NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

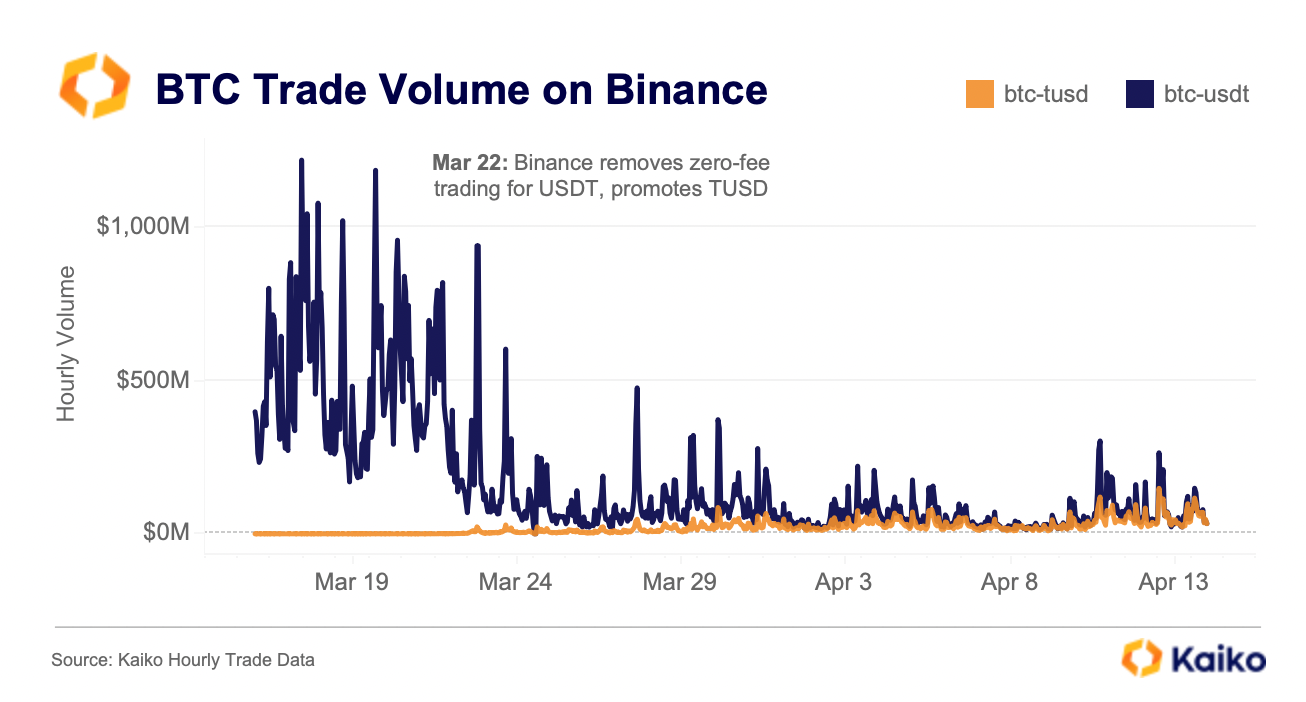

According to crypto data company Kaiko, although the TrueUSD (TUSD) stablecoin's market share in bitcoin (BTC) trading volume on Binance is closing in on Tether's USDT due to the exchange's zero fee trading discount, traders are still hesitant to utilize TUSD.

The market share of TUSD almost reached parity with Tether's following an increase to 49% between Binance's BTC-TUSD and BTC-USDT trading pairs.

“This is a massive increase over just a few weeks,” Clara Medalie, head of research at Kaiko, said.

Despite TUSD's growth, the decline in the trading volume of the BTC-USDT pair was too rapid to be offset, as Binance stopped offering a zero fee discount for Tether. According to data from Kaiko, larger buy and sell orders continue to be placed for the USDT pair, indicating that traders are still hesitant to use TUSD even though there are no fees associated with it. “This suggests that traders are still reluctant to use TUSD despite zero fees,” Medalie added.

TUSD's ascent can be attributed to Binance, the world's biggest cryptocurrency exchange in terms of trading volume, selecting it as the successor to its preferred stablecoin, Binance USD (BUSD), which is issued by Paxos Trust.

After Paxos Trust's decision to discontinue the issuance of BUSD, which led to a six-month hiatus in trading, the exchange resumed trading with TUSD. Moreover, it applied its zero-fee trading discount to the BTC-TUSD pair and waived the promotion from BUSD and USDT as of March 22.

The stablecoin market, valued at $132 billion, is currently experiencing a significant disruption due to both regulatory crackdowns and banking crises in the United States. In February, the New York Department of Financial Services (NYFDS), the leading financial regulator in the state, compelled Paxos to discontinue minting BUSD, which is the third largest stablecoin with a market cap of $16 billion. In the previous month, the collapse of Silicon Valley Bank, which was a reserve partner of the second largest stablecoin USDC, sent shockwaves throughout the market. Consequently, USDC suffered over $10 billion in outflows.

Tether's USDT and TUSD have emerged as the clear victors of the ongoing crisis in the stablecoin market. TUSD, with a market cap of $2 billion, has now become the fifth largest stablecoin in the crypto market. Meanwhile, USDT's circulating supply has increased by $10 billion over the past few months and is fast approaching its all-time high.

Stablecoins play a vital role in the cryptocurrency ecosystem, enabling exchange trading and acting as a link between government-issued fiat currency and digital assets.

TUSD is a stablecoin pegged to the US dollar that is issued by ArchBlock, formerly known as TrustToken. Its value is entirely supported by fiat assets, as confirmed by ChainLink's proof-of-reserve monitoring tool. In 2020, TrustToken disclosed that TUSD's intellectual property rights were acquired by Techteryx, an obscure Asian conglomerate.

Source Coindesk