MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

Bitcoin (BTC) has risen 20% in July and is currently experiencing what some are referring to as a "bear market bounce," but price movement continues to perplex observers.

The Puell Multiple has exited its bottom zone as the July monthly closure draws near, raising expectations that the worst of the losses may be behind us.

Puell Multiple attempts to cement breakout

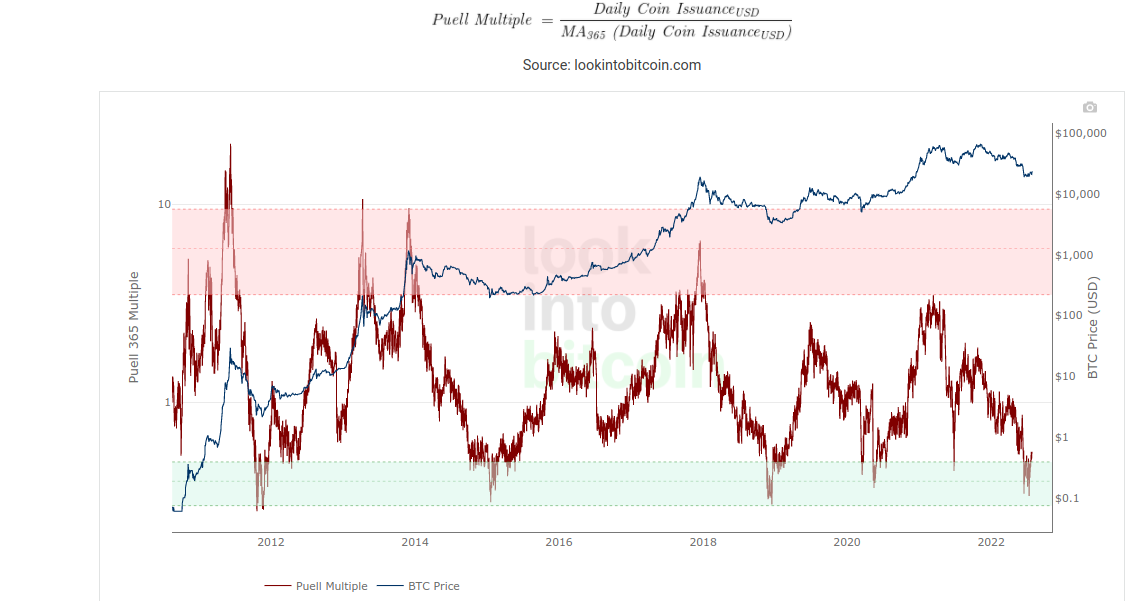

One of the most well-known on-chain Bitcoin measures is the Puell Multiple. It compares the worth of bitcoins mined on a given day to the value of bitcoins mined over the previous 365 days.

The resulting multiple is used to assess if the number of coins mined on a certain day is unusually high or low in comparison to the annual average. Profitability of the miner can be deduced from that information, coupled with broader judgments about how overbought or oversold the market is.

The Puell Multiple is currently shooting upward after reaching levels that are typically associated with macro price bottoms, which is something that is typically seen at the beginning of macro price uptrends.

In one of the company's "Quicktake" market updates on July 25, Grizzly, a contributor at on-chain analytics platform CryptoQuant, stated that, according to historical data, the breakout from this zone was followed by rising bullish momentum in the price chart.

There are other signals glowing green than the Multiple at this time. According to Cointelegraph, accumulating patterns among hodlers also point to the fact that the macro bottom has already been reached.

"Unprecedented macroeconomic conditions"

Bitcoin is currently close to its best levels in six weeks and far from a new macro low after its unexpected relief rally in the second part of this month.

Related: Despite a -31 percent GBTC premium, Bitcoin futures data indicates a "improved" mood

Market observers are highlighting unusual events that continue to make the bear market in 2022 very challenging to forecast with any degree of precision when mood leaves the "fear" zone.

CryptoQuant pointed out in a different recent "Quicktake" research report that even price trendlines are not behaving normally at the moment.

In recent weeks, BTC/USD has often crossed its realized price level, which did not happen in previous down markets.

The average realized price, which is now little under $22,000, is the price at which the BTC supply last changed.

According to CryptoQuant, the Realized Price has previously indicated market bottoms.

"More importantly, the bitcoin price did not cross the Realized Price threshold during the last two periods (134 days in 2018 and 7 days in 2020). Yet, since June 13, it crossed back and forth this level three times, which shows the uniqueness of this cycle due to unprecedented macroeconomic conditions."

According to Cointelegraph, these circumstances have manifested as forty-year highs in inflation in the United States, frequent Federal Reserve rate hikes, and most recently, indications that the American economy has entered a recession.

In addition to realized price, this bear market has seen an odd link develop between Bitcoin and its 200-week moving average (MA).

The 200-week MA often serves as support with minor dips below, but BTC/USD was able to change it to resistance for the first time in 2022. According to information from Cointelegraph Markets Pro and TradingView, it is currently hovering around $22,800.