MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

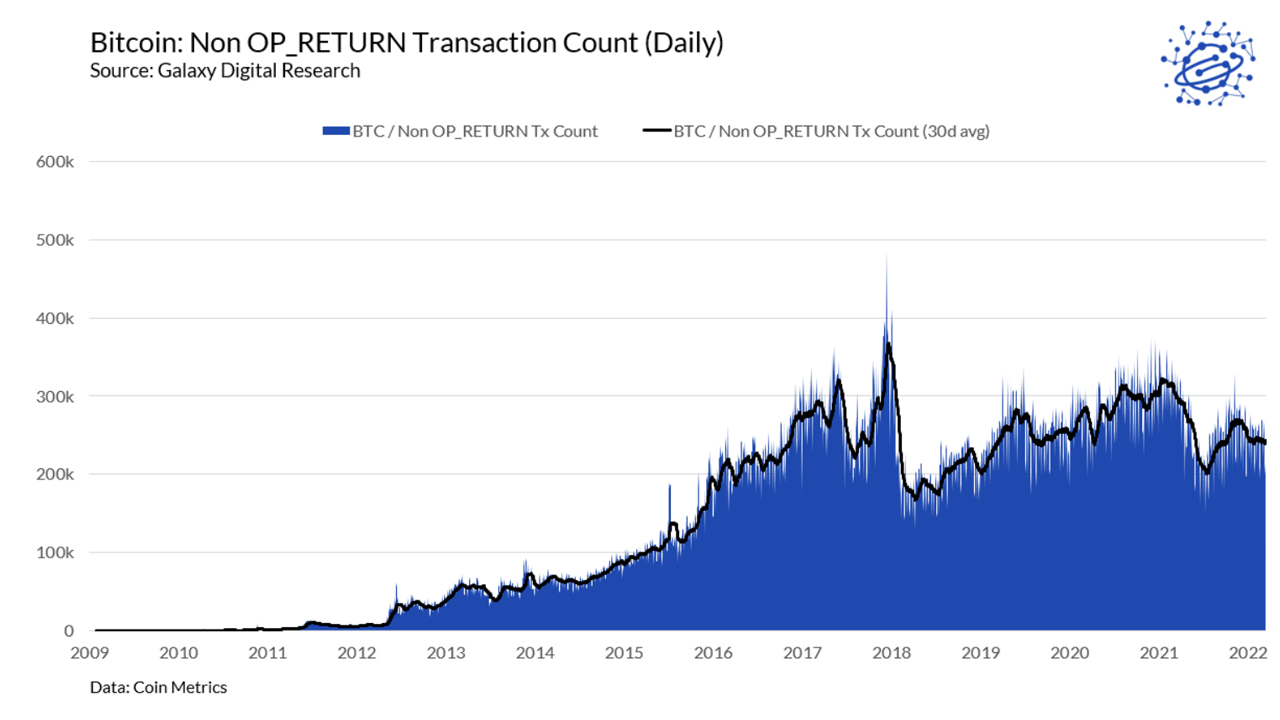

Dominance of OP Return Transactions Slows Significantly, Reducing Bitcoin Network Fees

Since July 1, 2021, the cost of transferring bitcoin has decreased significantly. The average transaction charge for sending bitcoin (BTC) was above $10 per transaction at the time. According to statistics, the average charge to transmit BTC at the end of April 2022 was 0.000042 BTC, or $1.62 per transfer. A paper issued this month by Alex Thorn, the head at Galaxy Digital Research, shows why onchain transactions are cheaper for a variety of reasons.

The utilization of transaction batching, greater Segregated Witness (Segwit) acceptance, and Lightning Network usage are among the reasons for decreasing costs, according to Thorn's study. Another trend covered in Thorn's study is the drop in OP Return transactions. According to the study, after the debut of Veriblock in 2018, the use of storing arbitrary data on the Bitcoin blockchain skyrocketed.

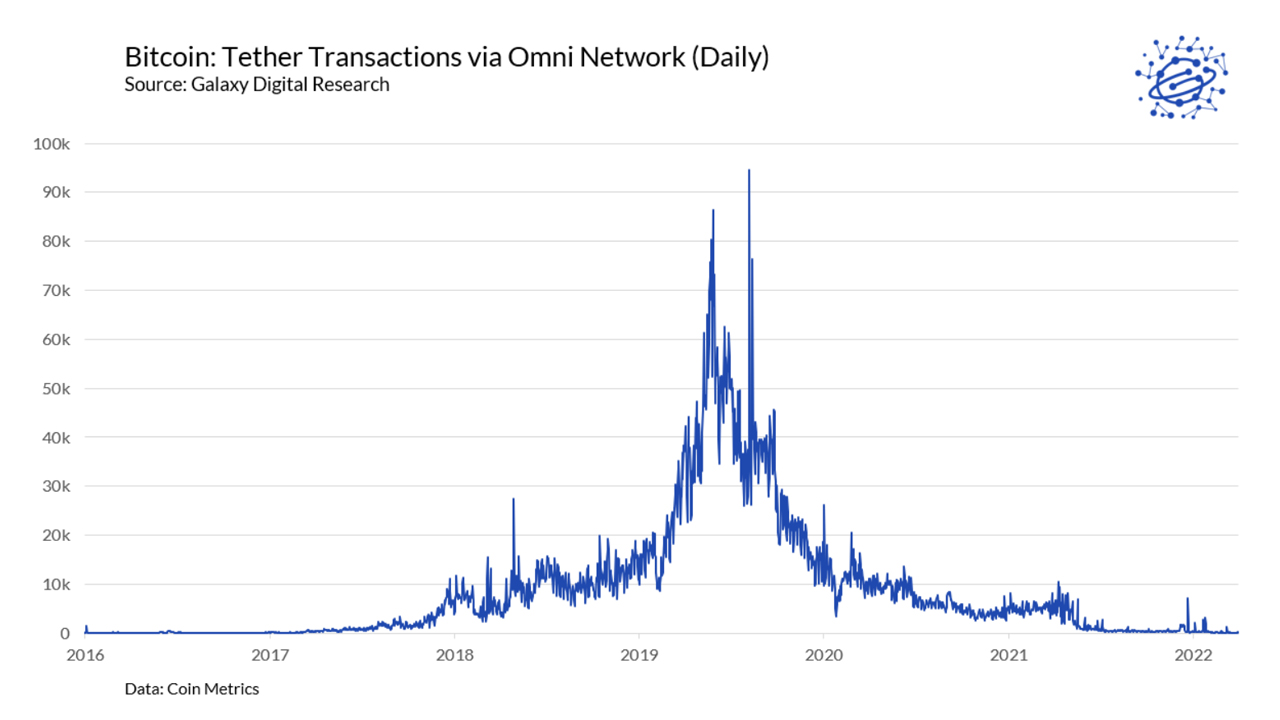

However, OP Return transactions via Omni from the likes of Veriblock and Tether have been down recently. The Galaxy Digital Research report outlines how most tethers have switched to alternate chains from the Omni Layer network, which leverages OP Return transactions. While Thorn's study mentions the increase in OP Returns following Veriblock, it ignores the controversy around putting arbitrary data on the Bitcoin blockchain at the time.

In essence, an OP Return is used to designate the output of a transaction, and users can add up to 80 bytes of null data to the Bitcoin blockchain in a single transaction. A large number of entities have utilized Bitcoin's script and null data to put messages on the blockchain and capture critical data. The use of OP Return grew in popularity and controversy during the close of 2013 and into 2014. OP Return transactions accounted for fewer than 2% of all transactions prior to 2017, according to research.

OP Returns have recently decreased, as seen by current daily statistics, and this is in stark contrast to 2019, when Veriblock acquired 57 percent of Bitcoin's OP Return outputs. People and organizations putting arbitrary data on the Bitcoin blockchain alarmed Bitcoin proponents at the time. In a study titled "The Impact of Omni and Veriblock on Bitcoin," released on December 11, 2020, "dominating" OP Return outputs are discussed.

Omni/Tether, Factom, Komodo, Blockstore, po.et, Chainx, and RSK were among the leading publishers of OP Return transactions between 2018 and December 2019. While many of these projects still exist today, they no longer generate as many OP Return transactions as they once did. Of fact, there's a risk that OP Return outputs may once again dominate BTC transactions. While publications such as Thorn's research and current statistics reveal that OP Return transactions have decreased, there is no apparent reason for this.

=====

Related Video: