U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

Good morning. Here’s what’s happening:

Prices: Bitcoin and Ether remained stable following a somewhat positive inflation report and the introduction of the Ethereum Shanghai upgrade.

Insights: CoinDesk analyst Glenn Williams suggests that going whale watching could provide insight into where the price of Bitcoin may be heading.

Prices

Bitcoin, Ether Remain Largely Unmoved by Major Events

Bitcoin and Ether remained relatively stable in their recent positions, despite the release of highly anticipated inflation data and the eagerly awaited Ethereum Shanghai upgrade.

Bitcoin, the leading cryptocurrency by market capitalization, was trading at approximately $29,900 in the past 24 hours, representing a slight decrease. Meanwhile, Ether, the second-largest cryptocurrency in terms of market value, was trading around $1,905, indicating an increase of nearly 1%. Despite Wednesday's developments, including the Ethereum "hard fork," which marks a significant step towards a more efficient proof-of-stake protocol from the previous proof-of-work protocol, some investors were anticipating a more robust reaction from both cryptocurrencies.

"We should be looking ahead at what’s in store for the Ethereum roadmap," Jake Boyle, director of retail crypto brokerage Caleb & Brown wrote. "A lot of progress has been made, and a lot is going to be made. And this paints a wildly optimistic picture going forward.

Boyle added: "We are heading into a recession, or at least it seems that way, and retail investors would be the profile of investors that would sell in the situation we find ourselves in. But this doesn’t seem to be the case, and this suggests to me that the profile of investors in the Ethereum ecosystem right now tends to be larger-scale. They appear to be more institutional-grade, and I don’t think that kind of investor would be quick to sell at this moment in time. They're long-term focused.”

Most of the other major cryptocurrencies have been experiencing a period of stagnation in their trading activity. The CoinDesk Market Index, which serves as an indicator of the overall performance of the crypto markets, has recently dropped by approximately 0.5%. Meanwhile, equity indexes such as the Nasdaq and S&P 500, both of which have a strong focus on technology, have experienced slight declines of 0.8% and 0.4%, respectively. On the other hand, gold has maintained its strength, hovering just over $2,039, which is close to its all-time high. This suggests that investors are continuing to view assets that hold their value as worthwhile investments.

Konstantin Boyko-Romanovsky, the CEO of the non-custodial platform Allnodes, expressed a positive outlook on the future of Ethereum in an email to CoinDesk.

"With previously locked ETH becoming available again, it could lead to "a rise in the staking ratio, increased liquidity, and potentially higher prices," Boyko-Romanovsky wrote. "As the staking ratio rises, it will boost network security, a crucial indicator of blockchain health, and decrease the amount of circulating ETH."

He added: "Early stakers will be able to reinvest their staking rewards. At the same time, removing uncertainty related to undetermined ETH lock-up periods will likely generate more interest in staking among retail and institutional participants."

