U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

SEC's Gensler Deserves Increased Congressional Scrutiny Regarding Crypto Regulation: U.S. Senator

Ether Whales Accumulate $94 Million in ETH Amidst Price Dive to $1.6K

After waiting for years, Ethereum is now ready to fully transition to a proof-of-stake (PoS) network. In addition to Ethereum's native currency Ether (ETH), the value of a number of other tokens has increased significantly and may continue to surpass ETH following the Merge.

Ethereum steps closer toward the Merge

On August 11, the top smart contract platform finished the last of its three "Goerli" public testnets. Ethereum's "Merge," which is scheduled to launch on September 19, shouldn't see any delays as a result.

After the Goerli update, the price of ether increased by 5% to over $1,950, its highest level in more than two months. In the meantime, several cryptocurrencies that stand to gain from a successful merge are rising in value and, over the past month, have even outperformed ETH.

Will these tokens continue to outperform ETH price into September? Let's take a closer look.

Lido DAO (LDO)

Validators, who will be forced to front 32 ETH as an economic stake, will replace Ethereum's army of miners after The Merge.

Due to this significant staking requirement, platforms that collect Ether from unfunded stakers and combine the funds to become validators on the Ethereum blockchain now have more chances. One of them is the Lido DAO.

Is it crazy to anticipate a significant increase in the price of Ethereum before and after the Merge?

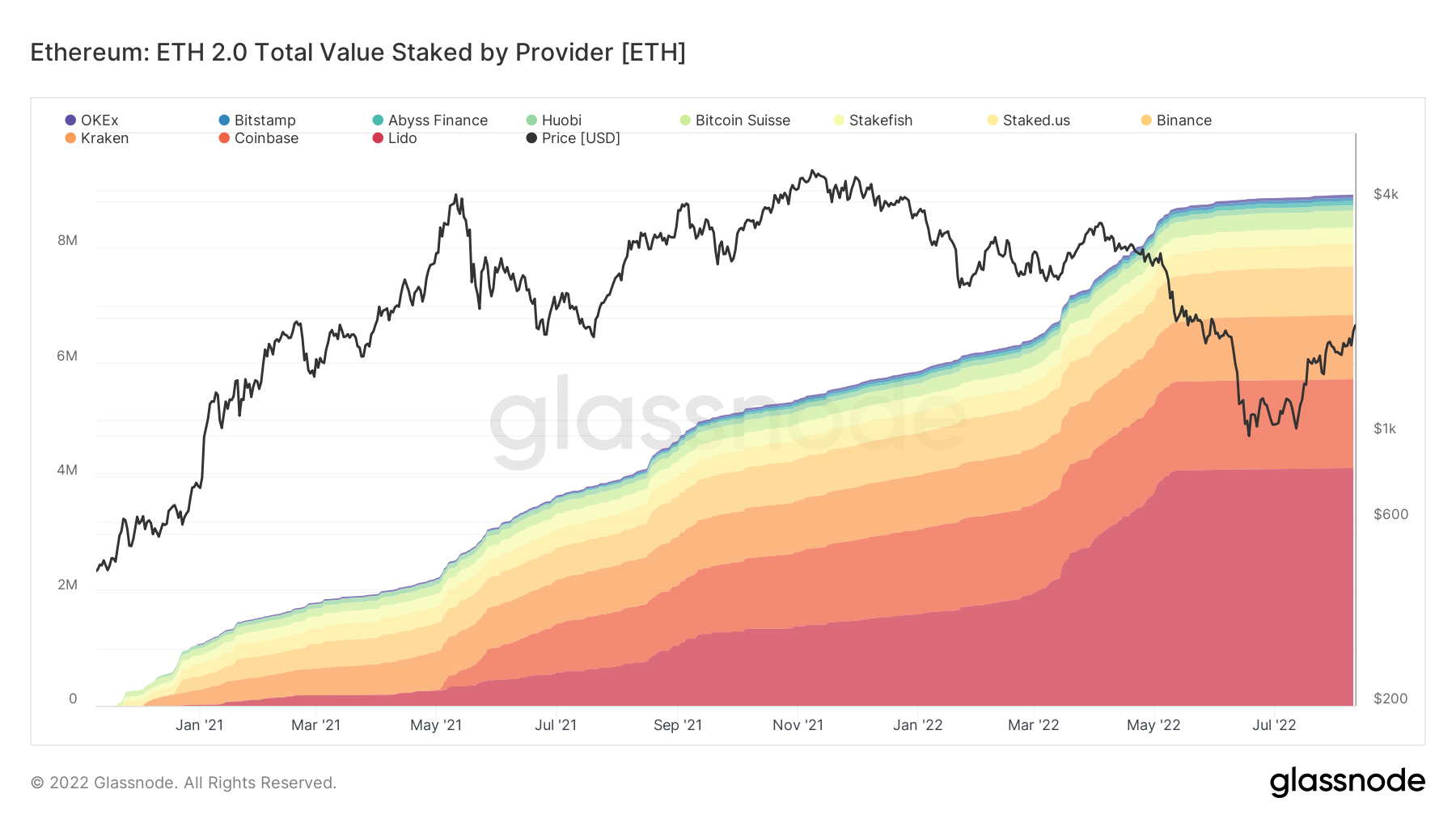

In terms of wealth that has been secured inside Merge's official smart contract, Lido DAO is the top staking service. Specifically, it staked 4.15 million ETH into the ETH 2.0 contract, surpassing Coinbase, which invested roughly 1.55 million ETH on behalf of its customers.

A successful Merge could boost the demand for Lido DAO services.

LDO, the platform's official governance token, may benefit as a result, as its value has increased by more than 200% since July 14, when Ethereum initially hinted that it would transition into a PoS chain in September.

Therefore, LDO is one of the primary crypto assets that could benefit the most from Ethereum's successful transition to POS.

Ethereum Classic (ETC)

Another asset that has recently caught the bulls' eye is Ethereum Classic (ETC). This is mainly because it might offer a safe refuge for miners leaving the Ethereum network.

Its split chain, Ethereum Classic, exhibits nearly all the technical characteristics of the current, PoW Ethereum network, making it a natural haven for ETH miners. Ethereum Classic is the result of a contentious hard fork in 2016.

ETC has increased by over 200%, similar to LDO, since the Ethereum Merge launch announcement on July 14. It has a strong chance of maintaining its upward trend both before and after the Merge.

Optimism (OP)

An Ethereum rollup service is optimism. To put it another way, it groups large amounts of off-chain transaction data into batches and delivers the final products to the Ethereum mainnet after a consensus is established.

After the Merge, Ethereum's "Rollup-Centric Roadmap" might help the so-called layer-2 solution. It's interesting to note that since the Merge release date announcement, OP, Optimism's governance token, has increased by around 250%.

The prospects of Ethereum deploying Optimism on its network after the Merge could serve as a bullish catalyst for OP price.

----------