MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

Like many other financial markets, the value of bitcoin and other cryptocurrencies has dropped so far this year. A few projects like Terra have failed right in front of our eyes. After this series of events, many investors and outsiders are wondering if the asset class that was so hot a year ago has a future.

Many people who bought bitcoin and other assets after the pandemic lost a lot of money this summer. Most people didn't understand the risks, partly because they were young and naive and partly because the crypto ecosystem was getting harder to understand.

Those of us who have been around for more than one market cycle saw the warning signs. In reality, each project is its own animal, and not all of them are built to withstand the many threats that lie ahead.

Even though it will take some time for people to feel better again, it's too soon to sell bitcoin and similar things. There could still be some potential out there. In the meantime, there are a few warning signs to look out for when evaluating other projects.

Oh my, there are experiments, pipe dreams, and cons!

When it started in 2009, Bitcoin was on its own. Since then, it has become a way to store value and a network that can't be shut down. Its market cap is now more than $1 trillion. Even though Bitcoin's price just dropped, I still think it has a lot of potential. I can't say that about every project that came after.

Today, there are more than 20,000 cryptocurrencies, digital assets, tokens, and projects that all claim to be the future of money. Each one takes some parts of Bitcoin's design—blockchain, decentralization, economics, mining, and cryptography—and changes them for a different purpose. As a technologist, I like that crypto is a place where people try new things. I care less about the buzz.

Even if the people behind a new project have good intentions, the project is still risky. Deadcoins.com keeps track of projects that have ended, and it has over 1,700 of them in its database right now. Keep in mind that half of all new businesses fail within 5 years, so it's not surprising that failure rates are even higher in this cutting-edge technology sector. Many projects will have goals that are too high, but the only way to find out if an idea works is to try to build it and see what happens.

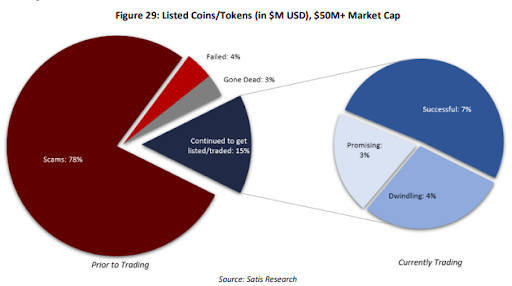

When looking at the bigger picture of risks, a 2018 report by Satis Group found that 80 percent of ICO projects that started in 2017 were outright scams, 7 percent had failed, and only about 10 percent looked like they might be successful in the long run.

When people get interested in cryptocurrencies, they often feel like they missed the boat and need to find "the next bitcoin." Entrepreneurs quickly realized this and started giving out altcoins and tokens with nothing more than a badly written white paper. This has led to a cycle of scams called "pump and dump" that don't show how hard many of us in the industry work.

bitcoin vs "the next bitcoin" pic.twitter.com/uGQ5n0n7cb

— Jameson Lopp (@lopp) July 3, 2022

If you fell for one of these scams, I think this bear market is a good time to think about it and learn more about the technology behind it, starting with Bitcoin. Bitcoin has been around for a while, but I don't think it's impossible that some value will come out of the many attempts to improve crypto. In science, you can't prove something isn't true. Also, the market will continue to find other valuable uses for cryptographically-secured protocols as it learns from their successes and failures.

Centralization's alluring call

A big part of engineering is figuring out how to balance things like the need for speed, ease of use, and safety. Bitcoin was made to be a decentralized network that handles groups of transactions about every 10 minutes.

Over the years, many people have tried to make this design better in different ways. Some people have tried to add more transactions to each block. Others tried to get transactions done more quickly. Several projects have tried to add real-world data to a blockchain in order to make complex markets like derivatives.

These attempts haven't been able to take over Bitcoin as the most popular way to store value because they usually involve some kind of centralization. Centralization is very efficient, but it hurts your efforts if you want to make finance more democratic and give people more power.

Centralization is bad for projects because it tends to ruin incentives for the communities involved. For example, an altcoin project could make it hard for regular users to run a node and join the network, or it could create an inner circle of validators to keep transactions from happening without their permission. If a validator collects data to add to a blockchain, it could be a single point of failure that could be bribed, worked with, or attacked.

Decentralization has been the key to Bitcoin's success. Users don't have to trust each other in order to use the network. They only have to trust the rules of the network protocol, which they can check with any software. This is why bitcoin has become more popular as a form of currency.

Too difficult to finish

Complexity is a threat to safety. The more parts a system has, the more likely it is that something will go wrong. If you can't stop abuse or denial of service, it might not do you much good to make a magical smart-contract platform. Sometimes, impressive white papers don't lead to projects that work well. Good can be hurt by trying to be perfect.

SlowMist says that flash loans, congestion attacks, and contract vulnerabilities are the most common ways that people lose money after scams. All of these are caused by systems that are fragile because they are hard to understand. When the number of ways users can interact with the code grows exponentially, it gets harder for developers to write code that works well.

In technology, discipline isn't given enough credit. It's hard to make a system that works as well as Bitcoin. It's made to be good money, and that's the only thing it's good at.

A big idea needs a big plan to make it happen, which is hard to do in a decentralized way. Building an open, permissionless network is like building an airplane while you're flying it. Developers have to be careful not to shift economic incentives in the wrong direction. When building something, each step needs to be checked to make sure it is stable and safe from both inside and outside threats.

Also, complexity makes users more vulnerable. A lot of private keys have been lost because users did something wrong. As the co-founder and chief technology officer of Casa, a company that provides security for bitcoin transactions, I try to find ways to help people from all walks of life. Simple things are best.

Bitcoin is changing the world because it gives people more power. As for crypto, every new project adds to the unknowns. The space has grown to the point where no one person can check out the technical details of every project, so it's natural to be both interested and skeptical. As you enter the cryptoverse, try to find a balance between optimism and realism. This will help you find vires in numeris (strength in numbers).

----------