Tornado Cash Developers Accused of Assisting Hackers in Laundering $1 Billion, Including Notorious North Korean Attacks

U.S. Senator Lummis and Crypto Advocates Call for Dismissal of SEC's Lawsuit Against Coinbase

Blockchain Association Submits Amicus Brief Supporting Coin Center's Lawsuit Against U.S. Treasury Regarding Tornado Cash Sanctions

Since Tornado Cash was shut down last week, it is perfectly reasonable and maybe even better for Ethereum blockchain-based apps to block users who have used the service. If we didn't do it that way, a lot of the Ethereum network would probably be open to criminal liability. And that includes the teams that started the new alternative economy of decentralized finance (DeFi),

This is not an excuse for the Treasury Department's action against Tornado Cash, which is based on the idea that Tornado Cash was used to wash $7 billion worth of digital assets since it was started in 2019. Many legal experts and business people have said that preventing all Americans from using a technology that protects privacy is too broad and could be against the Constitution.

Tornado Cash is an open-source "mixer" for cryptocurrencies that lets people hide their past transactions on the Ethereum blockchain. It doesn't need permission to be used, so anyone can interact with it, and its code can't be changed once it's been deployed.

In cryptography, there is an important difference between a protocol and the service that most users will use. These ways of getting in are called "front-ends," and they are basically sites or widgets on the web that interact with a smart contract on a blockchain that can't be changed.

In recent days, this difference has been brought to light as the crypto industry starts to figure out how big the Tornado ban is. When projects try to follow sanctions laws by putting up walls and cameras in front of them, they are criticized for supposedly going against the core ideas of DeFi.

The decentralization debate

Last week, a number of well-known DeFi projects, like the decentralized exchange dYdX and the Aave platform, said they had started blocking Tornado Cash-related crypto wallets from using their front-ends. Other companies, like the NFT (non-fungible token) marketplace OpenSea, have probably started doing the same thing, but they haven't said so publicly.

According to dYdX, this is because crypto compliance software providers like Chainalysis or Elliptic found a "sudden influx" of accounts that had been flagged. At this point, we don't know how much the authorities will enforce the penalty, which is broad enough to affect any address daisy-chained to Tornado, whether it's a sender or a receiver.

Even though only a small percentage of wallets have a direct link to Tornado Cash, almost half of the Ethereum network is only "two hops" away from an address that received funds from Tornado. An anonymous researcher at data shop Block119 named ElBarto Crypto called this the "six degrees of Tornado Cash."

"Everyone who criticizes DeFi companies for using compliance tools should host the Uniswap front-end on their domain without blocking," dYdX founder Antonio Juliano tweeted over the weekend. He said that in a funny way to get people to think about the risks of running a website that doesn't follow the rules, but the same idea has been put forward as a real solution.

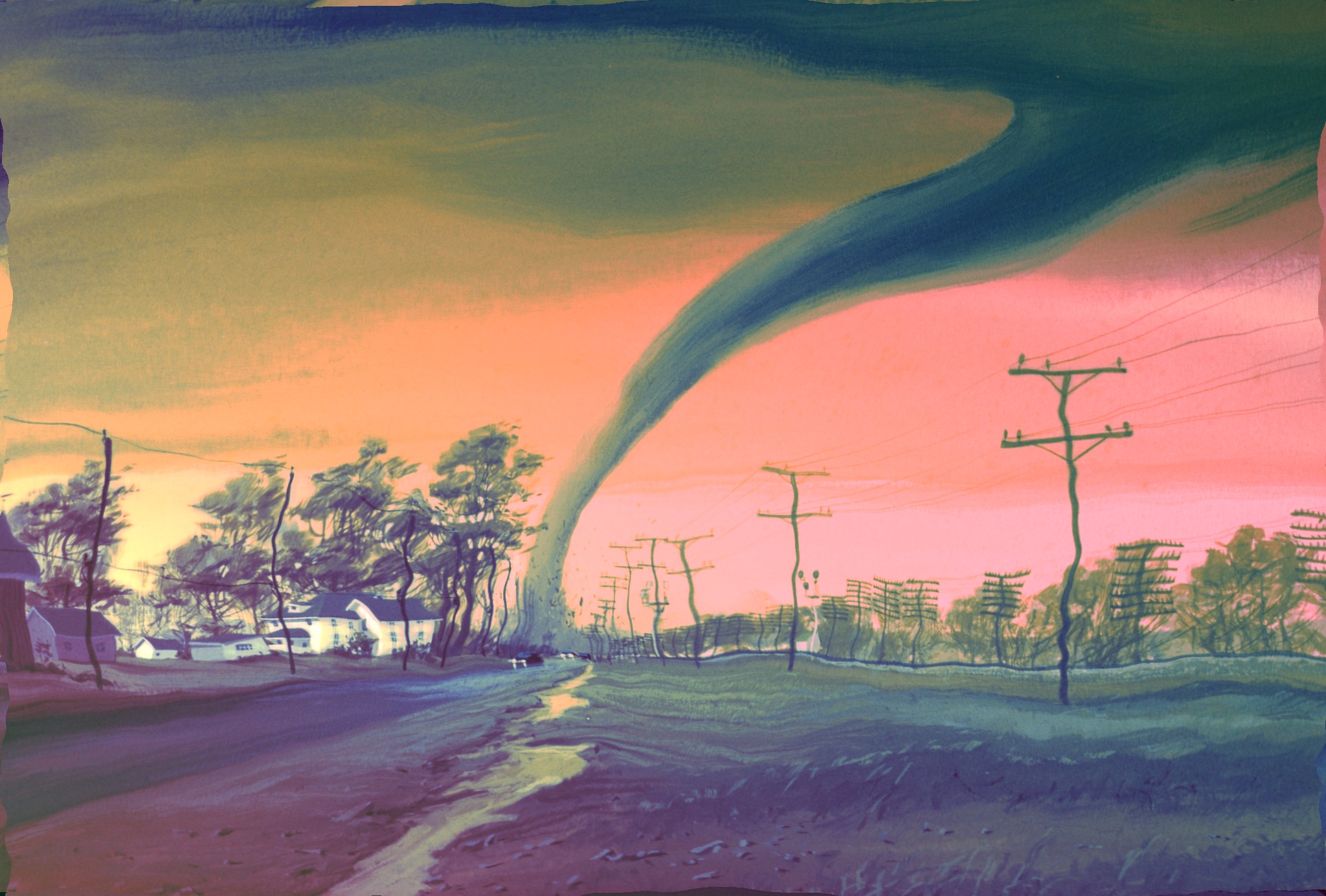

![Amid tornado cash sanctions, crypto decentralization remains a mystery - Paper Writer]() Bootlickers?

Bootlickers?

DeFi is meant to be an alternative to the current economic system. It offers many of the same financial services (and a few new ones) without the need for middlemen. Without permissionless access, crypto risks just being a more complicated way to do what we used to do. People might wonder what makes DeFi different from banks if all of its entry points start to report and block transactions.

But there is another way to look at the situation, and it starts with making front-ends less important. Most users don't use the command line; they only use Uniswap.io. This is the problem. Users of DeFi shouldn't depend on protocol founders to build user interfaces, since they are already taking on other risks.

Chief Daniel Roberts said that this was a "litmus test" to see who really cared about DeFi. But it seems like a false distinction based on words that is asking developers to run straight into legal trouble. Ethereum, on the other hand, doesn't need websites to work.

Eric Wall, a well-known crypto investor and person, said, "Let them censor. Let them follow the rules. Let them keep working in the open so the government can't say they did anything wrong." He also said, "It is OUR job to make sure there are other ways to get to the back ends if the first ones fail." That's something that's easy to do, doesn't take much planning, and doesn't need Aave's help."

I don't know what it would take to build a huge number of "decentralized" front-ends that all work together, but I think it's unlikely. But so are DeFi's final moments. I think it would take a "community" to really cut financial giants and the government out of an economy.

Everyone who wants to should share the risk of hosting easy access points to DeFi services. That would strengthen the ecosystem's "social decentralization," assuming that everything works technically as promised.

‘New age’

Rune Christensen, the founder of MakerDAO, the company that makes the dai stablecoin, said last week that the U.S. ban will likely bring DeFi into a "new age." In the pre-sanction period, the main goals were to get more users and grow the protocol. In the new period, decentralization would be the main goal. What this means is still being worked out, but Christensen said Maker could stop tying its stablecoin to the U.S. dollar, which would be a big change from what it is doing now.

In the same way, protocol developers should work even harder to make their systems resistant to attacks from the outside. The key is to keep the back end working and accessible at all times, while also following the law.

Protocols should still have some kind of front-end, but they should be completely clear about what information they collect and how it can be used. If the Tornado Cash ban isn't overturned, it's likely that crypto surveillance software will become more useful and less troublesome.

Part of the recent backlash comes from the fact that so many people couldn't use apps they were used to, even though they don't think of themselves as trying to get around sanctions or launder money. Gabriel Shapiro, a lawyer for crypto companies and DeFi projects, said that the financial compliance software they use now is "blank weapons."

These systems, which were made by companies like Chainalysis, look for any connection to Tornado, no matter how or why it was made. There are definitely good reasons to use a transaction anonymizer.

Still here

Others saw it as a way to get closer to compliance after a well-known crypto hack was used to launder money through Tornado. Even though they didn't end up going that way, it doesn't change the fact that Tornado is still up and running.

Just as interesting is the fact that the Tornado DAO is still trying to run the project. This past weekend, it voted unanimously to add signatories to the $22 million treasury to make the project more secure in case people are arrested. Even though the project's Discord and GitHub were shut down, it did so.

Front-ends can be watched, shut down, hacked, or put on a blacklist without changing what's behind them.

Bootlickers?

Bootlickers?