MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

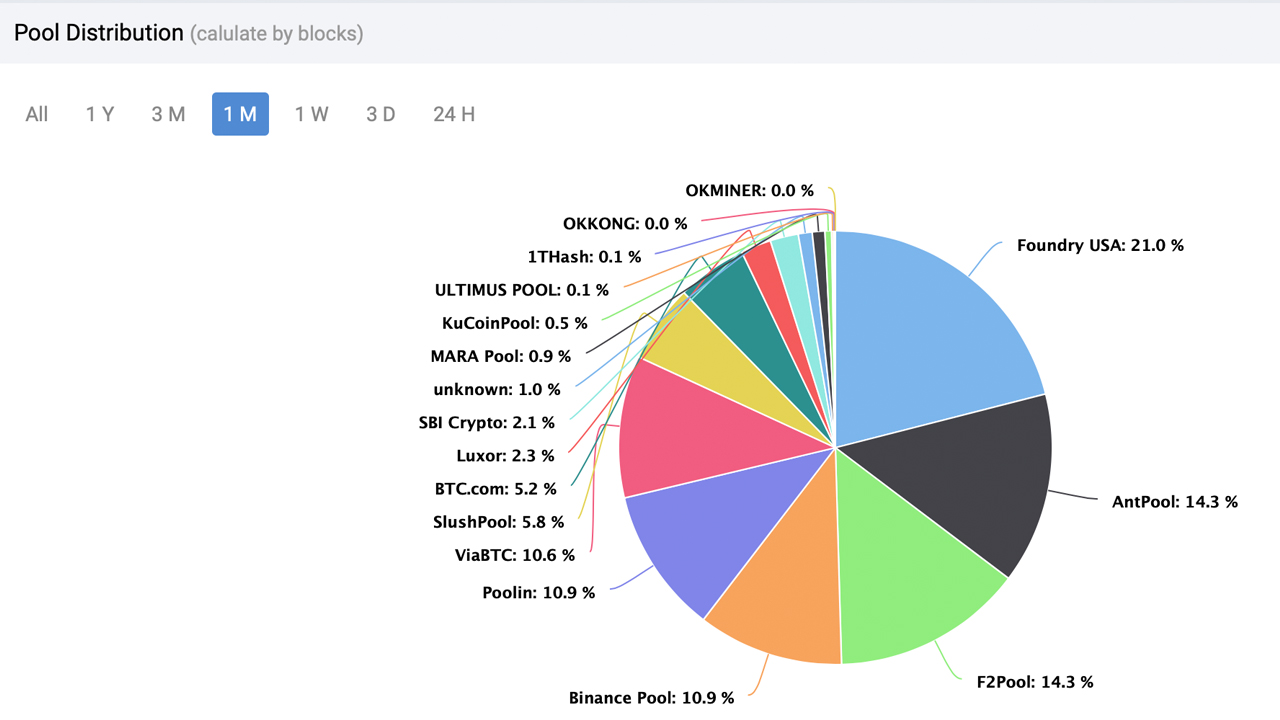

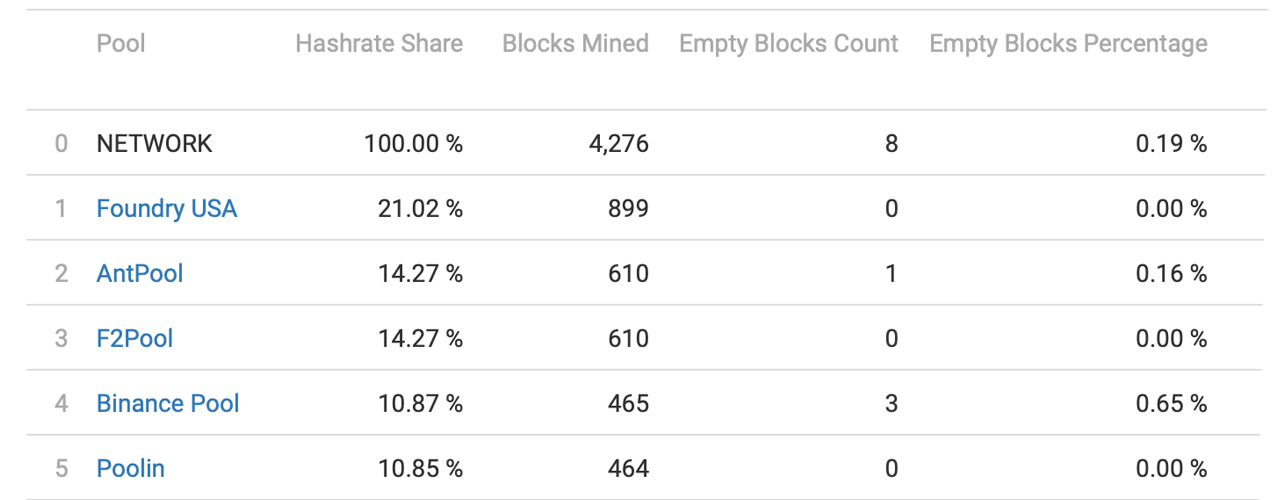

The Top Five Pools Acquired the Most Bitcoin Blocks Found Last Month Out of 16

The month of May has come to an end, and 4,276 bitcoin (BTC) block rewards have been discovered in the last 30 days. 26,725 new bitcoins were born into the system as a result of the 4,276 block rewards discovered. While the network's hashrate has been above 200 EH/s, Bitcoin's hashrate reached an all-time high on May 2, 2022, at block height 734,577. According to data from coinwarz.com, it hit 275.01 EH/s on that day.

According to statistics, 16 known bitcoin mining pools mined BTC in the last 30 days, with stealth miners, also known as "unknown," capturing around 1.03 percent of the hashrate. Unknown miners mined around 44 block rewards out of the 4,276 discovered, netting 275 bitcoin. Furthermore, the top five bitcoin (BTC) mining pools accounted for 71.4 percent of worldwide hashrate last month, according to data.

Last month, Foundry USA received the most block rewards, accounting for 21.02 percent of global hashrate. Foundry received 899 BTC block rewards out of a total of 4,276 and was able to purchase 5,618.75 additional bitcoins. Antpool (14.27 percent), F2pool (14.27 percent), Binance Pool (10.87 percent), and Poolin (10.85 percent) are the top five bitcoin mining pools by hashrate size, followed by Foundry (14.27 percent), F2pool (14.27 percent), Binance Pool (10.87 percent), and Poolin (10.85 percent). The five mining pools stated above account for about three-quarters of the worldwide hashrate observed last month.

The price of Bitcoin (BTC) is one of the factors that could influence the hashrate distribution. The market cycle appears to be in bearish territory, and a drop in the value of Bitcoin might shake up smaller mining pools. The halving will occur in 700 days, meaning mined blocks will pay out 3.125 coins per block instead than the current 6.25 BTC per block rate.

Finally, Bitmain and Microbt, two bitcoin mining rig makers, will introduce two new models in July that produce between 126 and 140 terahash per second (TH/s). The two new models have a higher hashrate per second than most current machines, therefore pools that have them will profit.

======