U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

SEC Finds 'No Grounds' to Deny Conversion of Bitcoin ETF, Grayscale Says

Bitcoin Bulls Encounter Headwinds as Monthly Stochastic Indicator Trends Downward: Analyst

The price of Bitcoin increased when the U.S. Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) remained unchanged in July.

As investors anticipated the inflation report, Bitcoin surged from a local low of $22,600 on August 10 in anticipation of the news. BTC's immediate reaction to the announcement of the information was a surge to $24,000.

The day before, crypto markets and stocks saw a modest fall as investors displayed caution ahead of the BLS report, despite CPI projections of 8.7% being lower than the previous month's 9.0%.

CPI vs. PCEPI?

Following the most recent FOMC meeting on July 27, Fed officials announced a second straight 75 basis point increase, resulting in a range of 2.25% to 2.5%.

The next meeting of the Federal Open Market Committee (FOMC) will be held on September 20 and 21, with anticipation rising that the Fed will be compelled to implement another major rate rise to counteract the red-hot labor market and the increase in Average Hourly Wages.

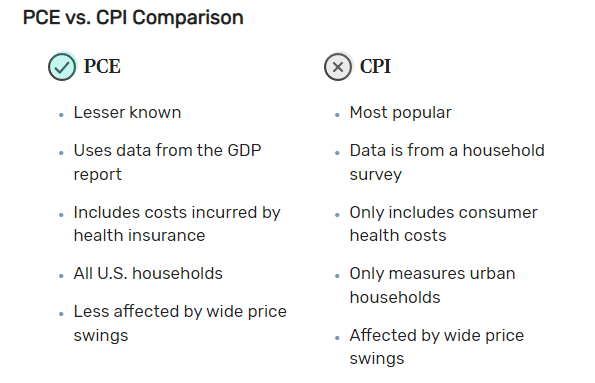

There are two official measurements of inflation in the United States:

CPI inflation - measures the monthly change in prices paid by consumers in the United States. The CPI is calculated by the Bureau of Labor Statistics (BLS) as a weighted average of prices for a basket of goods and services that is reflective of total U.S. consumer expenditure.

The Personal Consumption Expenditures Price Index (PCEPI) tracks changes in the prices of household products and services. Inflation is indicated by an increase in this indicator, whereas deflation is shown by a decrease.

The CPI is utilized by federal and state governments and enterprises. The PCEPI, in contrast, informs the FOMC of its inflation strategy.

September's FOMC meeting becomes the focus of attention.

Analysts anticipate that core inflation will rise from 5.9% to 6.1% in September, putting pressure on the Fed to implement a major rate hike. The CPI data indicates, however, that recent rate rises are acting to slow the economy.

In spite of this, Citigroup economists anticipate a 75-basis-point rate rise in the near future due to good job data and faster-than-expected wage growth. Nonetheless, a 100 basis point hike is also possible if core inflation is stronger than anticipated.

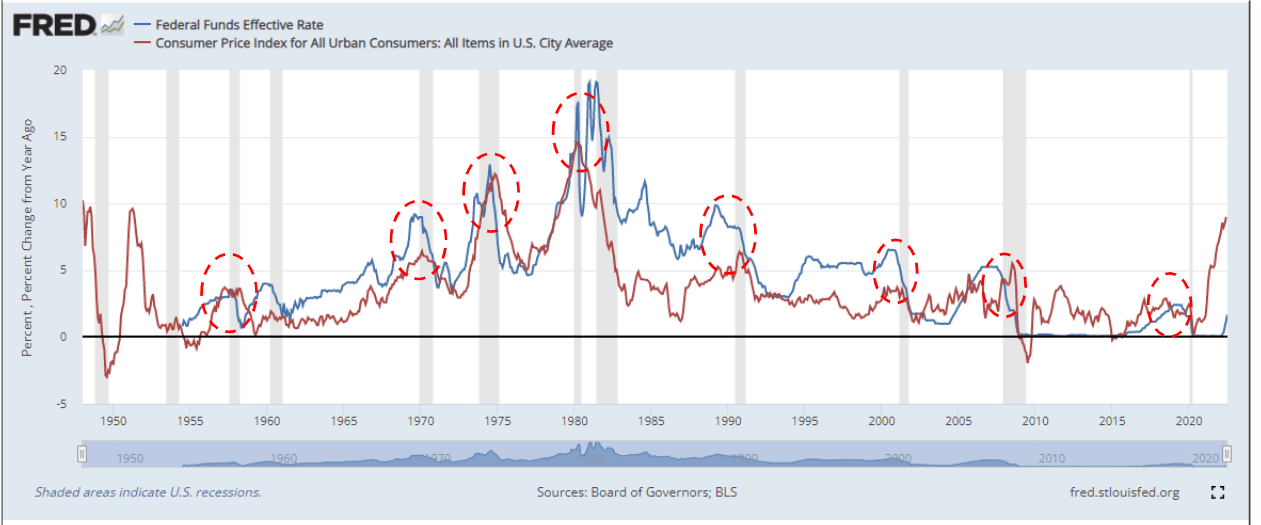

Stanley Druckenmiller, an investor, remarked, "Inflation has never dropped below 5% without Fed funds climbing beyond CPI," which is presently at 9%.

Therefore, if the Fed is serious about controlling inflation, a funds rate of 9 percent is necessary.

Related video