Coinbase-Backed Insurance Disruptor OpenCover Launches on Layer 2 Blockchain

Cronos Labs Initiates Quest for Participants in $100M Accelerator Program for Blockchain Developers

Binance Reaches Out to Low-Cap Crypto Projects in an Effort to Enhance Trading Activity

The established players in the world of crypto venture capital are a familiar bunch, comprising firms that have been active for years. Some of the big names include A16Z, Paradigm, Pantera Capital, and Digital Currency Group (the parent company of CoinDesk).

The sudden and dramatic rise of DWF Labs as a major player in the crypto venture capital space has taken many by surprise. In the last few months, the firm has made a lot of noise by announcing large investments in various projects. For instance, it invested $40 million in Tomi, an alternative internet provider, $40 million in Fetch.AI, a token related to artificial intelligence, and $10 million in CryptoGPT, a crypto data project with a focus on AI. These investments were widely publicized through press releases and media outlets such as CoinDesk and The Block.

On closer inspection, it becomes apparent that DWF Labs, whose founders earned their fortunes as high-frequency traders in the crypto market, doesn't always fit the traditional mold of a venture capital firm.

Despite the media headlines labeling DWF's dealings with crypto projects as "investments," the firm operates more like an over-the-counter (OTC) trading desk. According to various crypto projects that have worked with DWF, the company typically approaches them with an offer to purchase their tokens at a discount to market value, often in amounts totaling millions of dollars.

But DWF Labs says it's all a misunderstanding. “There might be some questions on the use of the word ‘investment’,” said DWF Labs Partner Stefano Virgilli. “When we use the word ‘investment,’ to us the most important thing is that if we're purchasing the tokens and they're using the funds to further develop, that's an investment,” he added.

The controversy

When it comes to investing in crypto projects, the venture capital model is typically followed. Projects seek funding from venture firms through various funding rounds (such as pre-seed, seed, Series A, etc.) and investors receive a percentage of the project's equity in return. In the case of early-stage investments, where a project has not yet launched a token, investors may receive a Simple Agreement for Future Tokens (SAFT) contract, outlining the tokens they will receive if the project eventually launches a token.

DWF Labs' investments are more ad hoc in nature, and the company tends to focus on projects that have already launched a token.

Although DWF Labs describes itself as "a global Web3 venture capital and market maker" or "multi-stage Web3 investment firm" in press releases, the deals they strike with crypto projects are often referred to as "strategic partnerships." These partnerships can involve a variety of services, such as token acquisitions, market making, commitments to enhance a token's liquidity and trading volume, and additional support for marketing and media exposure.

In September, the firm issued a press release announcing its launch and stated that it even assists in the sale of token holdings belonging to projects' treasuries.

In the post, the firm said that “DWF Labs invests in digital asset companies and supports existing markets, enabling digital asset companies to sell their tokens for up-front capital without adverse price impact,” adding that “DWF Labs buys tokens with its own funds, allowing its corporate customers to sell tokens quickly.”

It is a prevalent trend in the cryptocurrency industry for market-making firms to establish venture capital arms. Two prominent market-making firms, Jump Crypto and Wintermute, started out as trading firms but have diversified their operations to include providing funding to projects and developing core infrastructure. For instance, Jump has invested in the Wormhole cross-chain bridge, while Wintermute has launched its own decentralized exchange.

The norm in the industry is for market-making firms to keep their contracts separate. While the distinction between the two divisions can sometimes become unclear, DWF's recent activity and apparent bundling of various services under partnerships has caused concern among some industry observers.

“It’s a massive conflict of interest,” Walter Teng, research firm Fundstrat’s vice president of digital assets, told CoinDesk. “If you invest, you want the token’s price to go up. If you market make, you can manipulate the price to go up by spoofing.”

“All of their ‘investments’ are poorly disguised agency OTC (over-the-counter) trades,” a market making firm’s executive, who asked not to be named due to company policy, told CoinDesk. “They make a big announcement about ‘partnerships, investments’ or some other nonsense, but in reality it is a way for token projects to sell their treasury without announcing that they are selling their treasury.”

