Ripple's Acquisition of Crypto-Focused Chartered Trust Company Fortress Trust

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

DeFi and Credit Risk

Disclaimer: The datasets in this article were compiled from a variety of online resources and do not represent CCU's own research on the subject.

So, what about ADA? The jury is still out, with analysts' projections ranging widely. In fact, one could argue that once Vasil is past us, we'll have a better idea. As a result, it's natural to wonder if you, as an investor, should buy any more ADA in the market. This article will attempt to answer that question.

Cardano is one of the cryptos that has managed to secure a spot in the top ten by market cap (ADA). Cardano is not only well-known, but also frequently mentioned as having the most potential.

Cardano saw a fairly successful 2021. It had a remarkable showing, with bulls hitting over 691% in a year. In fact, it outperformed Bitcoin and Ethereum by 75% and 453%, respectively. At the start of 2021, Cardano had a market cap of $5.5 billion, with 1 ADA worth $0.18. By the end of 2021, however, its market valuation had risen to $49 billion. At the time, ADA was valued at $0.51.

As the network called the “Ethereum killer” continues to record significant blockchain development, the price of Cardano (ADA) has largely fluctuated in recent weeks.

The Cardano community specifically anticipates a potential increase in the token’s value, particularly with the impending Vasil hard fork. This line predicts that ADA will trade at $2.26 by August 31, 2022, according to NeuralProphet’s PyTorch-based price prediction algorithm that uses an open-source machine learning framework.

Cardano’s Charles Hoskinson was recently in the news too, with the exec taking a shot at his favorite target – BTC maximalists.

Bitcoin maxis are beyond stupid. I can't even force the vasil hardfork and everyone wants it https://t.co/bR4FoAYikq

— Charles Hoskinson (@IOHK_Charles) September 8, 2022

Bitcoin [BTC] maximalist Bryan (@btc_bryan_21) took to Twitter to claim that Hoskinson could alter the number of ADA tokens as a result of purported centralization. Cardano’s maximum supply is set at 45 million ADA tokens.

However, the Twitter user claimed that since blockchain’s monetary policy is relatively changeable, nothing would stop the crypto-tycoon from modifying it.

Hoskinson outright denied the credibility of these allegations. He further called the Twitter user “stupid”. This is not the first time the Cardano founder has commented on BTC maximalists. In July 2022, he stated that BTC maximalists are “toxic” and “useless” people to engage with.

The aforementioned statement was made in response to the MicroStrategy CEO’s claims that ADA is an unregistered security.

Since all ADA tokens now exist in the possession of their rightful owners, Cardano has consistently resisted the idea of destroying them. Hoskinson claims that this would be equivalent to stealing from the neighbourhood.

Eight of the biggest cryptocurrency exchanges have modified their infrastructure, according to IOHK. Furthermore, the Cardano network’s development team is now prepared for the much-anticipated Vasil hard fork.

Furthermore, three of the top twelve exchanges for Cardano liquidity are ready for the upgrade. Several exchanges, including Gate.io, MEXC, Bitrue, OKx, Whitebit, BtcTurk, AscendEX, and Revuto, have improved their platforms.

Given everything, purchasing ADA must ultimately be prudent, right? The majority of analysts have optimistic forecasts for ADA. Furthermore, the majority of long-term ADA price forecasts are confident.

Why do these projections matter?

Cardano saw a substantial decline in 2022, falling from a high of $3.10 in September 2021 to a little over 0.47 cents in July 2022. However, only 75% of the total number of coins are now in use, thus there is still room for investors to amass coins.

Also, it seems like the conflict between Ethereum and Cardano may come down to an upgrade war. With the Goguen “Mary” update behind the latter and Vasil on the horizon, it will be interesting to see what the impact of the same will be on the network and on ADA.

Over the past year, Cardano has established itself as one of the most active crypto-assets. As expected, it appears that cryptocurrency investors are optimistic as there has been an increase in the number of Cardano wallets. According to AdaStar, 121 new wallets have been created on average every hour since ADA’s record-breaking price run – A 98% hike.

Also, addresses holding between 10,000 and 10,000,000 ADAs have built on their accumulation tendencies, according to Santiment.

Since 27 July, these addresses have increased their portfolios by a total of 0.46% of ADA’s current supply. In just over 10 days, this amounts to an accumulation of ADA worth approximately $138 million.

3,105 Plutus-based smart contracts were implemented on the network, according to Cardano Blockchain Insights. Indeed, there has been an increase. In fact, in July, this number was 2,900. This demonstrates Cardano’s capability of enabling customers to create blockchain-related applications.

The bullish forecasts are in line with the generally bullish outlook on ADA that comes from network initiatives intended to make the asset more beneficial. The much-awaited Vasil hard fork is finally prepared for launch, according to Cardano’s Charles Hoskinson.

Supporters of the token are obsessed with price movement as it starts to recover, despite slight gains, ADA is yet to meaningfully react to the upgrade. The coin has, however, profited from the recent two-month surge in the wider cryptocurrency market.

In this article, we’ll quickly review the current activity of the cryptocurrency with a focus on market cap and volume. In conclusion, predictions from the most well-known analysts and platforms will be summarized together.

ADA’s price, volume, and everything in between

At press time, ADA was valued at $0.51. Its market capitalization was $17.1 billion and its 24-hour trading volume was $702 million. An appreciation of just under 13% was seen over the last 7 days too.

The overall number of ADA wallets was estimated to be 3,561,372 on 9 September, according to Cardano Blockchain Insights. Cardano was also able to add over 500,000 new holdings in the last six months. Even the upgrade’s delay was unable to convince ADA fans to change their minds.

On the DeFi front, Cardano’s TVL on DeFiLama saw a slight 4% decrease. The total amount locked was $81.4 million, at the time of writing.

The growth rate of FluidTokens, a DeFi lending platform that enables users to lend or borrow using CNFTs as collateral, was 54,000% over the previous month. However, the network did experience a considerable decline from its all-time high TVL of $326 million on 24 March.

By the end of the year, according to PLAYN creator Matt Lobel, ADA is likely to hike to $1.50. The management team’s quality-first philosophy, he claimed, will enable ADA “continue to develop and not encounter some of the quality challenges that other projects have,” although the rate at which it is expanding may be discouraging.

Martin Froehler, CEO of Morpher, concurs with this statement. He predicts that the value of ADA will reach $1 by the end of 2022 and states simply that “slow and steady wins the race.” The CEO and Xo-founder of Router Protocol, Ramani Ramachandran, is not as convinced about the future applications of ADA and believes the coin will only be worth $0.20 in 2022.

By the end of August, the CoinMarketCap community anticipates that ADA will trade at $0.58. About 17,877 members of the community agree with the projection, which assumes a price increase of about 8.71% from the crypto’s current value.

The estimate for September has been set by the community at $0.5891, up roughly 9% from its press time price. A curious prediction made by the algorithm is that by the end of September, ADA will trade at $1.77. Overall, both forecasting tools point to an increase in the price of a digital asset right now.

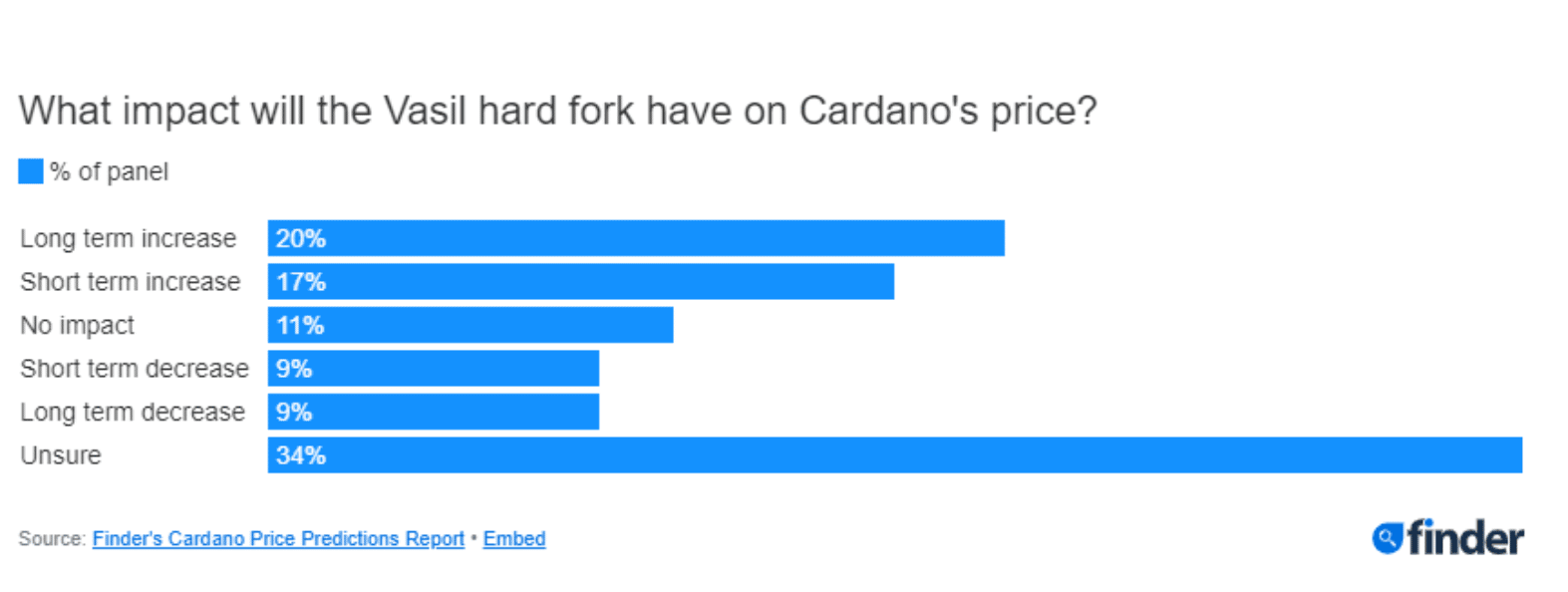

And, if these predictions seem too much to you, then you must know that there are reasons why the sentiments are so bullish. According to the same Finder research stated earlier, one in five (20%) panelists believes that the Cardano hard fork, which aims to further decentralize the network and boost throughput, will have a favorable long-term effect on the altcoin’s price. Another 17% believe it will at least have a favorable effect shortly.

The real value of the blockchain will increase as it becomes faster and more effective, and ADA’s value should increase along with it. Cardano may once again reach $1, according to the Motley Fool’s analysts, making it a solid investment at the moment.

The most cautious Cardano price forecasts anticipate roughly linear growth for ADA over the next five years. According to the Cardano projection, ADA will conclude 2022 at $2.74.

There’s good reason for the optimism behind Vasil too. In fact, according to developers,

“Vasil is the most significant Cardano update to date, bringing increased network capacity and lower cost transactions.”

Let’s now look at what well-known platforms and analysts have to say about where they believe ADA will be in 2025 and 2030.

Cardano ADA Price Prediction 2025

Now, even though most predictions are positive, some reasons force us to believe otherwise. Even though the much-awaited update of the blockchain is expected to take the price high, what if the update does not reach its promises and becomes a failure?

According to Changelly, the minimum ADA price is predicted to fall to $1.87 in 2025, while its maximum price will be $2.19. The cost of trading will typically be $1.93.

Cardano is forecasted by Finder’s team of fintech experts to soar to $2.93 by 2025.

A cryptocurrency’s price typically reacts favourably to upgrades, as it did when Ethereum’s EIP-1559 was pushed and the asset’s value once again soared beyond the $3,000-mark. However, in the instance of Cardano, the asset’s value fell dramatically, by nearly 50% within one month of the launch of Alonzo.

However, even in a down market, Cardano strives to consistently improve its products. Investors should feel confident as a result because the project’s utility keeps growing. This distinguishes Cardano from several other “meme currencies.”

This seems to support a bullish Cardano prediction, which is why many analysts believe that ADA will be valuable in the long run. Building the utility now might serve as a launchpad for when the cryptocurrency markets heat up again, which would cause the price of ADA to soar dramatically that it would even top its all-time high.

And, you have reasons to believe that. Until 2026, the Cardano blockchain project hopes to sign up as many as 50 banks and 10 Fortune 500 businesses, according to Frederik Gregaard, CEO of the Cardano Foundation.

Gregaard also discussed how he hopes to make it possible for banking institutions to use Cardano’s utility token in a formal presentation.

Cardano ADA Price Prediction 2030

Experts frequently advise educating the public about cryptocurrencies before broad adoption takes place. And, the recent frenzy has probably done just that for many. As a result, many believe that ADA has a strong possibility of continuing to rise through 2030 and beyond.

It’s not “out of reach” for Cardano to surpass the “double-digit threshold,” according to Josh Enomoto, a former senior business analyst for Sony Electronics who has experience working with Fortune 500 businesses, who wrote about it in Nasdaq.com.

He first presented that argument in May 2021 and even forecast that the ADA price would reach $22 by the end of 2022 and perhaps $100 by the end of 2027. Both up and negative trends in altcoin price are fairly powerful.

Finder’s panel has considered Cardano’s future, placing it in a good position. It believes ADA will hit $6.53 by 2030.

Furthermore, according to cryptocurrency exchange Kraken, the debut of the Minswap decentralized exchange (DEX) and growth in the SundaeSwap and MuesliSwap DEXs allowed Cardano’s total locked value (TVL) in decentralized finance (DeFi) apps to increase by more than 130% in March this year.

Eight years, though, are not without their ups and downs and rough patches. Inflation, recession, conflict, and the fear of an economic collapse are just a few of the hiccups.

Many in the cryptocurrency community are still optimistic about the chances of Cardano’s acceptance in the future.

In January, Ethereum’s Vitalik Buterin asked the community on Twitter which crypto, outside of ETH, they would prefer to see dominate transactions in 2035. ADA received 42% of the more than 600,000 votes, while Bitcoin received 38.4%.

Poll for Ethereum community. You wake up in 2035, and 80% of all transactions + savings in the world are in one currency that is not ETH. Which would you prefer it to be?

— vitalik.eth (@VitalikButerin) January 13, 2022

Of course, investing in cryptocurrencies is risky because of their tremendous volatility. However, investing in Cardano may allow you to “set it and forget it” and watch your money increase, at least through 2030.

Conclusion

After a significant decline in 2022, analysts predict that ADA might eventually provide value and a strong return on investment. The volatility of cryptocurrencies, though, makes everything possible. Never put more money at risk than you can afford.

Remember, that within three months of its release, ADA surged to over $1 during the 2017 crypto bull run, which saw retail investor FOMO (fear of missing out) drive the price of Bitcoin to $20,000. The entire advance was subsequently totally retraced down to $0.02 during the 2018 bear market.

Fundamental analysis (FA), such as a growth in network addresses and TVL, which indicate growing mainstream adoption of a crypto-project, should be of greater concern to long-term investors.

As crypto markets flourish, Cardano will follow. With an $18 billion market valuation, it will be very responsive to changes in price. The crypto-market will probably expand as the world transitions to a decentralized future, which is good news for Cardano in the long run.