NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

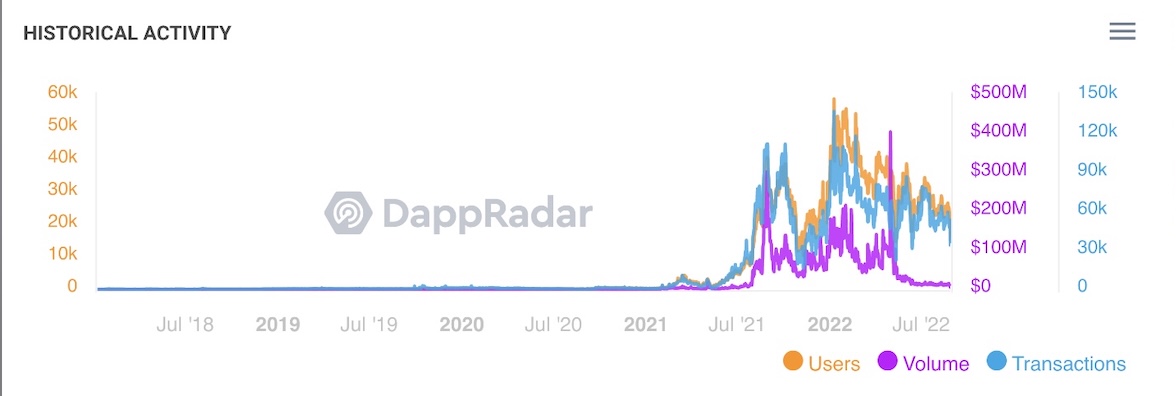

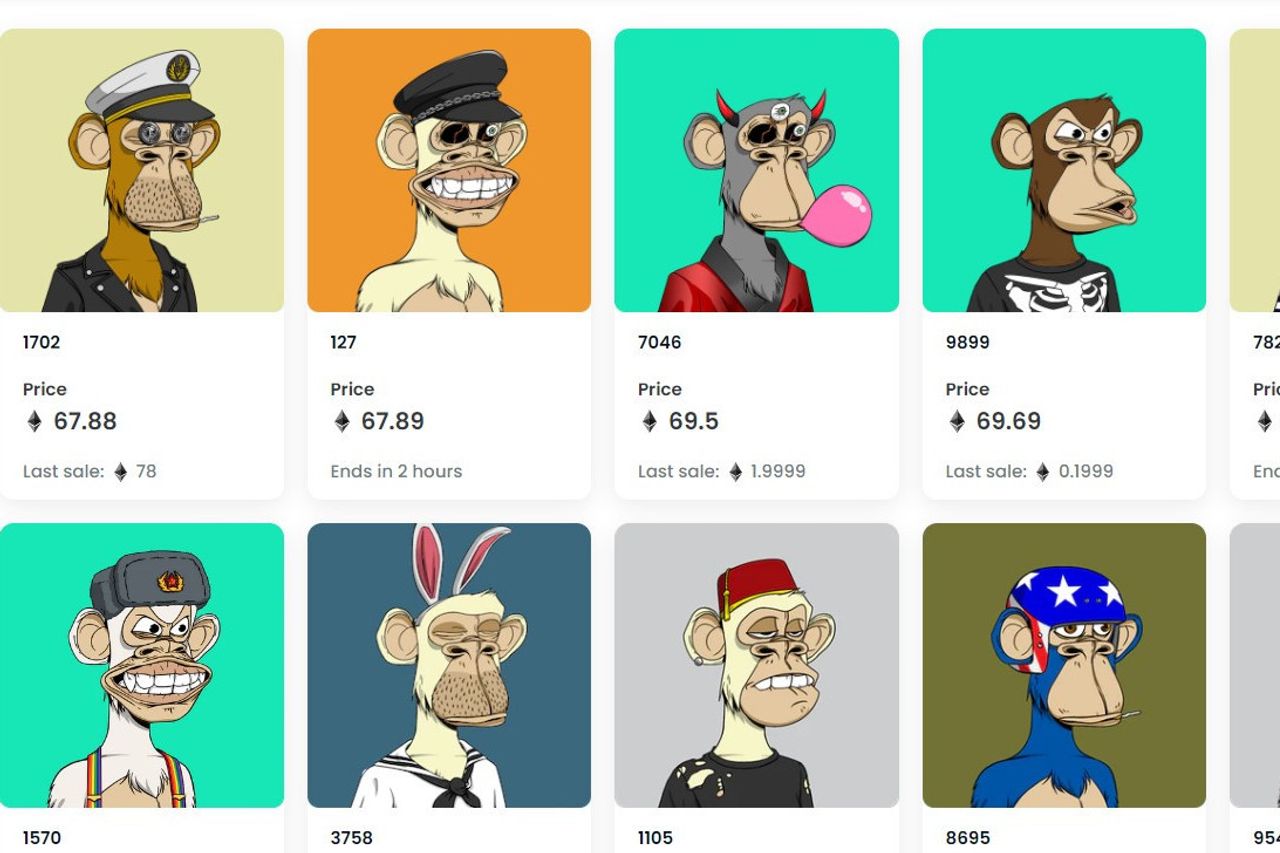

Nonfungible tokens (NFTs) have unquestionably suffered in the most recent months. Many have begun to doubt the worth of NFTs and their place in Web3 as a whole due to the depreciating market, the prevalence of scams and hacks, and the rise in low-quality projects. The Bored Ape Yacht Club and other well-known developments have both suffered this year, with floor prices falling below $100,000.

NFT market conditions have been strongly associated with and dependent on the overall crypto market over the most recent crypto cycle. As the value of technology and digital assets increased, it became simpler for investors and individuals to justify gambling on the developing NFT asset class. They frequently paid excessive premiums with the hope that some real utility and value would be realized in the future. It created the ideal conditions for a dramatic price increase that dropped even more drastically back to earth because NFTs are naturally scarce and illiquid.

Market circumstances are also influenced by changes in the ecosystem, which include widespread fraud and content oversaturation, raising concerns among parties currently active in the market and increasing reluctance among customers and companies considering entering it.

We must understand that this is a normal stage in the development of the NFT space. Over-speculation followed by a sobering encounter with reality is not only to be anticipated, it also necessitates that we act to address the problems at hand so that these digital assets can continue to expand and prosper.

Of course, scams and hacks hurt projects and consumers who participate in the NFT space. No buyer should unknowingly fall prey to a fraud or be the victim of a creator's work being copied and sold under someone else's identity. Projects shouldn't have to be concerned that a hacker may exploit infrastructure flaws and steal vast quantities of money. Furthermore, early backers don't have to worry that the project founders will run out of money or just give up on the product at the beginning of the roadmap.

My view on the NFT market action today... pic.twitter.com/iDjrJeQdMt

— Peter Smith (@OneMorePeter) August 22, 2022

However, what these security breaches do show is where the system's weak points are, allowing us to work harder to address them and stop them from happening again. They also serve as vital evidence for blockchain initiatives that, in order to succeed long-term and avoid future losses in revenue, infrastructure and security partners must be given top priority. The best way to secure users must also be considered internally by businesses and projects. OpenSea and MetaMask are taking measures to achieve just that. They need to make use of open-source technologies and add features of their own that help to bolster security.

Whereas fraud and hacking inspire mistrust and uneasiness, the proliferation of subpar initiatives has resulted in an overall oversaturation of the NFT industry. People are sick of hearing about NFTs that are either useless for practical purposes or have no artistic merit. It might be challenging to determine which projects or collections are even remotely valuable in a crowded market.

The bright side of this is that some of the lower-quality NFT projects are being eliminated by the market downturn. Projects will be compelled to keep their commitments, alter their plans in order to stay competitive, and better serve their audiences.

Marketplaces will first need to start curating art in order to prevent the overwhelming volume of NFTs and duplicates being listed from obscuring the best works. Additionally, they will need to better conform to changing IP and copyright regulations. To be successful in the long run, initiatives that are not only devoted to digital art must provide genuine value to customers or other businesses. Ownership rights, exclusive memberships, redeemable incentives, or access to groups of people who share your interests can all be considered forms of utility.

The fact that we have only just scratched the surface of NFTs' potential and range of applications is possibly the most crucial factor. This radically innovative token standard is capable of supporting efficient and secure digital ownership rights for priceless things and will do so. In addition to financial items, medical information, real estate, and intellectual property, additional interesting possibilities include immutable forms of identification, digital domain standards, and tickets for events and trips.

The difficulties we currently face will be overcome, creating a more robust ecosystem of projects that will radically alter our way of life. In addition, McKinsey & Company anticipated that by 2030, the Metaverse would probably be valued at $5 trillion. Identify the components of the Web3 metaverse. NFTs. The prediction made by another study that the NFT sector would be worth $230 billion by 2030 comes as no surprise.

NFTs function as digital identity or tickets for events in the Metaverse, give proof of attendance or payment, and serve as proof of ownership for games, wearables, or digital real estate because they reflect digital ownership that is both immutable and simple to transfer. All activity in the new digital economy within the Metaverse will be driven by NFTs.

The groundwork for the upcoming wave of new goods and services is being laid by NFTs. NFTs are here to stay, and while we work through the growing pains of this young business, that much is plainly obvious.

=====