Coinbase's Pursuit of Regulatory Clarity Shapes its Global Expansion Strategy

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

Coinbase Launches Innovative Crypto Lending Solution Targeting Institutional Investors

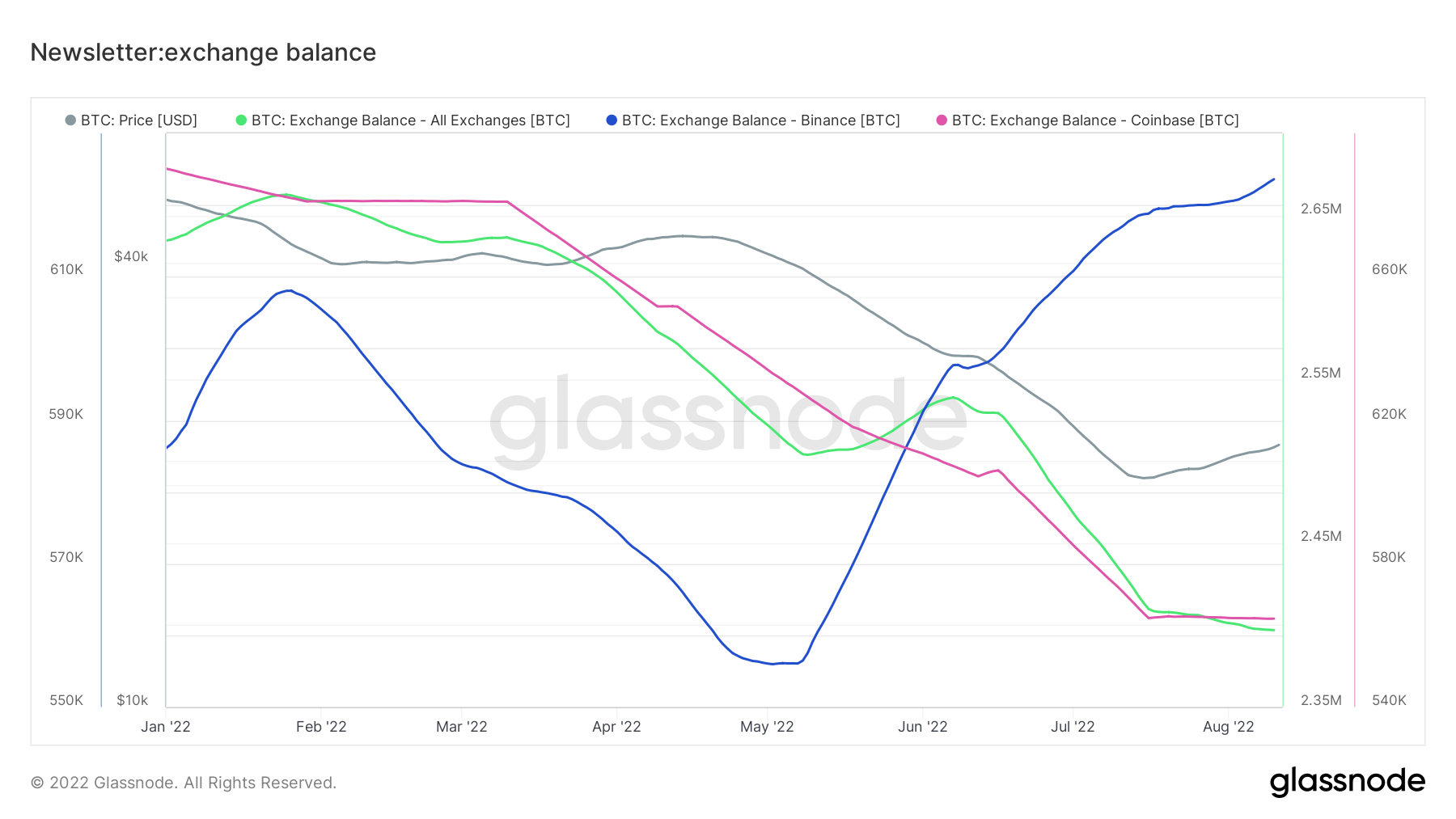

From January 2022, the amount of Bitcoin sitting on exchanges decreased for both Coinbase and Binance, until Binance's exchange balance dramatically flipped and began to climb in May. Despite the fact that both the total and Coinbase exchange balances are dropping, it is still increasing.

Bitcoin Exchange Rate (via Glassnode)

The graph above illustrates the cumulative Bitcoin exchange balance, the Bitcoin price, and the Binance and Coinbase exchange balances.

Since February, the green line indicating the cumulative exchange balance has been rapidly declining. At the start of the year, there were around 2,6 million Bitcoins on exchanges. This value is now fewer than 2.4 million, showing a net outflow of 200,000 Bitcoins.

This indicates that Bitcoin supply has been pulled from exchanges, indicating a long-term positive holding trend.

Coinbase

The overall balance of Coinbase has followed a similar path. At the start of the year, the exchange held around 690,000 Bitcoins, but it had slipped below 560,000 after eight months.

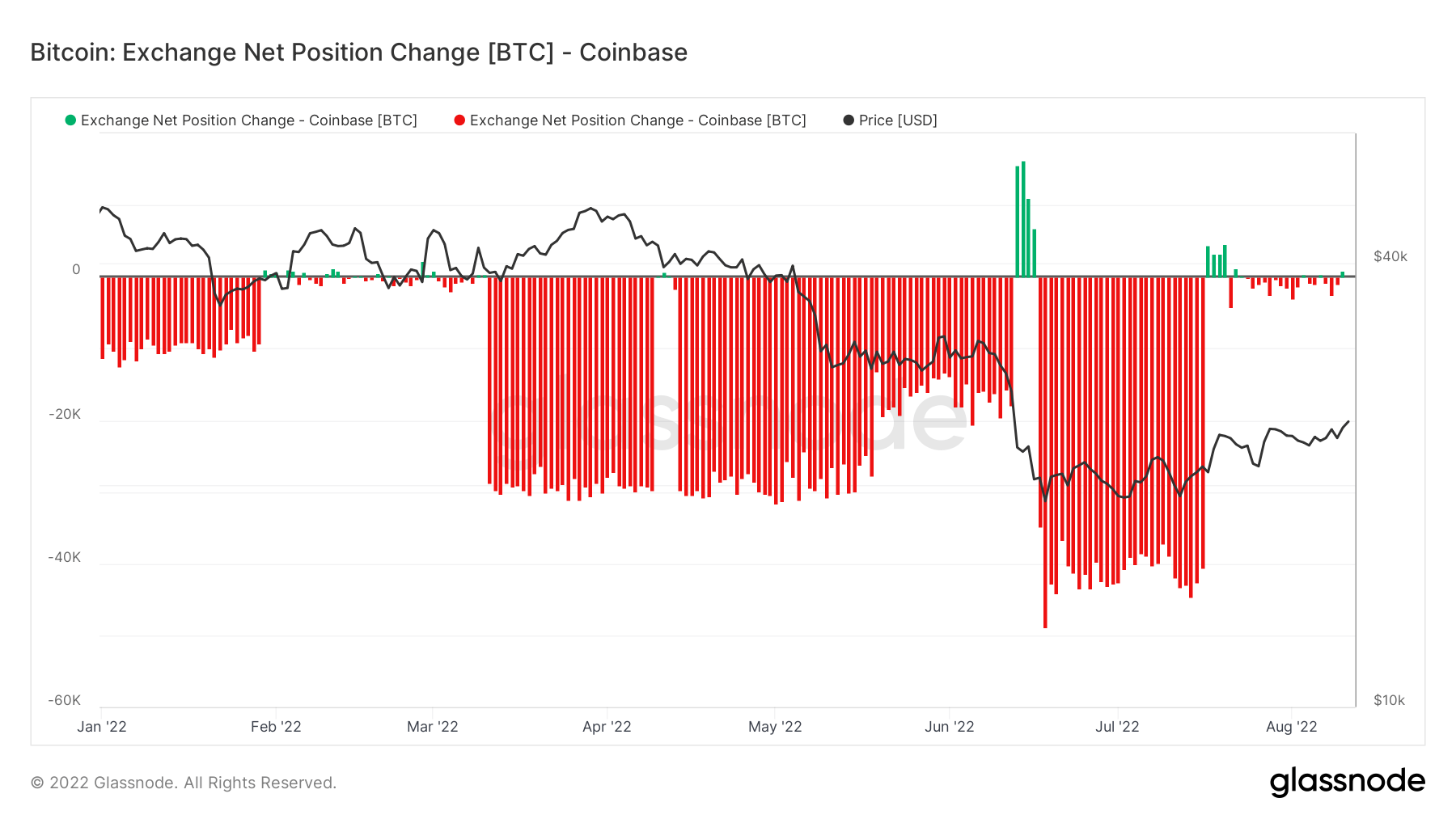

The graph above illustrates currency movement on Coinbase. The red lines indicate Bitcoins leaving the exchange, while the green lines represent Bitcoins entering the exchange. Coinbase has had a considerable amount of Bitcoin removed since the beginning of the year. Furthermore, between March and May, and again in July, the amounts taken out more than doubled.

These transactions may have been affected by the fact that US institutions prefer Coinbase. Institutions are more inclined to buy and hold in a falling market, which may have caused them to remove their Bitcoins from Coinbase.

Binance

Despite being caught in the similar decline at the beginning of the year, Binance ended up with more Bitcoins than in January. The exchange started the year with 586,000 Bitcoins, fell below 560,000 until May, and finished with 623,000 Bitcoins.

cccccccccccccccccccccccccccccccccccccc

The graph above demonstrates the drop in Bitcoin reserves from February to May, which then reverses.

Binance and Coinbase are on a downtrend.

According to recent news, Binance and Coinbase are approaching the winter market in various ways. While Binance remains unaffected by the harsh winter conditions and prioritizes its customers, Coinbase is battling with layoffs, lawsuits, and bankruptcy rumors.

Binance

Binance U.S. was valued at $4.5 billion in a seed financing round before to the start of the harshest winter in crypto history, and the exchange took the first step toward expanding in Abu Dhabi. Binance continued to spend and hire even after the winter hit. Binance CEO Changpeng Zhao even indicated that the company is in a highly prosperous position and would begin buying other firms shortly.

Coinbase

Coinbase, on the other hand, has been dealing with bankruptcy terminology in its quarterly report since the beginning of the winter season. Soon after, Coinbase users reported losing their Wormhole Lunas when attempting to send them to the exchange, which Coinbase declined to assist with at the time. Customers as well as Craig Wright then sued the exchange. Along with dealing with them, the SEC has initiated an investigation into Coinbase's staking program.

Meanwhile, due to market conditions, the company exchanged unhired fresh recruits and laid off 1,100 employees in response to a petition against executives. Finally, according to Goldman Sachs, Coinbase's income might decline by 61% as a result of the cold weather, and the company may need to lay off more workers to stay afloat.