MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

An report regarding the BIS's recently proposed rules for banks storing crypto assets screams, "Bank for International Settlements to allow banks to store 1 percent of reserves in bitcoin."

Changpeng "CZ" Zhao, the CEO of the cryptocurrency exchange Binance, retweeted the item and added, "Banks now use bitcoin for reserves. Most likely nothing. Crypto Twitter erupted. Thousands of others retweeted Zhao's message, and more than 10,000 people "liked" it.

It would be fantastic news for bitcoin as an asset class if the BIS indeed intended to "extend its hand" to bitcoin by enabling banks to hold it as reserves, as the story suggests, but perhaps not for those thinking it would eliminate banks. But regrettably, the BIS, a grouping of the biggest central banks in the world, has no plans to take such action. Sadly, the piece misinterprets the BIS suggestions. The BIS is cutting the rope for bitcoin, not reaching out to aid.

Frances Coppola writes a column for CoinDesk and speaks frequently on topics related to banking, finance, and economics. She promotes "helicopter money" to bring economies out of recession in her book, "The Case for People's Quantitative Easing," which describes how modern money production and quantitative easing function.

The BIS recommends that banks limit their entire exposure to all cryptocurrencies (including but not limited to bitcoin) and the majority of stablecoins to no more than 1% of their Tier 1 capital. Tier 1 capital, however, is not a reserve. That is not a license; it is a constraint.

Bank funds

Bank reserves are a form of digital money that central banks distribute to authorized banks for use in payment transactions. Banks that are solvent have more assets than deposits, but only a small portion of those assets constitute bank reserves. This is the origin of the phrase "fractionally reserved." It does not imply that the balance sheet of the bank is unbalanced. It alludes to the fact that commercial banks' primary goal is to make money by trading borrowed liquid assets (deposits) for illiquid assets with higher yields (loans).

Banks are always at risk of a bank run, which occurs when many clients demand their deposits back at once, because only a portion of the bank's assets can be utilized to pay deposit withdrawals. A typical bank run involves the bank selling its illiquid assets at a steep discount in order to raise the reserves required to pay back its clients. We refer to that as a "fire sale." It eventually runs out of things to sell and is compelled to close.

Regulators require licensed banks to keep a specific percentage of their balance sheets in the form of liquid assets in order to reduce the probability of bank runs and fire sales. The "reserve requirement" required banks in the U.S. historically to have enough bank reserves to cover at least 10% of permissible deposits. However, the reserve requirement was dropped by the Federal Reserve in March 2020. The "liquidity coverage ratio" (LCR) of the BIS, which requires banks to hold enough high-quality liquid assets to cover all known and anticipated payment requests over a 30-day period, has taken its place.

Superior liquid assets

Bank reserves and other assets that are easily convertible into bank reserves, such US Treasury notes, are examples of high-quality liquid assets. Cryptocurrencies are not included in the assets. The BIS proposal doesn't alter it in any way. Banks don't utilize bitcoin as reserves, and if regulators accept the BIS idea, they never will.

What then is Tier 1 capital if reserves aren't it? Well, it may be thought of as a safety net that shields depositors from losses in the event that the bank collapses.

The total realizable worth of a bank's assets at the time of failure is often lower than the sum of its liabilities and equity. Therefore, not everyone will receive their money back. As a result, claims made against the bank's remaining assets are resolved strictly in order of priority.

The bank pays secured claims (loans for which it has pledged collateral) and any "super-senior" claims last. The next group of creditors is made up of the bank's unsecured depositors and senior bondholders. The holders of junior ("subordinated") debt are then paid, if there is any money remaining. The shareholders, who typically receive nothing, are at the bottom of the list.

It should be clear that there must be sufficient shareholder equity and junior debt to cover any losses if depositors are to receive their money back. This is referred to as "capital" for banks. Common Equity Tier 1 (CET1) capital, which is comparable to shareholders' money, Additional Tier 1 (AT1) capital, which is often debt convertible to equity, and Tier 2 capital, which is a broader category of subordinated debt, are the three forms of capital used by banks. If a bank files for Chapter 11 bankruptcy, CET1 capital is next in line to suffer losses, followed by AT1. Usually, Tier 2 is only impacted if the bank enters liquidation.

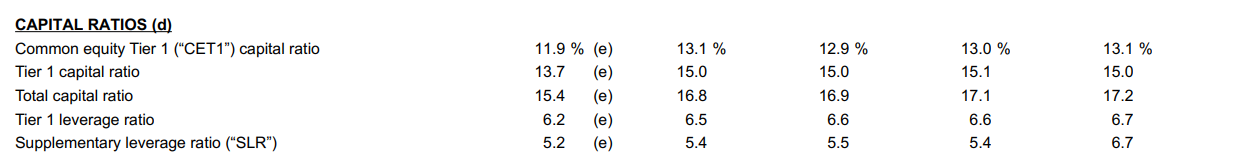

CET1, Tier 1, and total capital to total assets weighted for risk are the capital ratios that banks publish. The ratio of Tier 1 capital to unweighted total assets is known as the "leverage ratio," which was implemented following the 2008 financial crisis. J.P. Morgan & Chase, for instance, provided the following capital and leverage ratios for the first quarter:

(J.P. Morgan & Chase)

(The ”supplementary leverage ratio” (SLR) is a U.S. specific version of the BIS Tier 1 leverage ratio.)

Capital requirements

According to the fundamental BIS capital criteria, banks must have a minimum of 8% of risk-weighted assets in total capital, of which 6% must be Tier 1. However, national regulators typically have stricter guidelines, especially for the largest banks, or those that are "too big to fail." Nobody wants the government to have to rescue large banks once more, as it did in 2008. Therefore, J.P. Morgan has Tier 1 and overall capital ratios that are significantly greater than the BIS minimum in the scenario above.

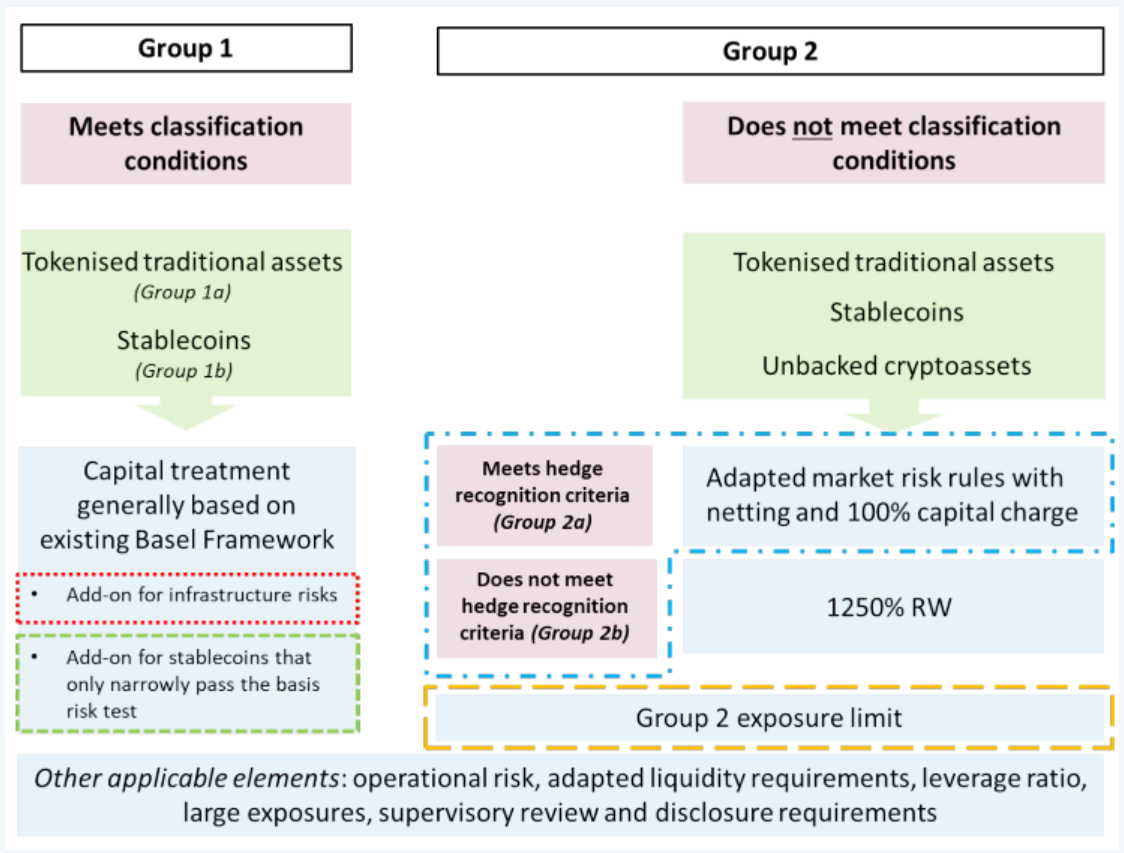

After defining the distinction between Tier 1 capital and reserves, let's take another look at the BIS proposal for crypto assets. The BIS offers a helpful chart that demonstrates how it classified cryptocurrency assets into two groups, each with two subgroups, and gave each group varying capital requirements:

(Bank of International Settlements)

Traditional assets that have been tokenized and stablecoins that meet strict stability and redeemability requirements make up Group 1. Group 2 includes all other items. Group 2 is subject to significantly stricter rules than Group 1 since it is thought to be riskier.

Group 2 includes all cryptocurrencies, including bitcoin. Most stablecoins are also.

Bitcoin limits

In fact, under the BIS's guidelines, holding or trading bitcoin for one's own account becomes incredibly expensive for banks. Banks are required by the rules for Group 2a and Group 2b assets in the aforementioned chart to fully write down their bitcoin holdings against capital. The minimum capital requirement of $100 (i.e., the same value as the original exposure, as 12.5 is reciprocal of 0.08) is what the BIS's 2021 proposals state: "A $100 exposure would give rise to risk weighted assets of $1,250, which when multiplied by the minimum capital requirement of 8 percent results in a minimum capital requirement of $100 (i.e., the same value of the original exposure)."

Before applying the capital charge to Group 2a assets, holdings might be netted and the impact of hedging taken into consideration. However, Group 2b must ignore any hedging and apply the capital penalty to the bigger of the total gross long and short positions.

In layman's terms, this means that banks are prohibited from financing the purchase of bitcoin or any other cryptocurrency using customer deposits or senior bonds. They can only fund them with capital. This guarantees that none of their clients or creditors will be impacted if the value of their cryptocurrency assets crashes to zero. However, equity financing is significantly more expensive than debt financing, and shareholders may be wary of a bank using their money to take such risks.

If enacted, these laws will only apply to banks that own and trade private stablecoins and cryptocurrencies on their own behalf. They won't stop banks from offering their clients custody and trading services for cryptocurrencies. Additionally, they won't stop banks from launching their own stablecoins and tokenized assets. In fact, it could be argued that the recommendations incentivize the banks to do this because these could satisfy the requirements for Group 1 assets.

A place for CBDCs

The central bank digital currencies (CBDCs), or the "elephant in the room," are digital assets issued by central banks but are completely disregarded by this system. Banks are prohibited from using bitcoin as part of reserves under BIS's proposals. CBDCs, however, might be able to supplement or replace reserves. Additionally, as they would be issued by the central bank, they would not be subject to the strict capital requirements of the BIS. Therefore, these measures not only make storing bitcoin highly unattractive for banks, but they also pave the way for CBDCs to enter the cryptocurrency space.

==========