MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

According to Glassnode, for Bitcoin (BTC) to continue its recent price rebound, there needs to be more demand and network fees invested, as several on-chain measures are still in a bearish area.

The blockchain monitoring company Glassnode reported on Monday in its most recent "The Week On Chain" report that market growth over the previous week had been only moderate.

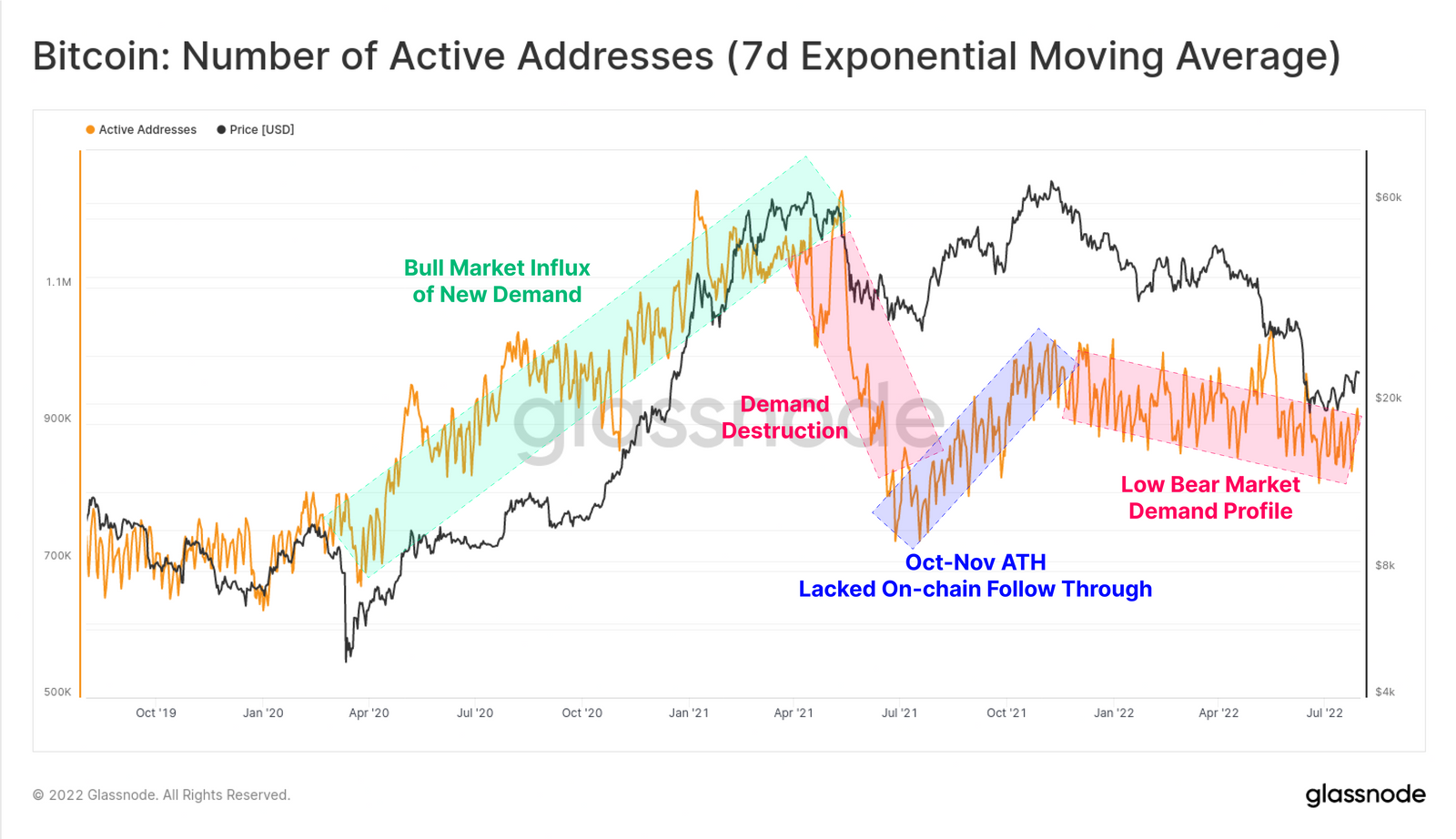

In it, researchers cited factors that should calm investors' euphoria over the 15% increase in BTC price over the last week, including sideways growth in transactional demand, active Bitcoin addresses continuing in "a well defined downward channel," and decreasing network costs. BTC is currently trading below $23,000 at $22,899, according to CoinGecko, down 2% over the last 24 hours.

#Bitcoin and #Ethereum have rallied strongly off the bottom, reaching above the Realized Price.

— glassnode (@glassnode) August 1, 2022

Attention now turns to whether this is a bear market rally, or whether the fundamentals are following through in support.

Read more in The Week On-chain 👇https://t.co/taOkbeVlyv

The report begins by highlighting the characteristics of a bear market, which includes a decline in on-chain activity and a rotation from speculative investors to long-term holders. It suggests that the Bitcoin network is still demonstrating each of those traits.

Glassnode wrote that a decline in network activity can be interpreted as a lack of new demand for the network from speculative traders over long-term holders (LTHs) and investors who have a high level of conviction in the network’s technology. The report states:

“With exception of a few activity spikes higher during major capitulation events, the current network activity suggests that there remains little influx of new demand as yet.”

In contrast to last week, when a significant level of demand appeared to be established at the $20,000 level for BTC and creating a floor, the additional demand needed to sustain any further price increases is not observable. Glassnode refers to the steady decline in active addresses as a “low bear market demand profile,” which has been in effect essentially since last December.

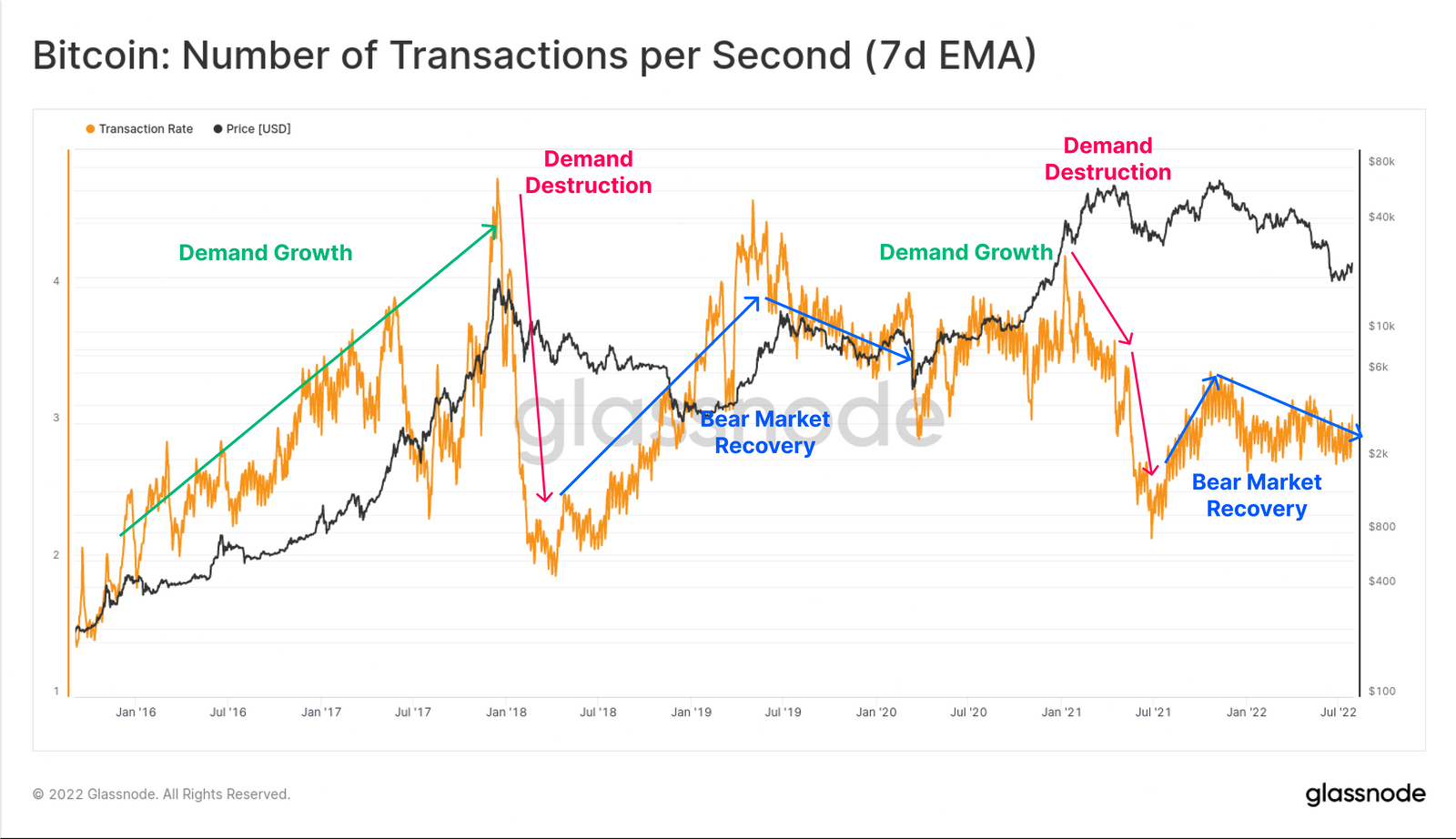

According to the investigation, the current network demand pattern and the one that was created in the 2018–2019 timeframe are identical. Network demand decreased after the April 2021 all-time high in the price of Bitcoin, similar to the previous cycle. Prior to the following November, there was a noticeable increase in demand as prices rose to a new all-time high.

However, since last November, demand has been declining, with a significant decline in May's large sell-offs:

“The Bitcoin network remains HODLer dominated, and as yet, there has not been any noteworthy return of new demand.”

The lack of demand from users other than ardent Bitcoin fans, according to Glassnode, is pushing network costs into "bear market territory." Daily costs were just 13.4 BTC during the past week. In contrast, daily network costs exceeded 200 BTC when prices reached their ATH in April.

Assuming fee rates climb noticeably, Glassnode contends that this could indicate rising demand, supporting a further "positive structural shift" in the Bitcoin network's activity:

“Whilst we have not seen a notable uptick in fees yet, keeping an eye on this metric is likely to be a signal of recovery.”

=========