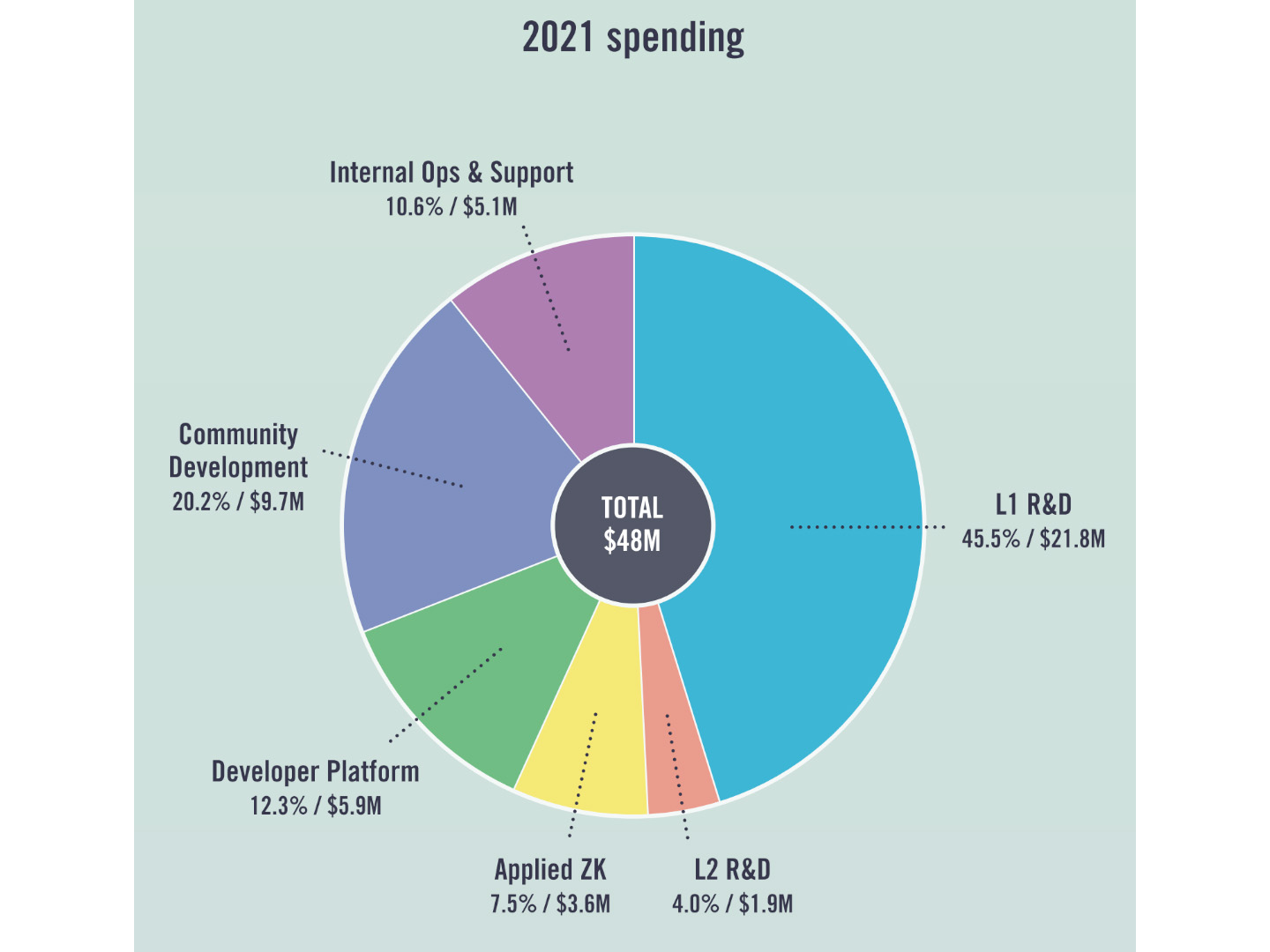

The report includes details on how the EF treasury has been used to stimulate ecosystem growth over the past year, in addition to a breakdown of the EF treasury.

Last year, the EF said it spent $48 million on its mission to expand the Ethereum ecosystem. According to the study, "about $20 million of this total was spent on external spending, which includes grants, delegated domain allocations, third party funding, bounties, and sponsorships." "The remaining $28 million was allocated to fund EF community teams and programs."

Ethereum Foundation 2021 Spending (Ethereum Foundation) (Ethereum Foundation)

The EF discussed how it has collaborated with third-party organizations such as Gitcoin to employ quadratic funding to award grants to public goods initiatives in its report.

"Public goods" in Ethereum development refer to infrastructure that benefits the Ethereum ecosystem and development community as a whole. Grants to public goods are awarded by organizations like Gitcoin based on a community vote. They use "quadratic funding" - a simple mathematical formula – to ensure that the most expensive projects don't get all of the money.

Keep a watch out for a future edition of this newsletter to learn more about my ideas on the benefits (and drawbacks) of what Gitcoin refers to as a "optimal" approach of supporting public goods.

A shadow of a merge

Aside from the EF report, no Ethereum newsletter would be complete without mentioning The Merge, Ethereum's imminent change in consensus methods.

Developers came together in conference rooms to observe the second shadow split of the Ethereum mainnet as Devconnect wrapped up this past weekend. If you've been following Ethereum's shift to a proof-of-stake network over the last few weeks, you may have heard about shadow forks, which are essentially trial runs for the changeover.

Tim Beiko, an Ethereum core developer, goes into into information about shadow forks in his Ethereum Roadmap FAQ, which is worth a look if you want a more in-depth look at how the Merge is moving.

"TL;DR: a shadow fork is a new devnet built by forking a live network with a small number of nodes," according to Beiko's FAQ. The shadow branch maintains the same state and history as the main network, allowing it to replay transactions."

Shadow forks are useful because they "enable us to examine how nodes behave when The Merge occurs using only a small number of nodes and without interrupting the canonical chain," as Beiko explains.

For the past several weeks, Ethereum engineers have been executing shadow forks on Ethereum testnets, and the first shadow fork on Ethereum's mainnet occurred about two weeks ago.

A mainnet shadow fork is the Mount Everest of shadow forks, simulating how the network will respond in the most realistic (read: difficult) circumstances.

While the last two mainnet forks were "successful," in the sense that the network was able to effectively shift from proof-of-work to proof-of-stake, node operators have encountered challenges that must be resolved before the Merge can take place (hopefully sometime later this year).

Pulse check

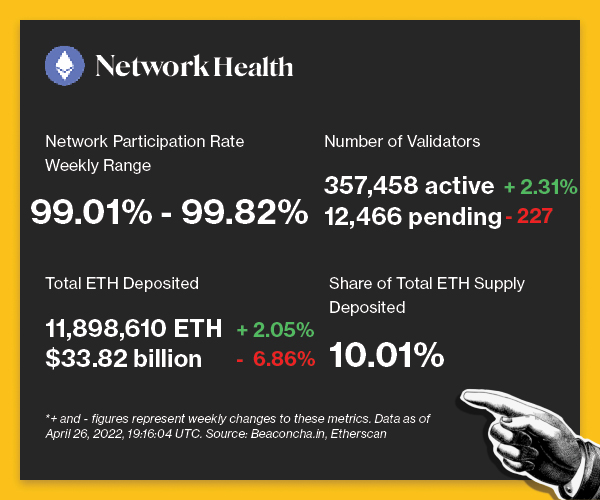

The following is an overview of network activity on the Ethereum Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Valid Points Network Health 4.26 (Sage D. Young)

