MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

Despite the fact that "crypto crash" has been the most searched keyword for all cryptocurrency searches in the previous 24 hours, savvy cryptocurrency traders are still making big-brain movements.

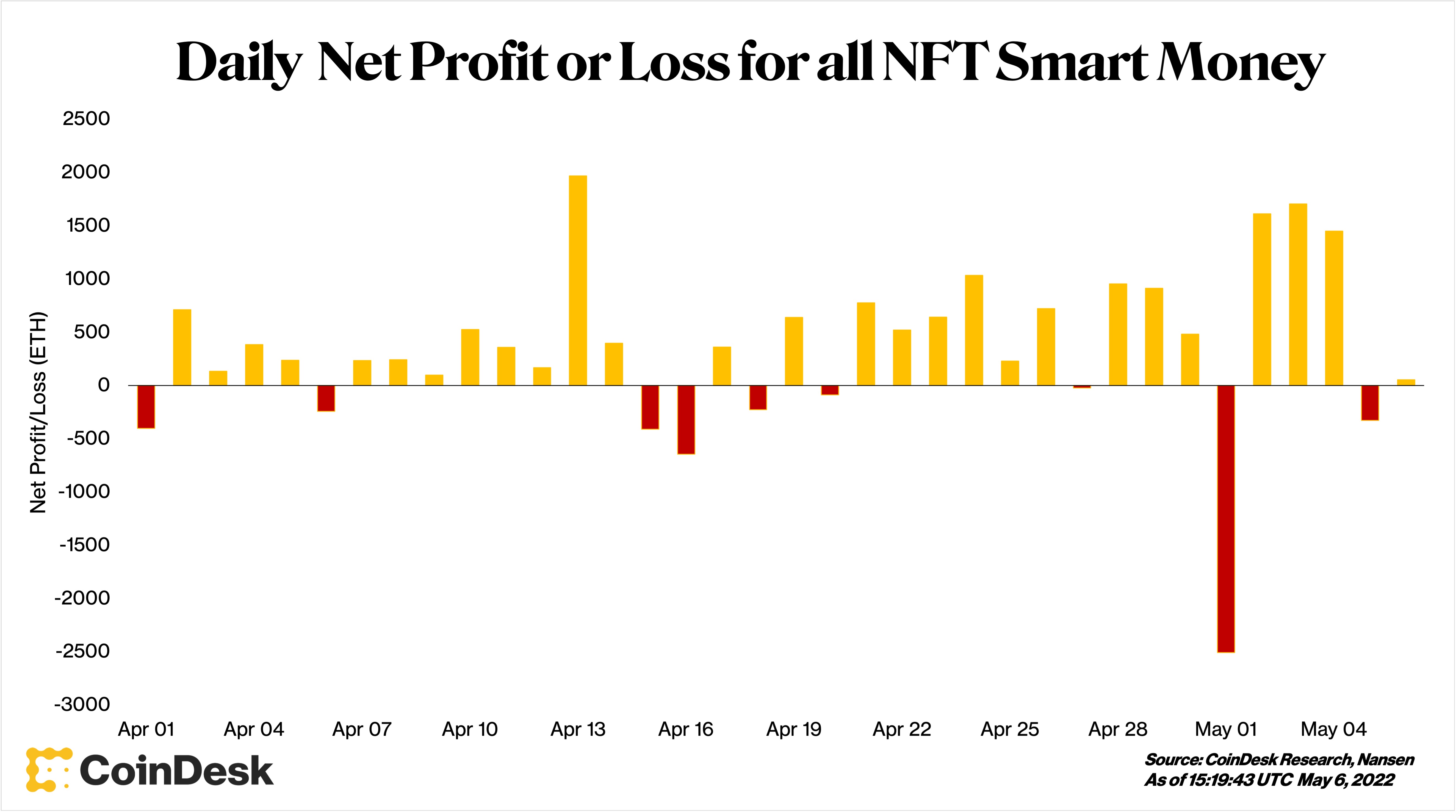

The daily net profit and loss for all smart money addresses trading NFTs, according to data from blockchain analytics firm Nansen (non-fungible tokens). Since April 1, smart money wallets have seen 27 days of profitable NFT trading and nine days of negative returns.

If a wallet is "historically successful," Nansen deems it "smart money," meaning it fits at least one of several criteria, including the following:

- Being in the top 100 addresses based on their current NFT portfolio's expected profits, as well as the top 100 addresses based on an internal "hodler score metric."

- Having at least five times in realized earnings on numerous NFT collections that were minted in the previous 60 months.

- Having completed many lucrative trades on a decentralized exchange in a single transaction.

- Belonging to a cryptocurrency investment fund that invests and manages funds.

(CoinDesk Research, Nansen) (Nansen)

Since April 1, smart money has invested 4,864 ETH in NFT trading, returned a total of 17,581 ETH, and made a profit of 12,717 ETH.

As the few red bars illustrate, smart money is not infallible, and not every deal is profitable (emphasis on few). The biggest loss for smart money wallets trading NFTs was on May 1, the day Yuga Labs released its Otherdeed NFT collection, when investors lost over 64,000 ether just in fees.

