Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

International Regulatory Authorities Unveil Comprehensive Global Cryptocurrency Policy Blueprint

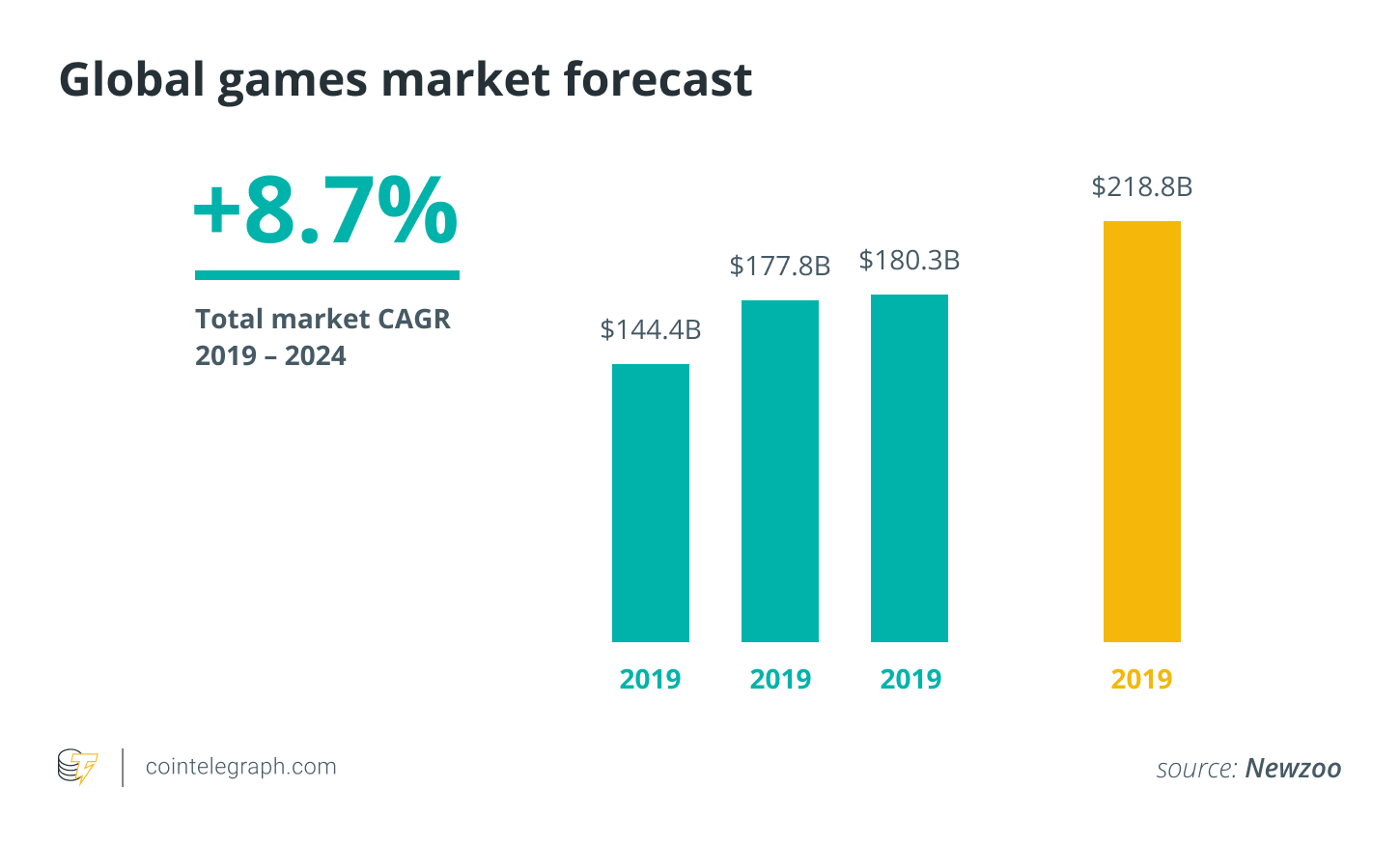

It's something you've seen before. An incredibly brilliant gaming founder teams up with a top-tier company, promising to offer a fantastic game experience based on the most powerful engines in the business. But then it happens: it's linked with a dubious shitcoin that goes live long before any game content is released.

