SEC's Response to Challenge Groundbreaking XRP Ruling

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Coinbase's Pursuit of Regulatory Clarity Shapes its Global Expansion Strategy

Despite high-profile incidents of staff layoffs and recruiting restrictions at major internet businesses, the bitcoin employment market shows no signs of slowing down.

Several prominent software businesses have announced job reductions in recent weeks, citing a slowing traditional market and dwindling demand for products that soared during the pandemic. Twitter, Uber, Amazon, and Robinhood have all recently announced layoffs.

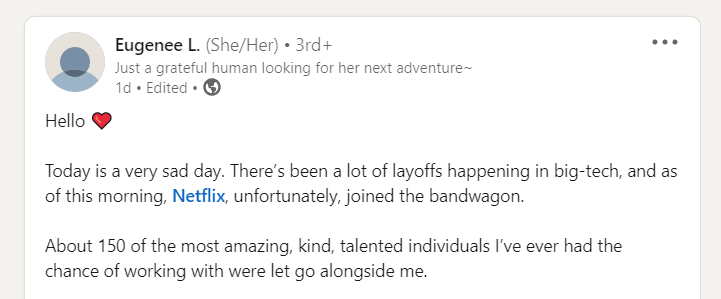

Netflix laid off 150 employees, the majority of whom were headquartered in the United States, on Tuesday, citing a slowdown in revenue growth. After failing to fulfill sales objectives earlier this month, Facebook parent company Meta implemented a hiring block for most of its mid and senior level employees.

The cryptocurrency business has not been completely spared. Following a $430 million loss in the first quarter, Coinbase said on Tuesday that it was shutting down hiring. In an internal message, Coinbase CEO Emelie Choi said that plans to triple the company's staff by 2022 had been put on hold due to market conditions that force the company to "delay hiring and review our headcount needs versus our highest-priority business goals."

So, are we at the start of a huge hiring slowdown in the crypto industry? Crypto recruiters contacted by Cointelegraph disagree.

We've been hearing about a big slowdown in tech but we've hardly noticed it other than many more candidates looking to enter the crypto markets. We've been overwhelmed with requests for quality candidates and have positions across all sectors.

— Cryptorecruit (@cryptorecruit) May 18, 2022

"The recruiting of crypto professionals has not slowed." "We're as busy as ever," said Crypto Recruit founder Neil Dundon.

Dundon's organization specializes in blockchain and cryptocurrency recruiting.

"We have a global team based in the United States, Asia/Pacific, and Europe, and demand is equally high across the board."

Layoffs in the tech sector, according to Kevin Gibson, creator of Proof of Search, have had little to no influence on his crypto business clients thus far.

"I've only heard of two companies laying off employees," Gibson remarked. "This could change in the next month, but any gaps will be quickly filled by well-funded, high-quality projects." As a candidate, you will not notice any differences... If you lose your job, you'll have many employment offers relatively rapidly."

VC funding timelines

Most crypto companies, according to Gibson, are still in the early phases of their life cycle and rely on venture capital (VC) money received last year.

"The vast majority of good initiatives were funded last year, so [they] will keep building and hiring." Any pullback from pre-funded projects will go unnoticed because there was such a talent imbalance."

According to CB Insights' State of Blockchain Q1 22 study, blockchain and crypto start-ups saw a record-breaking funding quarter, with venture capital reaching an all-time high of $9.2 billion in the three-month period, topping the previous quarter's $400 million in Q4 2021. It was the seventh quarter in a row that blockchain funding reached new highs.

More traditional tech organizations and employees are coming into the crypto sphere, according to Dundon, significantly enhancing the crypto job market.

"At the very least, most forward-thinking tech businesses are dedicating some resources to [...] investigate how they may incorporate blockchain into their existing models [...]" As traditional IT downsizes, more companies are going into this arena, and applicants are flocking over."

According to a Linkedin report published in January this year, crypto-related job posts in the United States increased 395 percent from 2020 to 2021, compared to only a 98 percent gain in the tech industry during the same period. Blockchain developers and engineers were the most popular job titles.

The average yearly blockchain developer pay, according to Glassdoor, is US$109,766. The average annual compensation for a blockchain engineer in the United States is US$105,180.

When asked if the current crypto bear market will lead to more crypto layoffs, Dundon stated he doesn't expect a situation similar to what happened in 2018.

"In the past, when the Bitcoin price dropped, crypto recruiting slowed dramatically." It was practically precisely proportional to its price," Dundon explained.

"This time, though, it's different since crypto firms are now considerably more prudent with their treasuries [...] All of this adds up to a considerably more stable job market."

=====