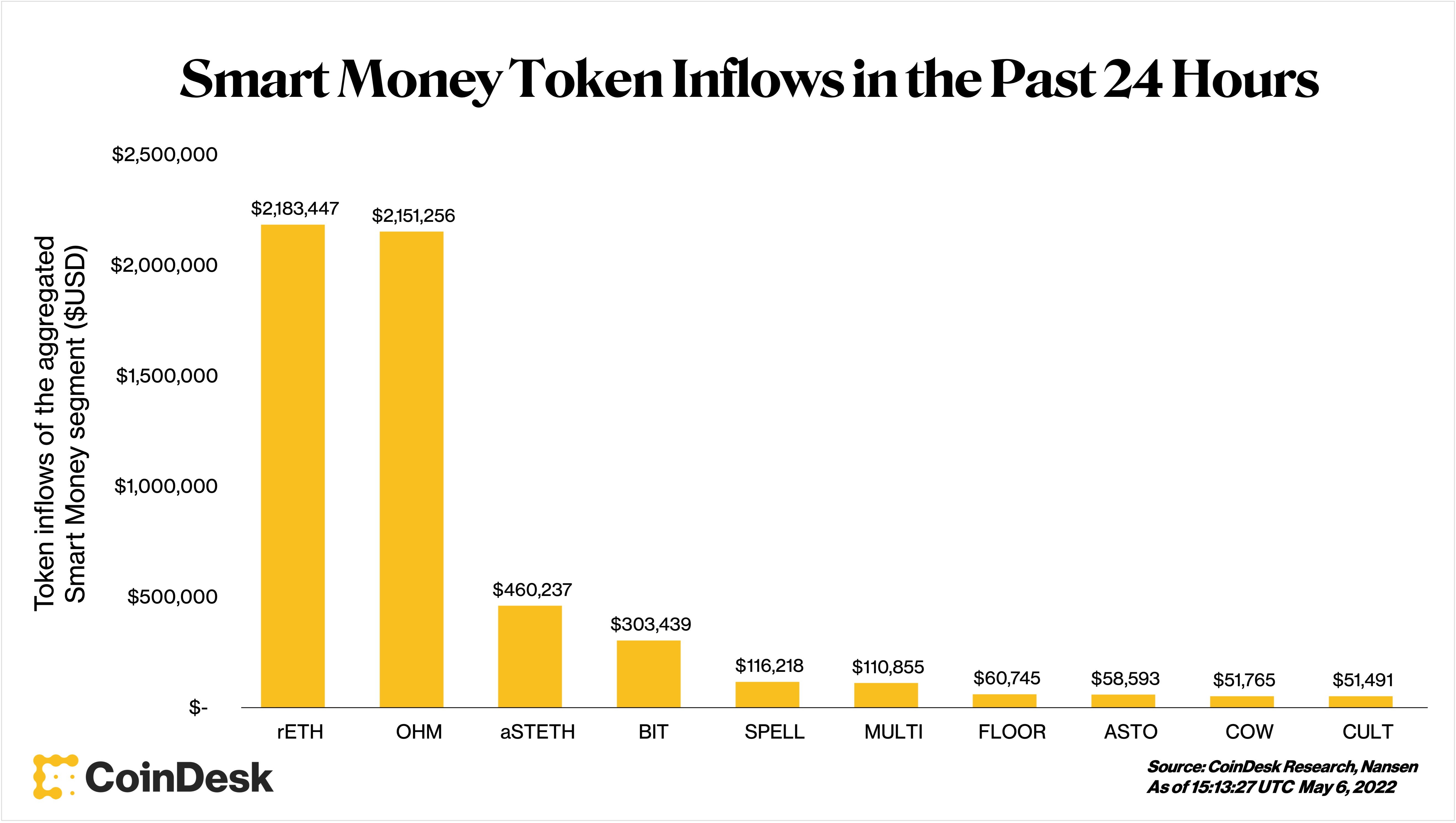

In the last 24 hours, $2.18 million in rETH and $460,000 in aSTETH have streamed into "smart money" wallets, according to Nansen.

(CoinDesk Research, Nansen) (Nansen)

Despite the fact that the "Fear and Greed Index," which measures volatility, volume, dominance, and search engine trends to gauge market sentiment, shows we're in a "Extreme Fear" period, smart money traders aren't sitting on their hands, as evidenced by their holdings of Ethereum's staking derivatives rETH and aSTETH.

rETH is a Rocket Pools currency that represents locked ETH on the Ethereum Beacon Chain, while aSTETH is Aave's yield-bearing token for stETH, which represents staked ether in Lido's protocol.

The attraction of staked ETH for smart money is demonstrated by smart money inflows of rETH and aSTETH during a time when conventional market players are concerned.