DWF managing partner Andrei Grachev defended the firm’s token maneuvers in a recent tweet, calling it “dumb” if a market maker (MM) leaves all the acquired or borrowed assets in a wallet, because an “MM should create markets, provide depth, improve order execution instead of doing nothing and waiting when the market is skyrocketing to execute its call options.”

DWF Labs’ strategy

In September, Digital Wave Finance unveiled its investment-focused subsidiary, DWF Labs, which operates as an arm of the high-frequency trading firm. Digital Wave Finance conducts trades in both spot and derivatives markets across more than 40 exchanges, as stated in the company's press release.

According to Grachev, DWF Labs' funding is derived from the profits generated by the high-frequency trading business. In 2018, Grachev served as the head of office in Russia for Huobi, a cryptocurrency exchange, and played a significant role in the company's expansion within the country.

Grachev refuted rumors circulating within the crypto industry that his firm had received funding from Russia.

Grachev said the firm has multiple types of investments, some with token lockups, others without vesting period, and focuses on projects with tokens. “We prefer to have tokens but we also have several equity deals,” said. “But, frankly, with equity … it is not our strong side,” he said.

While he said that DWF Labs “usually do not include market-making deals in our venture side,” later he admitted that “we have pure investments without market making, we have market-making [agreements] without investment, and we have [them] combined.”

“As a market maker, of course we support our portfolio. If we invest, we will provide much more liquidity to the project compared to if we don’t invest,” Grachev said.

When asked about DWF’s investment strategy and due diligence, Grachev talked about focusing on five sectors – traditional finance (TradFi), decentralized finance (DeFi), GameFi, centralized exchanges (CEX) and artificial intelligence (AI) – and aiming to “have stakes in all major chains (...) in order to have access to their ecosystems.” The firm looks for projects with “life and traction,” he said, checking social media posts and what exchanges their token is listed on.

"If a project is listed on BitFinex, Coinbase or Binance, then the project is proven and good because these exchanges have very strict due diligence and very strict policies of listing," he added.

Grachev also said DWF doesn’t usually participate in specific venture rounds. “We just approach them,” he says.

CoinDesk has obtained a collection of messages exchanged between DWF Labs and a cryptocurrency project, which reveal that a DWF Labs team member expressed interest in investing in the project and offering complimentary market-making services. DWF Labs proposed two investment options for the project: a direct OTC purchase of liquid tokens from the project's treasury or an investment with a lockup period and accompanying market-making services.

In a series of messages between a market maker and another project, DWF Labs offered to purchase tokens from the project in daily tranches at a discounted price without any lockup period, or in a single installment with a one-year lockup at a steeper discount. The messages also indicated that DWF Labs pledged to assist with listing the token on South Korean exchanges, including Binance Korea, leveraging its "good relationship" with the exchange. Additionally, DWF Labs offered to create options trading and "build a narrative" utilizing its team and media presence.

There have been several previous instances where DWF Labs combined investment activities with market-making deals and made public announcements regarding these initiatives.

The company made a significant move by announcing a strategic partnership with the derivatives trading platform, Synthetix. In a press release dated March 16, it was revealed that the company had acquired $15 million worth of Synthetix's native token, SNX. The acquisition was aimed at enhancing liquidity and market making. Grachev, the company's spokesperson, expressed enthusiasm for the investment, stating that "we are thrilled to invest in Synthetix."