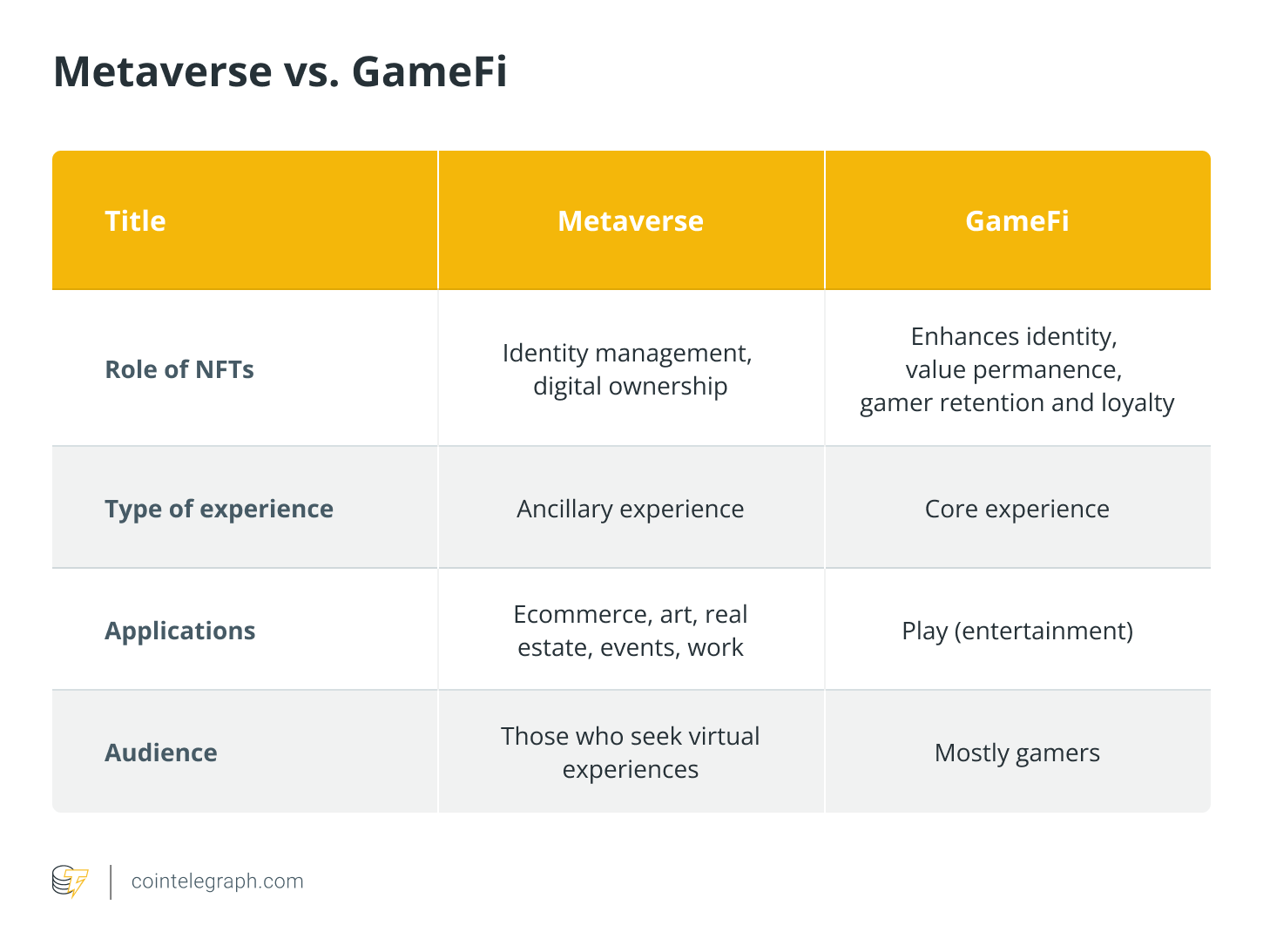

The hype-fueled crypto bull market may have been referred to by mainstream media in the not-too-distant past, but with Bored Ape floor pricing still in the skies, we'll respectfully refer to it as the monkey run. Despite market instability, Metaverse proponents maintain that Web3 money will transform the way games are monetized. I call BS.

The current focus is not on new revenue models. These token offerings are simply questioning the concept of capital production, not commercialization. The monkey run, although seductive, has swiftly led some of our smartest founders to believe that raising a ridiculously enormous amount of capital from tokens generated out of thin air is a poor alternative for a serious monetization strategy.

We’re ready for a change of mindset. The critical question is this: how can we make the hyper-capitalized, hyper-hyped Web3 Metaverse project work — for gamers, for founders, and for investors?

Path #1: Shilling is thrilling

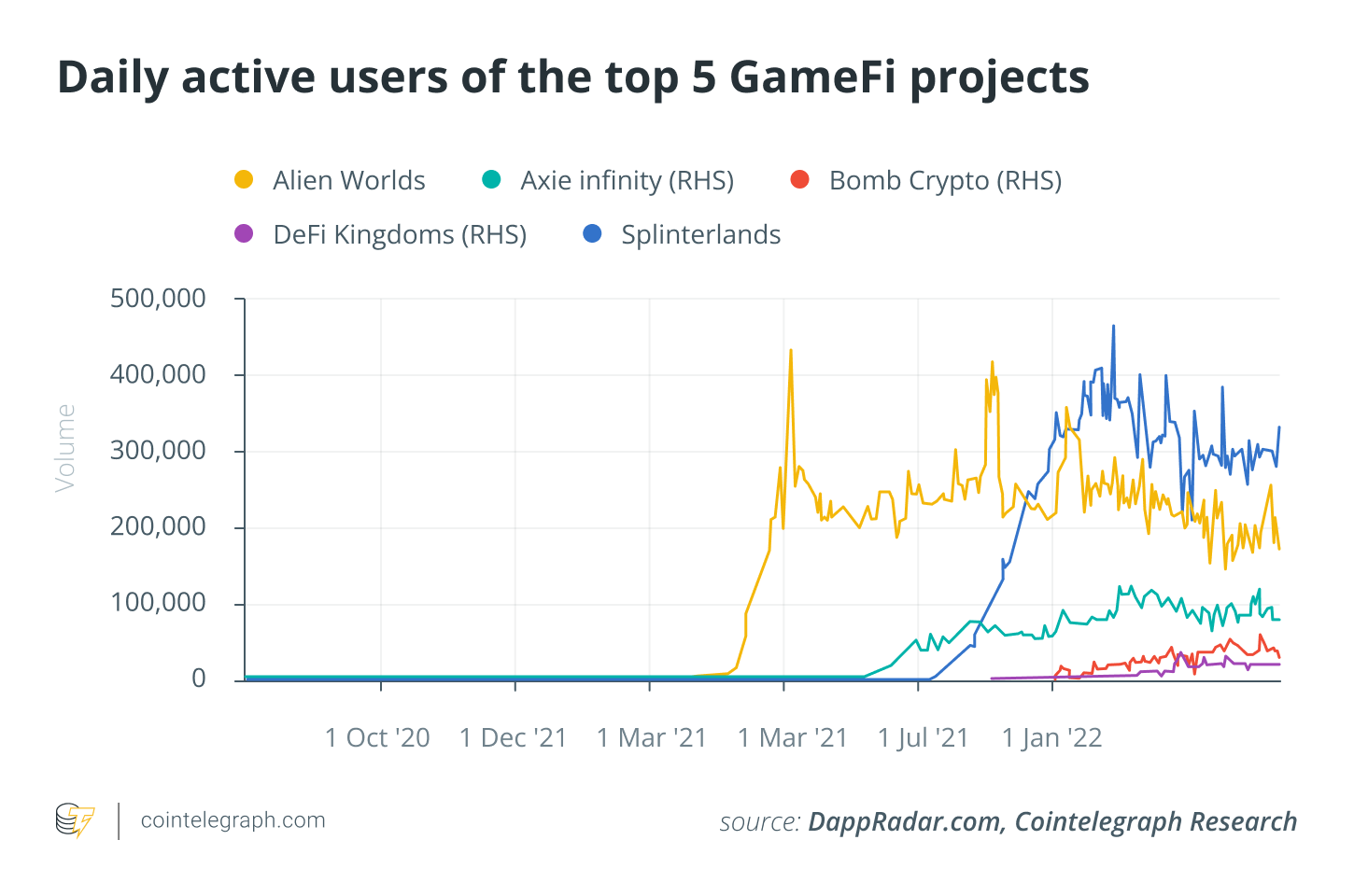

In terms of money, everyone wins in a monkey run. The monkey market elegantly substantiates the premise that there are no shitcoins — only shit prices, from big smart contract platforms to experimental DeFi protocols to the next Axie Infinity knockoff.

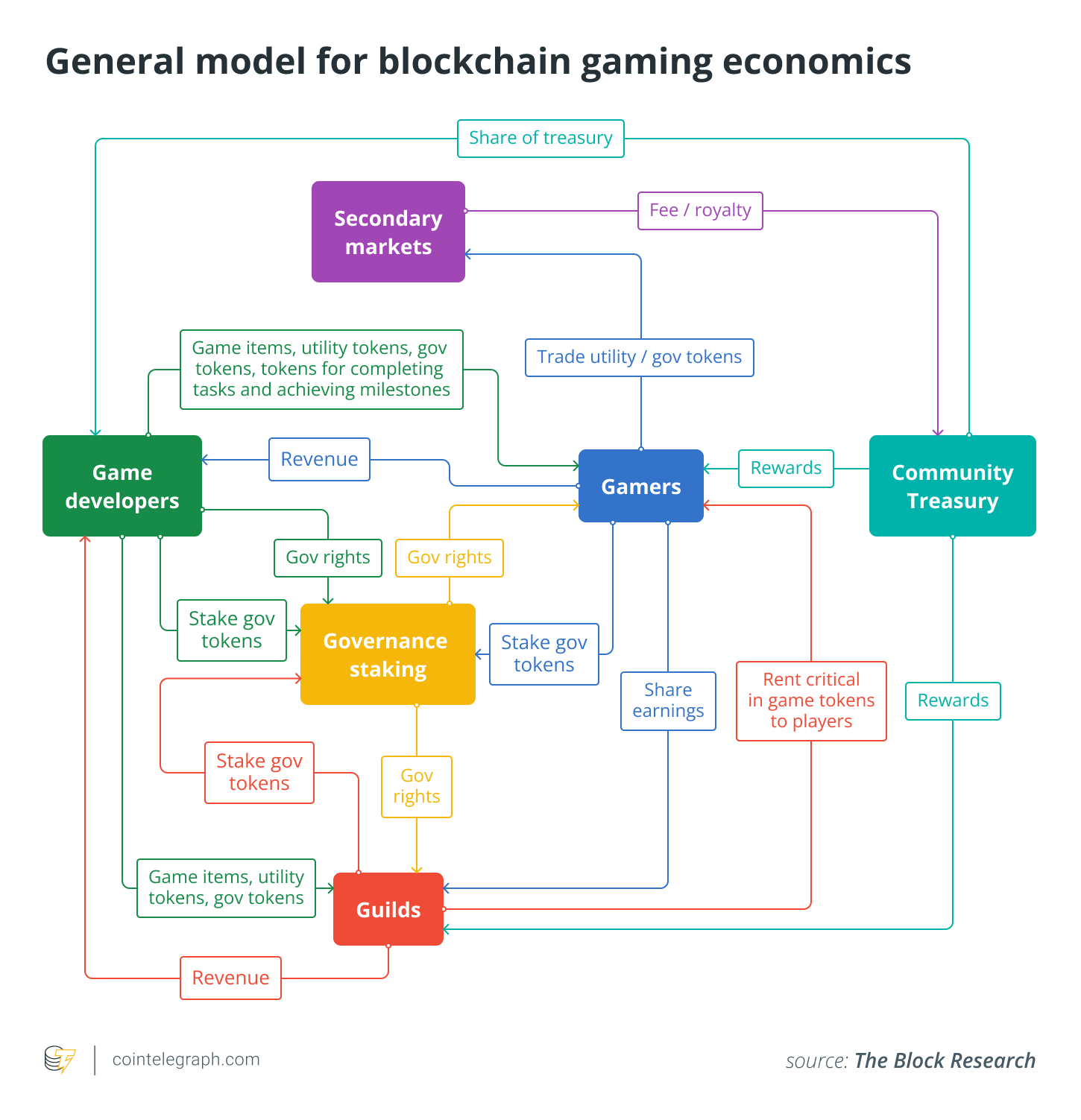

Travel with me down the deal pipeline into the heart of crypto venture finance, where dazzling new metaverse and gaming ventures constantly flood inboxes for a clearer picture. Links to cinematic trailers, Unreal Engine mockups, and muddled "token economics diagrams" abound, echoing their demands for millions of dollars in simple agreements for future coins in order to appropriately prepare their token launch(s) and initial decentralized exchange offering.

When will the game be released? It might be a Q3 "mini-game" or a huge triple-A launch in mid-2023. What kind of features will the token have from the start? You can use them to earn more tokens and possibly gain entry to the game's first NFT sale. They may even market a utility-less utility token and a governance-less governance token, claiming that their existence is justified by the fact that the big daddy exchanges have committed to list them in a matter of months.

This may appear to be an exaggeration, and I hope it is. However, these are the most concerning aspects confronting the current environment of token launches in the midst of a bull — or should I say, a monkey — market. They capture short-term enthusiasm without a long-term strategy for future development. These presentations capture a fleeting moment, but they lack the necessary vision and business strategy for the future of gaming.

Path #2: Building to last

The GameFi token market is highly fragmented. While early liquidity is appealing, launching a coin too soon has significant dangers. The delicate balancing act of developing sticky tokenomics and good game design actually allows project tokens to focus on user engagement and retention rather than pure income.

What is the final optimization issue? Increase user retention and engagement per project token issued, subject to a certain amount of existing Web3 earnings and user community.

To monetize your app, you don't need your own project token right away. Tokens are essentially forms of trade for the assets generated and sold by your virtual environment. Your Web3 game is doomed if it can't operate on an existing liquid, volatile token or, worse, a well-pegged stable. Please try again!

Instead, raise enough private funds to get through beta launch comfortably. Work with your smart contract platform of choice in beta to integrate its native token and your preferred stablecoin into your game. Start tracking your main game loops and income streams.

Consider yourself a data scientist. Is there any user activity that you know is legitimately entertaining yet still underperforms? Is it such a worthwhile loop that a subsidy could be able to jumpstart things? Do your customers avoid currency fluctuations? What are the sources of your most active users? How many workers in emerging countries are underpaid? How many prosumers are on the lookout for the next cool hangout? How many whales are driving up auction prices?

Finally, your token must be designed to encourage users to stay in your realm. For example, similar to foreign currencies, you may give a discount on consumption when paid for using your own project token — yet your digital items are priced in USD. You might also use a layered-risk treasury model, in which you accept USD (and equivalents), your preferred L1 or L2, and your project token. This ensures that you have a broad, ready-to-engage audience ready to engage with your world right away. It also protects you during crypto and macro downturns, and the surplus may be used to reward investors and users without putting sell pressure on your token – among other significant advantages.

As a Web3 gaming founder, the most important thing you can do is keep focused on improving your game. Tokens will not be able to make or break your game.

The right priorities for a sustainable GameFi future

The value of gaming and metaverse applications is not derived from the tokens they use. Revenues, which, in the long term, come from unique in-game digital assets, are what give a project its value. When a community owns, experiences, and understands these NFT-based assets, value grows — or, to put it another way, the community's refusal to sell grows.

I'm looking forward to the day when this approach becomes the norm, because it will get us closer to the best Web3 games ever. We'll see improved gameplay and tokenomics bundled into one gaming ecosystem built for the long term, rather than the market favoring short-term bag grabs.

Engagement, then retention, and finally monetization In that sequence, optimize for those items. Select the appropriate path.

=====