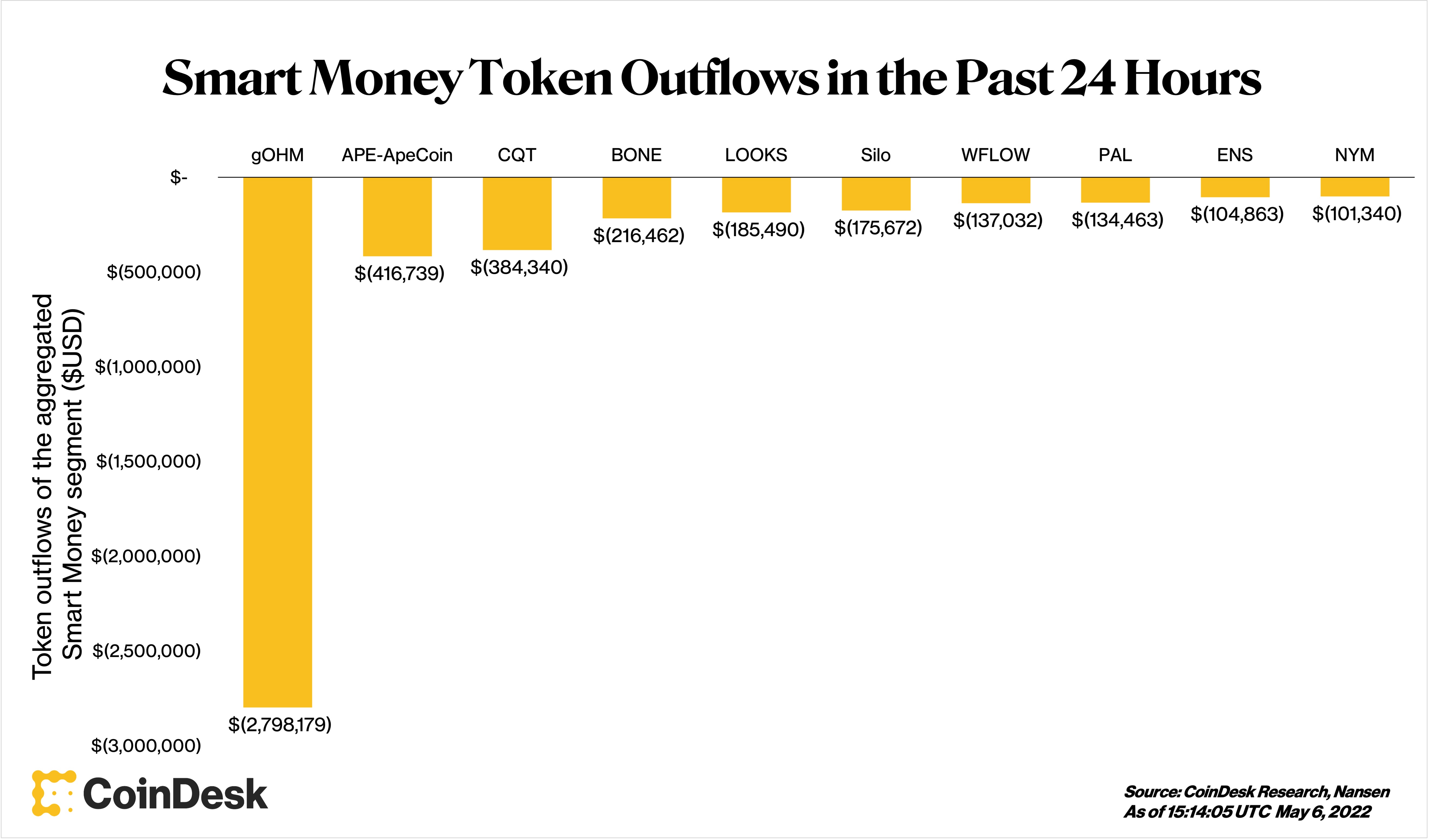

gOHM, the token with the largest outflow among those observed by Nansen, has exited one smart money address designated "Smart LP: 0x413" in the same 24-hour period. At the same moment, $2.2 million in OHM has been deposited in the same wallet, as seen above.

Smart LP, one of Nansen's several smart money wallet designations, is defined as a wallet that earned at least $100,000 by supplying liquidity to DeFi platforms SushiSwap and Uniswap, discounting so-called transitory losses.

Aside from this transaction, slightly over $400,000 in APE, ApeCoin DAO's governance token, was moved out of smart money wallets on Friday, continuing a recent trend of APE emptying.

Despite the fact that Yuga Labs' NFT collections have high floor prices and continuously high volume activity, the related token has struggled. APE has been one of the top coins to depart smart money wallets every day since Monday. A total of $3.7 million in APE flowed out of smart money holdings between Monday and Friday. According to CoinMarketCap data, the price of APE fell over 23% from a high of $17.21 to $13.26, in the same time frame.

(CoinDesk Research, Nansen) (Nansen)

Nansen is one of many companies that parses publicly available data regarding cryptocurrency transactions, but unlike Chainalysis and similar companies, it focuses on giving investors an advantage rather than assisting law enforcement discover illicit actors.

While cryptocurrency addresses appear on public blockchains as random strings of letters and numbers, Nansen makes assumptions about the entities behind pseudonymous wallets using algorithms, its own investigations, and information given by users. It's crucial to remember, though, that past performance does not guarantee future outcomes.

=====

Related Video: