MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

In the last 24 hours, crypto futures have seen more than $1 billion in liquidations, owing to negative market sentiment and major assets losing key support levels.

Bitcoin (BTC) has dropped by as much as 8% in the last 24 hours. Similar losses were seen in Ether (ETH), BNB Chain's BNB, and XRP. Terra's LUNA plunged 50% as its UST stablecoin lost its peg to the US dollar, but memecoin dogecoin (DOGE) fared better than the market, dropping only 6%.

In early Asian hours, Bitcoin briefly dipped below $30,000, helped by a sluggish broader market. The Nasdaq technology index fell 4.29 percent on Monday, while Asian markets fell more than 1% on Tuesday.

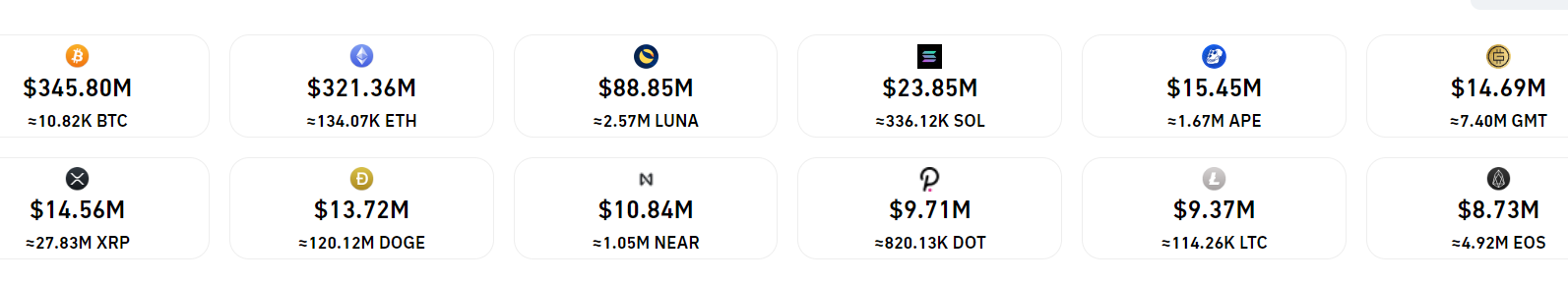

As a result of this price activity, this year's greatest liquidations losses have occurred. Bitcoin futures traders lost $346 million, ether futures lost $321 million, and LUNA futures dealers lost $87 million – a higher-than-usual total for that asset.

Crypto futures racked up $1 billion in losses. (Coinglass)

Long traders, or those betting on rising prices, accounted for more than $793 million of the total liquidations, accounting for 74% of all futures deals. OKX accounted for $257 million of total, followed by Binance with $181 million and FTX with $102 million.

The amount of outstanding derivative contracts that have not been resolved, known as open interest, declined by 5.6 percent, indicating that traders were closing their holdings in expectation of a further drop. As a result, the crypto market has lost approximately 8% of its overall value in the last 24 hours.

At the time of writing, the markets appeared to be steadily recovering. Ether reclaimed the $2,800 milestone, while bitcoin traded above $31,800. However, as market experts have already stated, a protracted rebound would be contingent on how larger equity markets move this week.

=====