MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

The issue of bitcoin adoption's accessibility has been addressed for years, yet it is as relevant today as it was then. Janet Yellen's views on digital asset policy and regulation have brought this subject to the forefront of the United States government's attention. It is our responsibility as developers and leaders in this innovative sector to remove the obstacles that prevent more people from taking advantage of cryptocurrencies, such as a lack of financial literacy and technological resources.

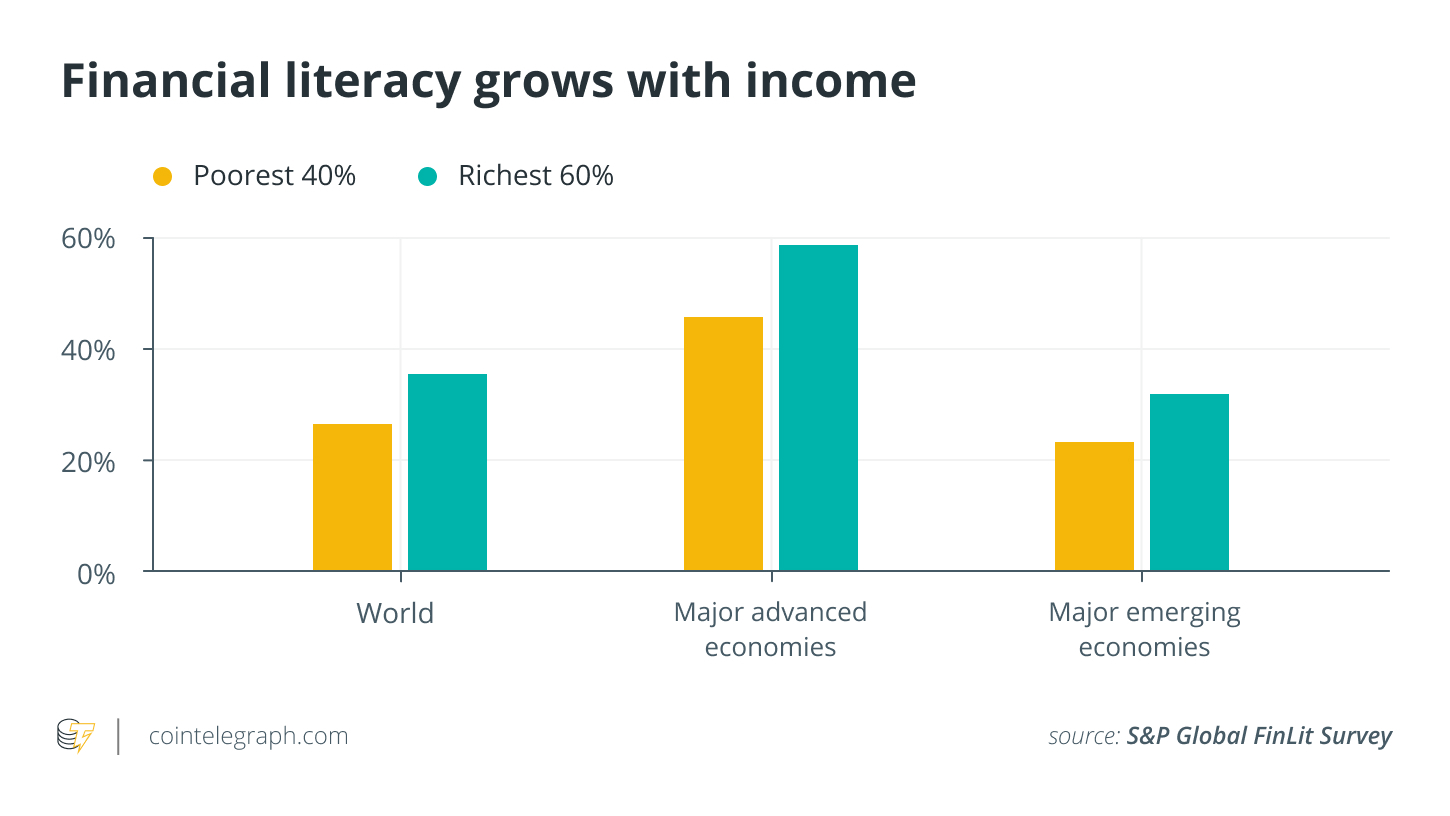

Only 33% of persons around the world are financially literate, according to research. This is an important factor for many projects in the decentralized finance (DeFi) area, which aim to provide those without access to traditional financial institutions with tools for earning, saving, and trading..

Additionally, traditional financial institutions face additional hurdles that cryptocurrency projects are overcoming, such as needing extensive documentation, prohibitive fees, and a lack of financial institutions in emerging markets. DeFi, on the other hand, necessitates an understanding of money in order to access the market. Those who have previously felt excluded from the realm of traditional finance need to be educated on the fundamentals of finance, including how to save and how to monitor the market.

Cryptocurrency education and technostress

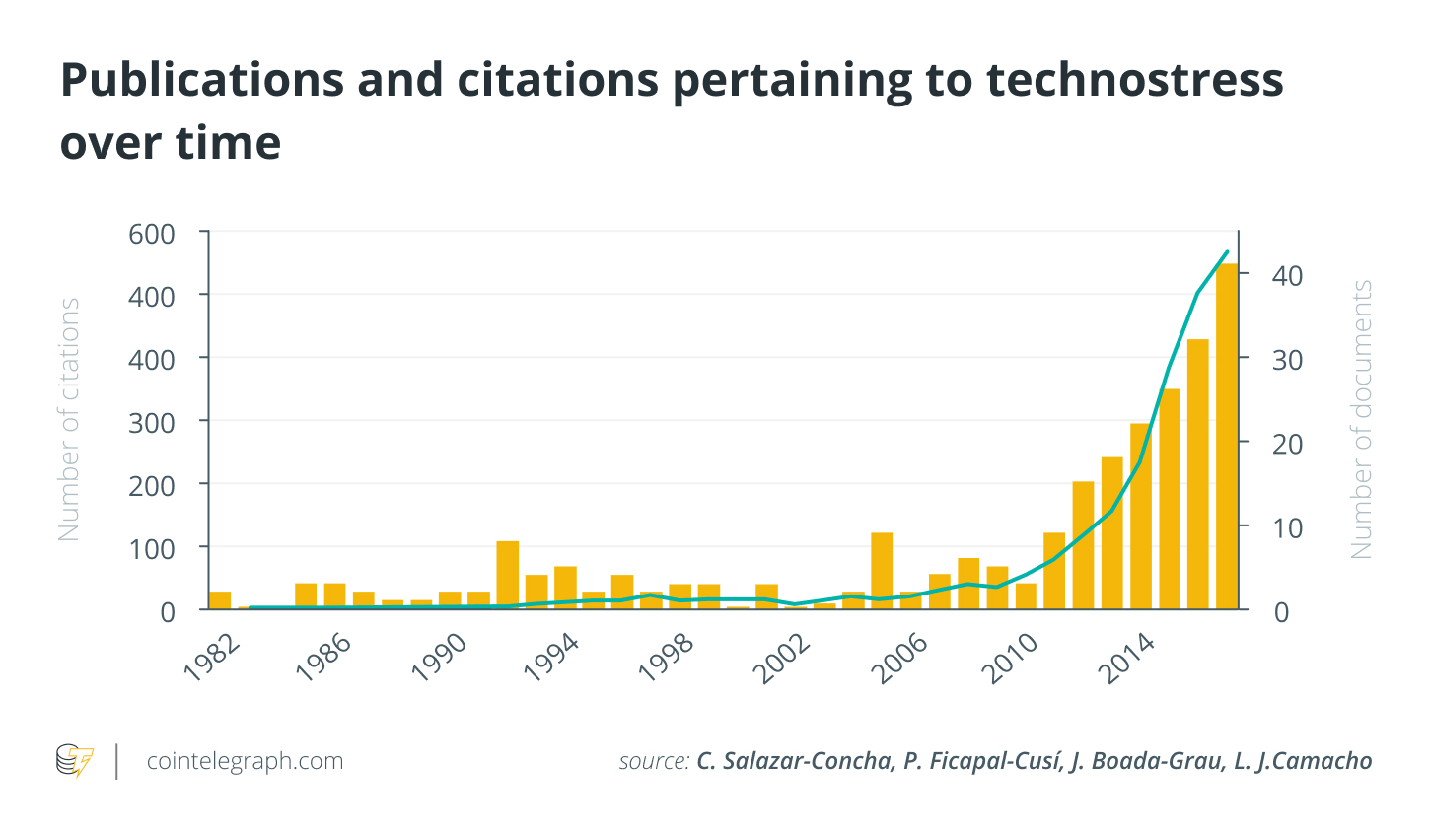

Education about cryptocurrencies and blockchains is also essential. It's so frequent that the word "technostress" was invented to describe this issue.

There are two things I've seen in the field that discourage crypto-curious people from going into the DeFi world: very technical language and frequent use of jargon. Providing materials that explain the fundamentals of blockchain technology, such as blog posts or videos, helps to bridge the gap between engineers and the general public. A good start, but education also necessitates the use of a valuable yet scarce resource: time.

The amount of time and effort it takes to become well-versed in blockchain and cryptocurrency technologies might be a significant barrier to entry. Despite the fact that simple instructional tools are valuable, they only serve a small portion of the population. While financial literacy and crypto education are critical, leaders and developers must also take additional initiatives to facilitate consumer acceptance. When developing a platform and messaging, project leaders should also take into account any gaps in knowledge. Welcoming new users requires clear, concise language that can be understood by a wide range of people.

How the wealth gap serves as a barrier

As previously stated, the widening wealth disparity makes it difficult for lower-income individuals to access the market. One of the most significant barriers to entrance is a lack of access to and time for education.

Investing can only be done by those who have enough money to fulfill their basic needs while still having some left over for other endeavors. People who are strapped for cash or who just do not want to take a chance with their savings are much less likely to invest their money.

While traditional investing opportunities are more established and regulated, digital assets are less so. The widespread adoption of crypto will be boosted by undercollatoralized loans, which will allow those with less money to invest in the market. It's encouraging to see initiatives like Teller Finance, which allows users to borrow crypto assets without pledging any of their own. This area will continue to expand, which is essential if we are to make it more accessible.

How leaders and developers can navigate these barriers

The platform must reflect the creators' focus on user-friendliness and ease of usage. You have a chance to make a lasting impression on a new user by making the onboarding process as simple as possible. It's understandable if individuals don't want to sign up for an account if there are too many steps involved. Easy Know Your Customer identification, rather than time-consuming protocols, is one method projects can improve their onboarding encounters with their customers.

Building a strong network of partners is another step ventures can take. These include compatible blockchains and decentralized applications, as well as collaborations like Celo's DeFi for the People initiative, which aims to boost real-world use cases. It's difficult to keep track of several accounts and applications when there are so many projects in the field. Users are more likely to use your platform if they can access it through a variety of suitable applications, which in turn encourages them to do so.

The growth of the blockchain sector necessitates a continual stream of new participants. To do this, we as an industry must design new products and services with the needs of new customers in mind. When we provide instructional information, we lay the groundwork for a new economic model.

Consider that not all users will benefit from this, and identifying extra strategies to encourage new users to join the space is vital.. Increasing the availability of uncollateralized loans helps to close the growing wealth gap that has emerged as cryptocurrency has grown in popularity. Design, messaging, and products all need to be taken into consideration when thinking about your target. Finally, blockchain technology should be integrated into applications so that consumers don't even need to be aware that they are participating in the blockchain. As soon as our apps are as easy to use and comprehend as the traditional financial tools that millions of people have downloaded, we'll see a surge of new users.

=====