NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

On Tuesday, Bitcoin (BTC) maintained its position above the $30,000 level, with investors eagerly anticipating two upcoming events. Firstly, Wednesday's release of the U.S. consumer price index (CPI) report for March is expected to provide important insights into inflationary trends, which could impact the cryptocurrency market. Additionally, the Shapella upgrade for Ethereum is also generating interest among investors.

Bitcoin (BTC), the largest cryptocurrency by market value, has recently been hovering around the $30,200 mark, representing a more than 3% increase in the past 24 hours. Late on Monday evening (Eastern Time), BTC surpassed the psychologically important $30,000 level for the first time since last June. Analysts are anticipating the release of the March CPI report, which is expected to show a continuation of the recent trend of cooling inflation. Specifically, the year-over-year rate is predicted to rise by 5.2%, down from February's rate of 6%, while the month-over-month rate is also expected to decrease.

“Traders [are] speculating that this week’s CPI number could come in at a level that gives the Fed reason to think about pausing raising rates in the next meeting, thereby giving a boost to assets like bitcoin,” James Lavish, managing partner at Bitcoin Opportunity Fund, told CoinDesk in an email.

Lavish stated that in the event of BTC sustaining its upward momentum, it is probable that it will surge into the mid to high $30,000 range, resulting in short speculators being compelled to cover their positions and switch to buying. As a result, certain investors are endeavoring to establish their positions in advance.

In a client note on Tuesday, K33 Research analysts emphasized that open interest (OI) in BTC perpetuals had experienced a notable surge of 10% on Monday, reaching 297,000 BTC and marking the highest daily growth in OI since early October. This sudden increase was shortly followed by a surge in volatility and a decline in intraday trading.

“While BTC’s performance following surges in OI has varied, it has tended to foreshadow long or short squeezes,” analysts wrote, adding that similar daily growth in OI occurred during a spring rally in 2022 and before the short squeeze of July 2021.

The second-largest cryptocurrency, Ether (ETH), was trading at approximately $1,895, representing a 0.3% increase from the same time on Monday. Market analysts and validators are closely monitoring the upcoming Shapella upgrade for Ethereum, which is slated to be launched on Wednesday evening (ET). This upgrade will allow validators to withdraw their ETH from the Beacon Chain, which had been locked up for a prolonged period of time.

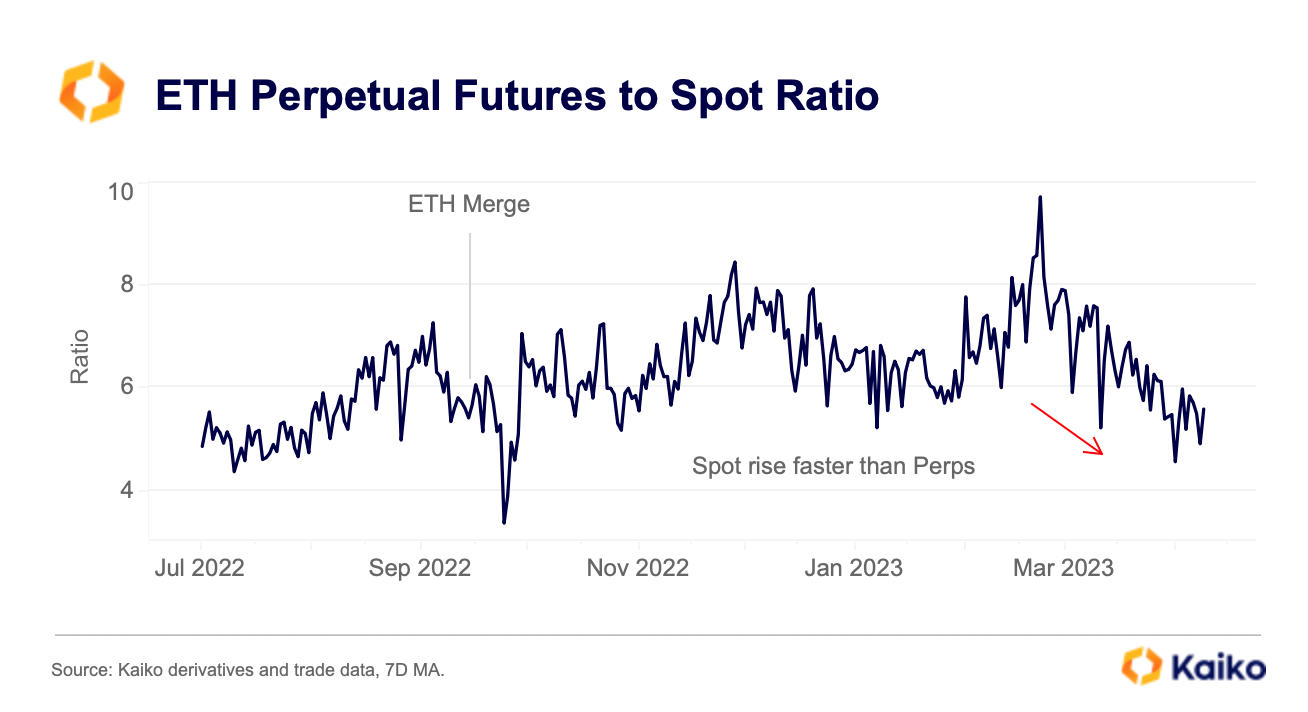

In a report published on Tuesday, Kaiko, a crypto data company, pointed out that ETH markets have been predominantly driven by spot trading in the last month. The perpetual futures-to-spot ratio reached its lowest level since the network's Merge in September. This is in stark contrast to the beginning of the year when the ratio had surged to almost double the pre-Merge levels.

Solana's SOL saw a significant increase of more than 12%, reaching a trading value of approximately $23.2, while Ethereum Classic's ETC, a derivative or fork of Ethereum, experienced a gain of over 4%, reaching a trading value of $21.6. The CoinDesk Market Index, which provides an overview of the performance of the cryptocurrency market as a whole, rose by 2.3% during the day.

In addition to the continued momentum of crypto-related stocks from Monday, the recent rally in the cryptocurrency market was also observed. On Tuesday, shares of bitcoin mining company Marathon Digital Holdings (MARA) surged by 12%. Similarly, both exchange Coinbase (COIN) and business software firm MicroStrategy (MSTR), which is a major corporate holder of BTC, witnessed a rise of over 6%.

During the afternoon of Tuesday, equity markets showed a mixed trend, as the S&P 500 remained stable and the Nasdaq, which predominantly comprises tech stocks, experienced a decline of 0.4%. On the other hand, the Dow Jones Industrial Average (DJIA) gained 0.2%.

Source Coindesk