U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

Typically, the general market mood is assessed by analyzing long-term market activity. However, while zooming out might provide a clearer view on current market circumstances, the most reliable indicator of the market's position is sometimes found in the center.

SOPR and the need of market analysis

The Spent Output Profit Ratio (SOPR) is a useful indicator for gauging market mood as a whole. As its name implies, the measure compares the value of outputs at the time they were spent to their value at the time they were generated. The statistic indicates the proportion of realized profit for all coins traded on-chain within a given time interval.

When SOPR is more than one, the coins in question trade at a profit. When the ratio is below one, coins are exchanged at a loss. A SOPR ratio of 1 is known as a SOPR reset and is frequently used to indicate the beginning or conclusion of a midterm cycle. The SOPR reset may also serve as support or resistance in bull or bear markets.

While the measure is a simple and straightforward signal, it may be changed to provide a far more complicated market perspective.

For instance, aSOPR is used to filter transactions to exclude any "in-house" activity (e.g., transactions between addresses belonging to the same owner), which results in stronger market signals than raw-data SOPR. The SOPR and aSOPR metrics may be subdivided into long-term and short-term holdings.

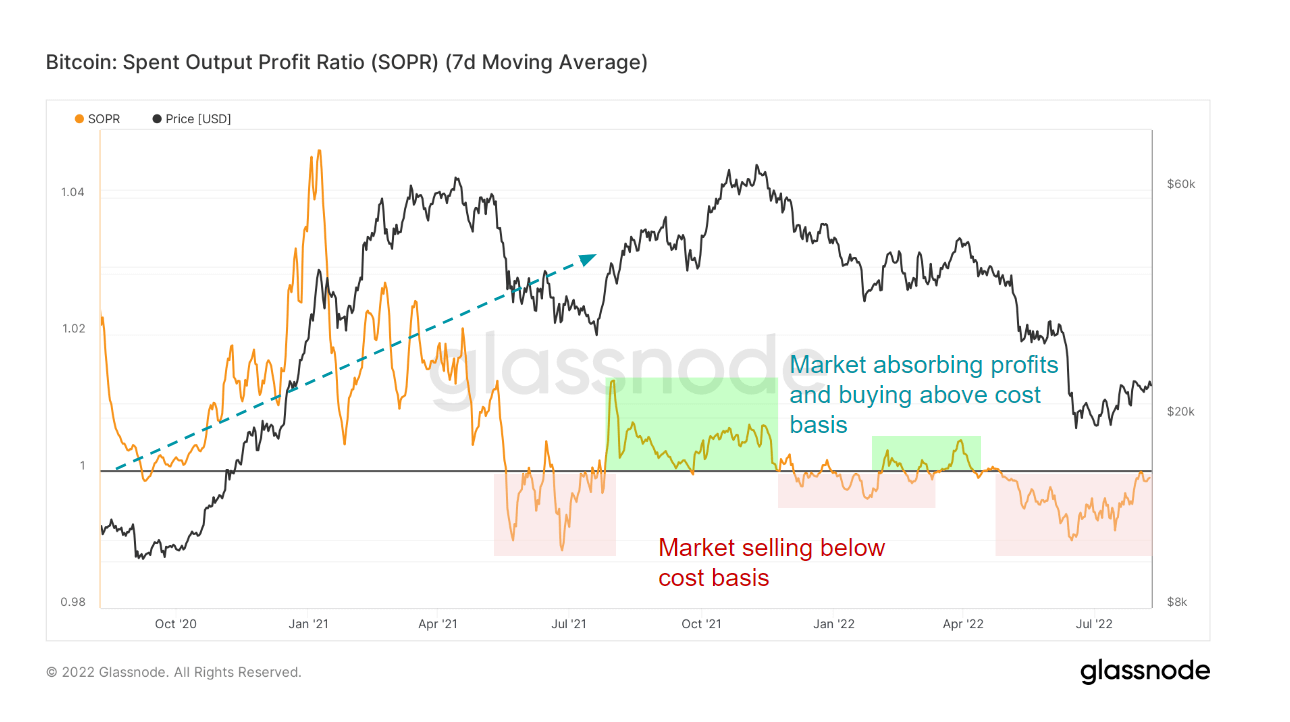

The Bitcoin SOPR

Bitcoin's seven-day MA SOPR is attempting to break above 1 for the first time since May. Bitcoin's SOPR reached one at the end of July and has been retesting it during the first week of August.

Each time Bitcoin reached a SOPR of 1 and failed to overcome resistance, its price saw a temporary increase. Attempts to overcome SOPR resistance have almost always been accompanied by bear market rallies, sometimes known as dead cat bounces.

And while Bitcoin's failed attempts to overcome resistance may appear discouraging, the prognosis is optimistic. Historically, it has always required many efforts for SOPR to surpass 1 The harder it struggled to surpass the ratio of 1, the greater its subsequent support.

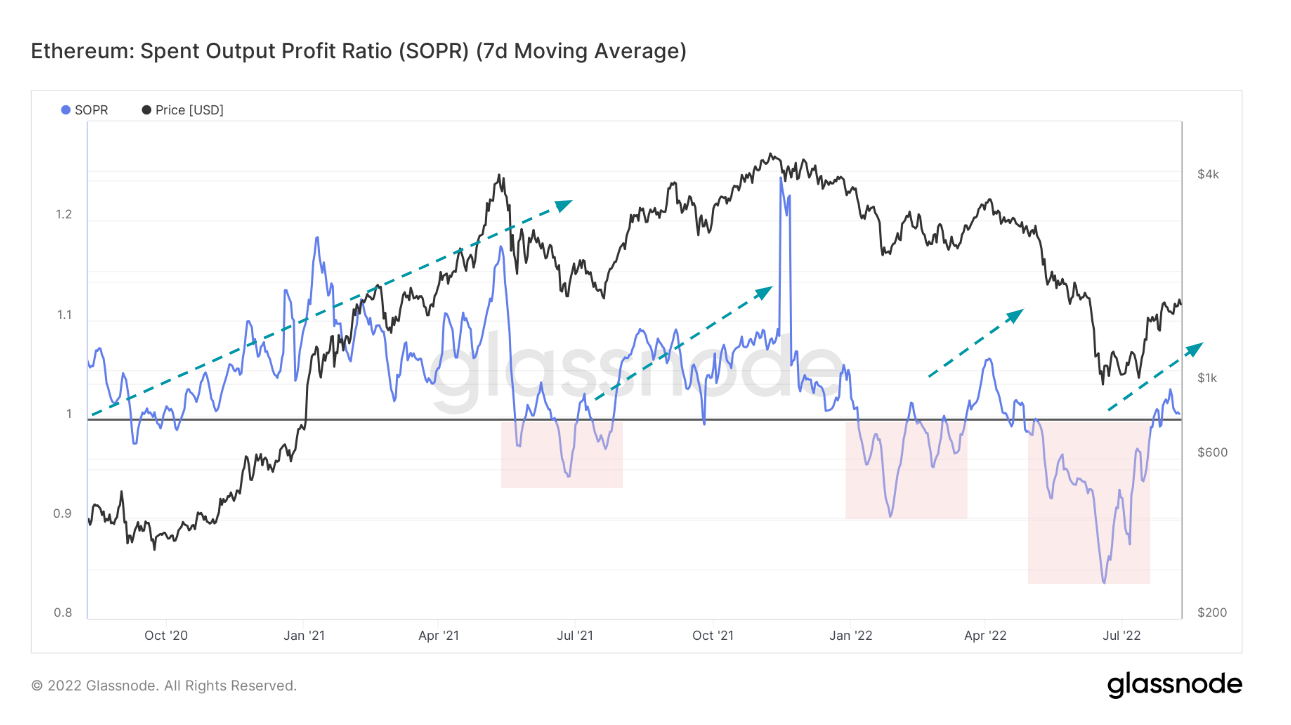

The Ethereum SOPR

Ethereum, unlike Bitcoin, was able to surpass the SOPR of 1 on the first attempt. According to statistics from Glassnode, Ethereum appears to have found support at 1 in August, having rapidly rebounded from its most recent decline. Ethereum's increasing SOPR is a direct outcome of ETH's growing price, which has been defying the prevailing market trend that has most currencies trading in the red.

Bitcoin has been retesting its resistance, and Ethereum has been retesting its support, indicating that the two may be heading in opposing directions. Historically, in order for the spent output profit ratio to operate as strong support, the ratio had to pass through resistance several times.

As previously reported by CryptoSlate, Ethereum's market-defying rise is partly due to rumors around the forthcoming Merge. This is evidenced by a huge growth in futures trading, which increased Ethereum's open interest to $6.4 billion, $1.4 billion higher than Bitcoin's. The increase in futures trading contrasts with the decline in network user activity, as seen by the decline in gas prices.

This level of speculation threatens the stability of Ethereum's SOPR. Any decline in Ethereum's price would undoubtedly influence the ratio and drive it below 1. If it were to drop abruptly, Ethereum's SOPR may see significant resistance if it attempted to re-break above the level.