Insights

Bitcoin Whales May Forecast BTC's Price Path

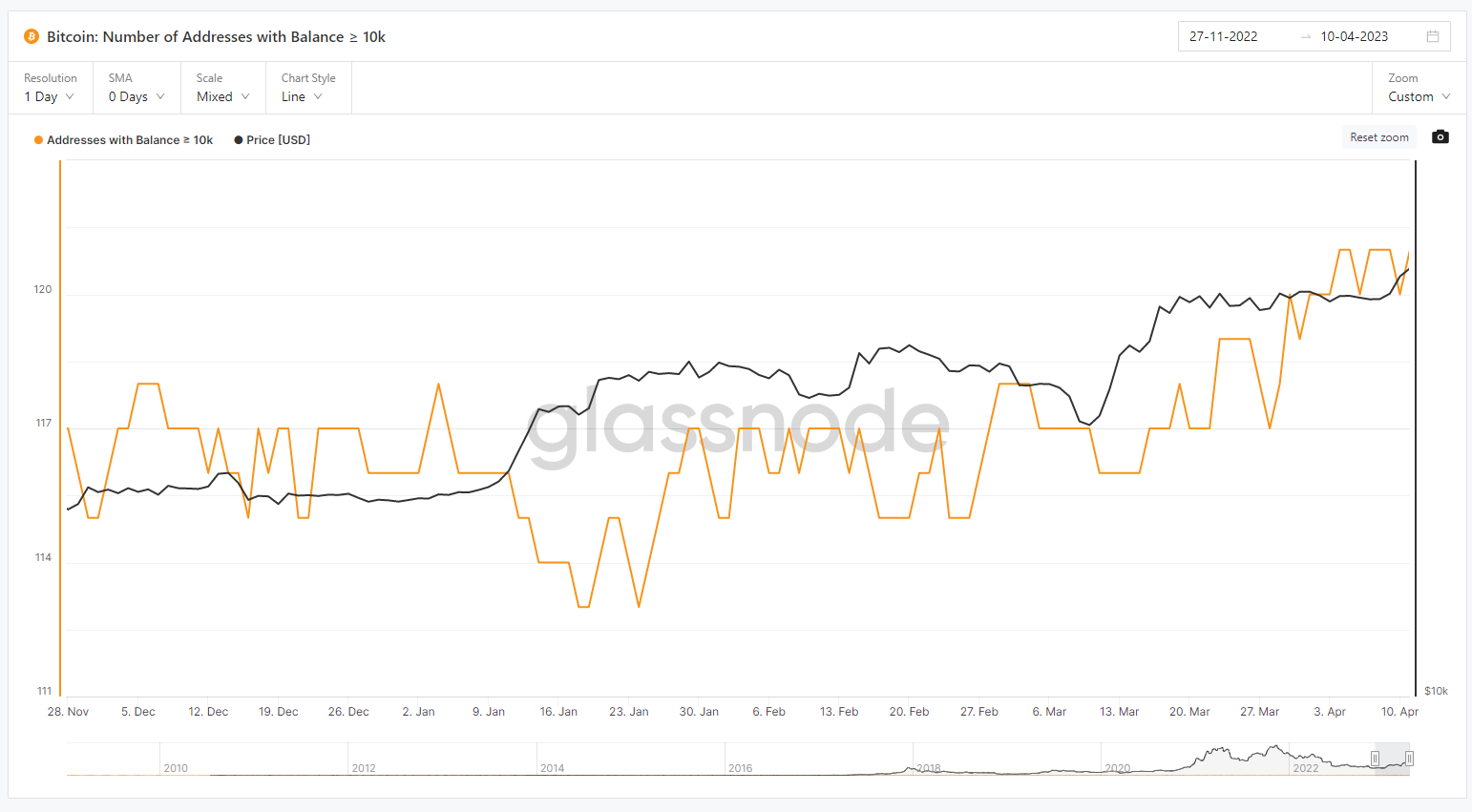

With bitcoin currently finding new support levels at approximately $30,000, it may be beneficial for investors to monitor larger and distinctive wallet addresses. These wallets hold substantial amounts of cryptocurrency and can provide insight into the potential direction of BTC's price trajectory.

- Since January, the quantity of wallets containing between one and 99 BTC as well as those with over 10,000 BTC has been increasing.

- During the same timeframe, there has also been an increase in the quantity of wallets containing anywhere from 100 to 9,999 BTC.

- Large-scale whale investors holding a minimum of 10,000 bitcoins have demonstrated a nimble approach in the market. Despite their bullish sentiment, these major traders have been open to both entering and exiting positions swiftly, capitalizing on short-term peaks for profits and pulling back as the price retraces.

Investors who are on the verge of owning 10,000 BTC might exhibit optimism, as they could be fully committed to the asset and steadily boosting their stake, thereby positioning themselves to step up to the next level.

The positions they hold could serve as a strong support for BTC prices as those investors who took a bullish stance on the digital asset back in January have gained an impressive 80% year-to-date return.

Important events.

Web3 Festival 2023 (Hong Kong)

1:00 a.m. HKT/SGT(17:00 UTC) United States IMF Meeting

Source Coindesk