NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

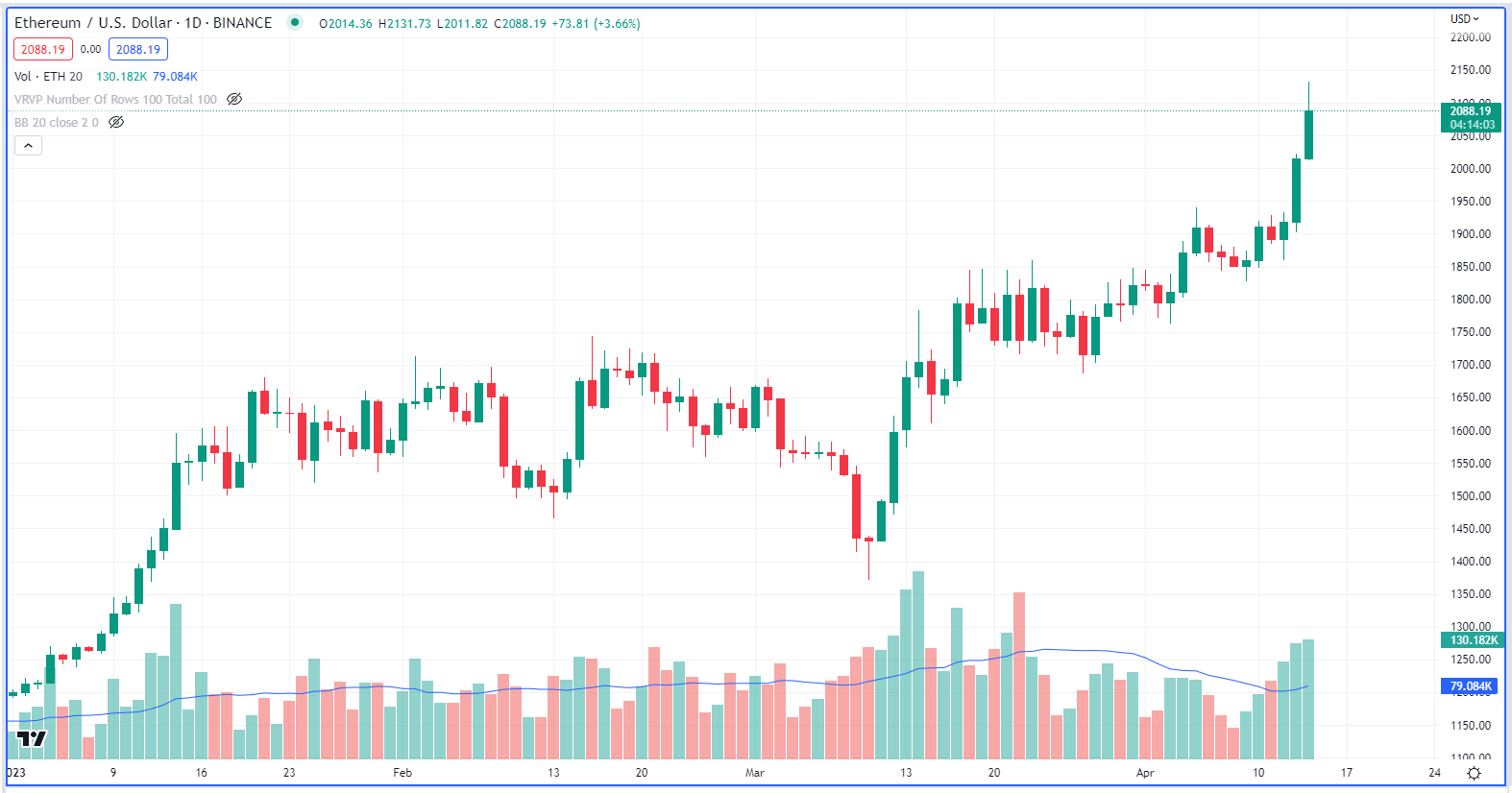

During an eventful week that included positive inflation data and the highly anticipated Ethereum Shanghai upgrade, major digital assets experienced a surge in both confidence and value. This surge was evident in the increased trading volumes across crypto markets.

Over the past seven days, both Bitcoin (BTC) and Ether (ETH) have experienced notable increases, with gains of approximately 9% and 11%, respectively. These gains were particularly concentrated over the latter portion of the week.

Recent economic reports have revealed lower-than-expected inflation and higher-than-expected jobless claims. These developments may provide the Federal Reserve with justification to abstain from raising interest rates at the next Federal Open Market Committee (FOMC) meeting scheduled for May.

The bond markets have begun to react, with the spread between two-year and 10-year Treasury bonds narrowing since early March, although it remains in negative territory.

The completion of the highly-anticipated Shanghai update was the biggest news in crypto markets, as it enabled ETH stakers to withdraw their deposits. Following the completion of the upgrade, Ether experienced a notable price increase of around 9%.

One of the primary concerns among investors was that the unlocking of 18.2 million ETH would result in a significant amount of selling pressure on the asset. However, the de-risking of ETH staking has been viewed positively by the markets thus far.

The recent surge in ETH's price has resulted in the asset gradually reducing Bitcoin's dominance in terms of market capitalization. Additionally, the trading volume in crypto markets has increased significantly, with ETH's daily volume on Thursday reaching more than double its 20-day moving average. While BTC's volume breached its 20-day moving average every day this week, except for Thursday.

Both BTC and ETH have broken through the upper range of their Bollinger Bands this week, indicating a heightened level of bullish sentiment. The Bollinger Bands indicator is a technical tool that tracks an asset's moving average and plots two standard deviations above and below it. A breach in either direction is considered to be a significant event, with this week's breach being a bullish one.

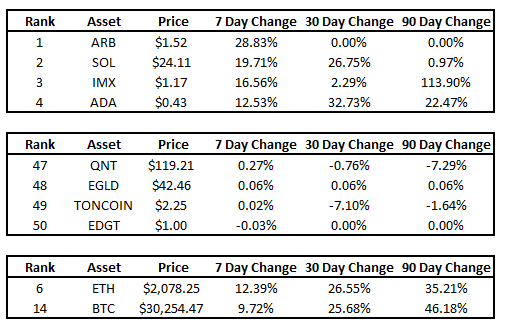

This week, some altcoins also experienced upward momentum. The native token for the Ethereum layer 2 system Arbitrum, ARB, had the most significant increase, rising 28% over the past seven days. Other altcoins that had a strong week include Solana (SOL) and Immutable X's IMX, which rose 20% and 17%, respectively.

Source Coindesk