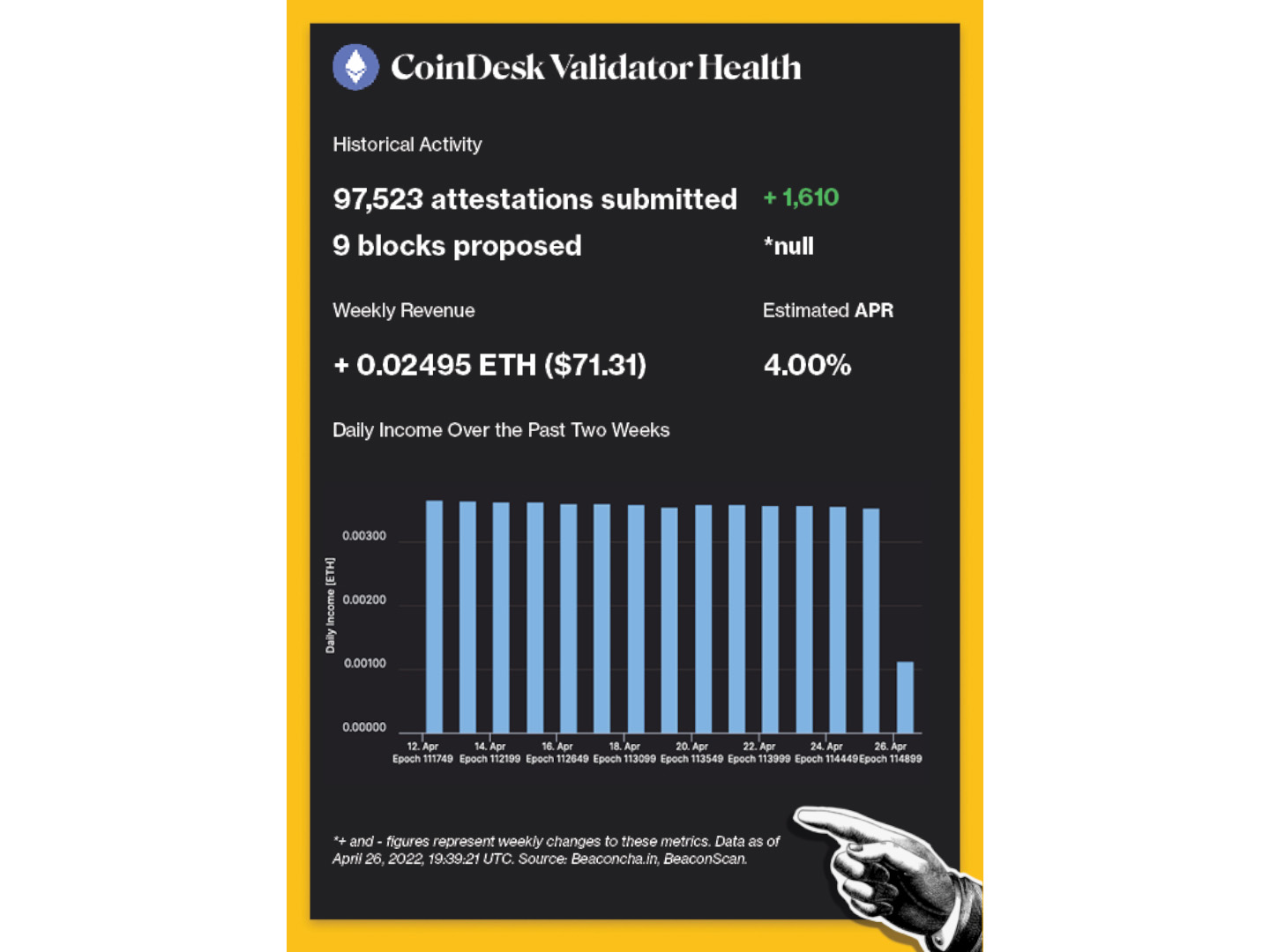

CoinDesk Validator Health 4.26 (Sage D. Young)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

Fireblocks, a cryptocurrency custody specialist, saw $500 million deployed into Terra DeFi in the first week.

-

WHY IT MATTERS: Fireblocks gave institutional customers access to Terra, the blockchain ecosystem and issuer of UST, the largest stablecoin after USDT and USDC. Consequently, institutional customers stampeded into decentralized finance (DeFi). Fireblocks CEO Michael Shaulov said pent-up demand from members of the company’s early access program, including crypto hedge funds, venture capital firms and high net-worth individuals, has been “crazy.”

Twitter accepted Elon’s Musk’s $54.20-a-share buyout offer.

-

WHY IT MATTERS: In the latest chapter of the Elon Musk-Twitter saga, Tesla and SpaceX’s chief executive reached a deal to buy Twitter at a $44 billion valuation. “Twitter is the digital town square where matters vital to the future of humanity are debated,” said Musk. Twitter’s independent board chair, Bret Taylor said, “the proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.”

Dogecoin jumped roughly 9% when Elon Musk’s acquisition of Twitter was announced.

-

WHY IT MATTERS: While there isn’t a direct correlation between dogecoin’s price and Musk’s acquisition, Musk has repeatedly endorsed the meme coin. In a tweet on April 9, he suggested using dogecoin payments for the Twitter Blue premium service. Moreover, Tesla already accepts DOGE payments on its online merchandise store, and Musk has indicated he worked with dogecoin developers to improve its efficiency.

Crypto acts as a lifeline for Russian emigrés opposing Putin’s war in Ukraine.

-

WHY IT MATTERS: Many Russians abroad were unbanked soon after the Feb. 24 invasion when Visa and Mastercard stopped processing payments for Russian cards. The lack of traditional options spurred cryptocurrency adoption for Russian emigrés globally. For some Russian emigrés, cryptocurrency was their backup option given that nothing else worked.

Residents in Buenos Aires, the capital of Argentina, will soon be able to pay their taxes using cryptocurrencies, according to Mayor Horacio Rodríguez Larreta and Secretary of Innovation and Digital Transformation Deigo Fernández.

-

WHY IT MATTERS: This is the latest step Buenos Aires is taking to integrate cryptocurrency into their society. The announcement follows Buenos Aires’ white paper presentation back in March that proposed a blockchain-based digital identity platform that aims to give the city’s residents control over their personal data.

Factoid of the week

Valid Points Factoid 4.27 (Sage D. Young)

=====

Related Video: