SEC's Response to Challenge Groundbreaking XRP Ruling

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Turkish Crypto Exchange Thodex CEO Faruk Özer Sentenced to 11,196 Years in Prison for Collapse

Decentralized finance (DeFi) has caught the attention of regulators, although they do not appear to be actively seeking to eliminate it - at least not yet. Recent reports from authorities in the United States and France suggest that their primary focus is on comprehending the potential risks that DeFi may pose to both its users and the wider financial industry, as well as exploring possible strategies to mitigate these risks while still enabling DeFi to operate.

DeFi by any other name

The narrative

The emergence of decentralized finance (DeFi) has rapidly become a key area of focus for financial regulators, with recent reports released by both the United States and France outlining the potential risks that DeFi projects could pose to their respective governments. These reports also offer recommendations for how regulators and developers can work together to address these concerns and reduce potential risks associated with DeFi.

Why it matters

Decentralized finance (DeFi) has been a rapidly expanding segment within the cryptocurrency industry for some time. However, recent events such as exchange collapses, bank failures, and lender bankruptcies have brought increased attention to decentralized (or allegedly decentralized) projects. As a result, regulators are now exploring ways to oversee these entities and services in order to ensure their reliability and security.

Breaking it down

Recently, the U.S. Treasury Department and the French central bank released reports evaluating the extent to which DeFi entities comply with anti-money laundering (AML) regulations. These reports also examined the potential for DeFi tools and entities to be exploited for illicit financial activities.

The U.S. risk assessment report highlighted several significant hacks and challenges that have arisen in the DeFi sector over the past few months. These include North Korea's use of DeFi platforms to launder funds, as well as concerns regarding potential violations of know-your-customer/anti-money laundering (KYC/AML) rules by DeFi projects. Additionally, the report noted that some DeFi projects may be highly vulnerable to theft and security breaches.

It's worth noting that these reports did not paint a particularly favorable picture of the cryptocurrency industry. For instance, the U.S. report highlighted that numerous DeFi projects are open source, with the intention of enabling the wider community to identify vulnerabilities. However, this same openness could also expose these projects to exploitation by attackers seeking to exploit any security weaknesses that they find.

“This vulnerability can be compounded if the smart contracts are not written carefully or if they lack a mechanism for quick deactivation or alterations if a critical exploit is identified,” the U.S. report said. “As such, it is critical that the DeFi service identify and address vulnerabilities and potential exploits in open-source code.”

However, the report appears to maintain a fairly impartial stance toward DeFi as a whole, offering recommendations that range from strengthening current supervisory and enforcement measures to comply with legal requirements, to improving collaboration with private-sector initiatives.

Likewise, the French report proposed several measures that the government could take in response to the risks posed by DeFi. One option suggested was the creation of a set of "minimum standards" to establish a framework for assessing risks and decentralization, or even exploring the possibility of conducting financial transactions on private blockchains. The report went on to suggest that a certification program could be developed for DeFi developers to meet in order to improve safety and reliability within the sector.

The U.S. Treasury Department also solicited feedback from the public by asking a series of questions, one of which was how it can effectively determine whether a given DeFi project should be classified as a financial institution and therefore subject to Bank Secrecy Act regulations.

The U.S. report even implied the possibility of offering additional guidance for DeFi projects to enhance clarity and improve compliance.

“The assessment finds that non-compliance by covered DeFi services with AML/CFT obligations may be partially attributable to a lack of understanding of how AML/CFT regulations apply to DeFi services,” the report said, referring to combating the financing of terrorism (CFT). “Are there additional recommendations for ways to clarify and remind DeFi services that fall under the BSA definition of a financial institution of their existing AML/CFT regulatory obligations?”

The U.S. report even implied the possibility of offering additional guidance for DeFi projects to enhance clarity and improve compliance.

Stories you may have missed

- Drugs, Erratic Dismissals and Feuding Founders: Behind Bitcoin Marketplace Paxful’s Unraveling: CoinDesk's Frederick Munawa and Helene Braun have provided a comprehensive report on the Paxful collapse that is truly remarkable. Reading it is highly recommended to fully grasp the intricacies of the situation.

- Former FTX US President Reportedly Quit After ‘Protracted Disagreement’ With Bankman-Fried: FTX's new management recently released its inaugural comprehensive report outlining several problems associated with the previous management. According to reports, founder Sam Bankman-Fried referred to Alameda Research as "unauditable."

- Wyoming Defends ‘Legitimacy’ of Its Crypto Charter Framework in Custodia Lawsuit: Wyoming has filed a motion to intervene in Custodia Bank's lawsuit against the Federal Reserve Board, specifically to affirm that its special purpose depository institution legislation is not inadequate.

Consensus 2023

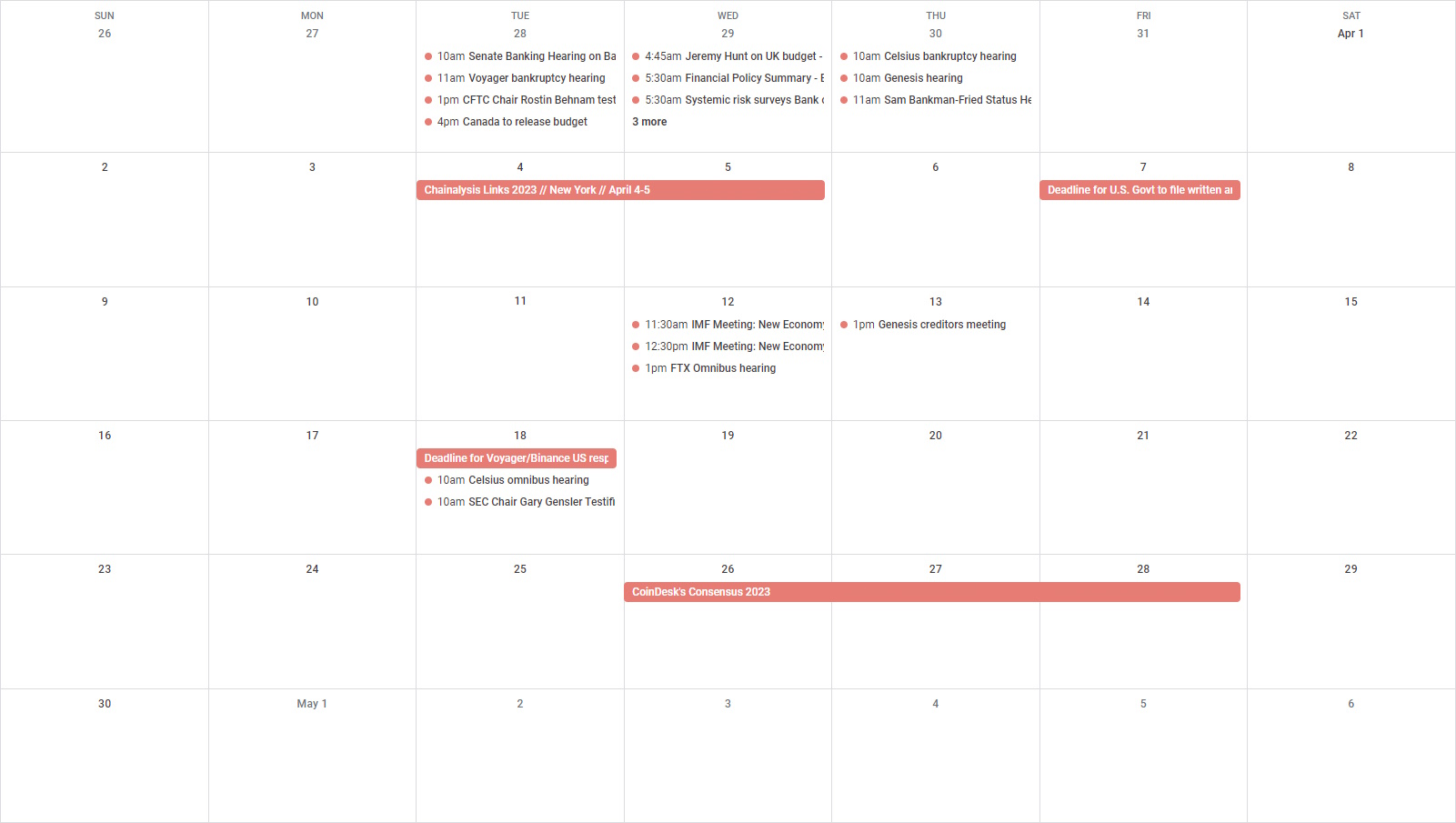

It's that time of the year again - CoinDesk's Consensus 2023 will take place on April 26-28 in Austin, Texas. I am excited to moderate four sessions, including one-on-one discussions with Coinbase's Paul Grewal, NYDFS' Adrienne Harris, and CFTC's Christy Goldsmith Romero, as well as a panel featuring House Financial Services Committee Chair Rep. Patrick McHenry and Senator Cynthia Lummis. I'm eager to hear from you about what you would like to know from these speakers. If you have any questions, please email me with the subject line "Consensus 2023 question", and I may select some of the best questions to ask on stage.

This week

Wednesday

- 15:30 UTC (11:30 a.m. ET) The annual spring meeting of the International Monetary Fund and World Bank is taking place this week, featuring two panels focused on crypto issues scheduled to start at 11:30.

- 17:30 UTC (1:30 p.m. ET) FTX is set to hold another bankruptcy hearing to address various matters, including whether founder Sam Bankman-Fried can use the company's funds to pay for his own legal fees.

Thursday

- 17:00 UTC (1:00 p.m. ET) Genesis creditors will meet. (Genesis is a CoinDesk sister company.)

Elsewhere

- (Gizmodo) Google's plan to eliminate third-party cookies is generating buzz. Check out this article to learn more about the potential implications of this move.

- (The New York Times) On Monday, The Times published an article that had been highly anticipated, which discussed the impact of crypto mining on the country. The article alleged that the industry has led to higher energy costs for local residents and raised other concerns. Riot, a mining firm, issued a brief response to the article later that day.

- (U.S. District Court for the Eastern District of New York) A lawsuit against Signature Bank was inevitable, and this may be the first of multiple class action lawsuits alleging that Signature and its management misled shareholders.

- (Iowa Law Review, forthcoming) Julie Hill, a banking expert and researcher from the University of Alabama School of Law, will publish a paper asserting that the Federal Reserve has exceeded its authority by rejecting payment services applications from firms like Custodia.

- (Foreign Affairs) Hilary Allen, a member of the CFTC's Technology Advisory Committee and a Professor of American University College of Law, has called for U.S. regulators to either ban or at least limit crypto-related activities.

Source Coindesk