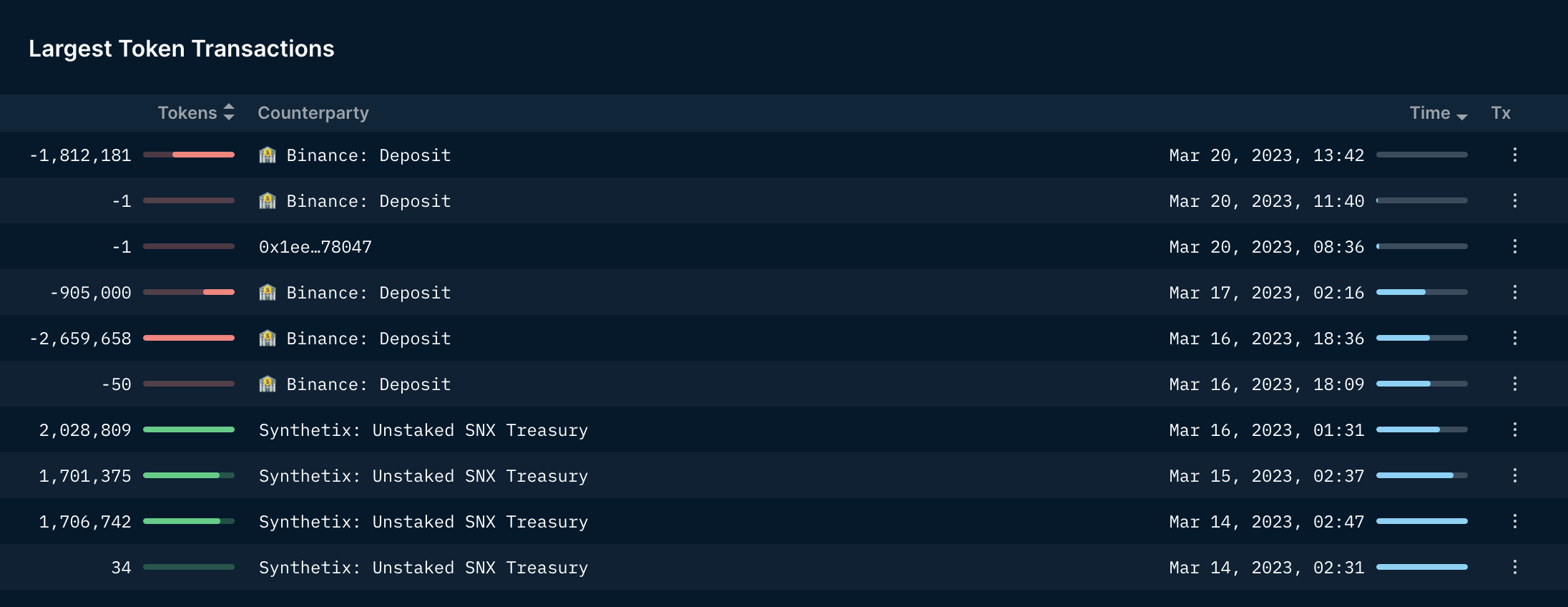

According to blockchain data analyzed by crypto intelligence firm Nansen, DFW's wallet received 5.3 million SNX tokens directly from Synthetix's treasury wallet between March 14 and March 16. Subsequently, DFW transferred all the tokens to Binance in multiple transactions from March 16 to March 20.

In November, DWF announced a $10 million investment in the TON ecosystem. The firm’s press release said the “strategic partnership” with the project extends to “an investment, token development, market creation and exchange listing.” The partnership also includes “50 seed investments scheduled over the next 12 months,” doubling the TON token’s trading volume in the first three months of the partnership, and developing an OTC market “to let buyers and sellers complete large transactions.”

An additional example involves a company called DWF, which made an investment in the Web3 influencer platform So-Col. As reported by The Block, a publication focused on cryptocurrency, DWF purchased $1.5 million worth of So-Col's native token SIMP in February as part of a funding round. According to Irene Zhao, the founder of So-Col, the tokens are subject to a one-year vesting period that will conclude in February 2024. However, the post does not provide any details on additional services or offerings beyond the investment.

Nansen's blockchain data recorded on the Ethereum blockchain indicates that DWF's cryptocurrency wallet received 3.3 million SIMP tokens from March 6 to March 24. During this time frame, DWF transferred approximately 2.6 million tokens to the KuCoin exchange, while the remaining tokens were transferred to an unidentified wallet on March 30. Following the announcement on March 28, SIMP's value nearly doubled within a week, rising from approximately 1.7 cents, according to CoinGecko data. However, the token's value began to decline sharply towards 1 cent on April 4th.

CoinDesk examined Telegram messages from a representative of So-Col, who stated that they chose to collaborate with DWF Labs not only because they serve as a market maker but also because DWF has made direct investments in the project, which has helped to extend the startup's runway.

Sending tokens to exchanges

Grachev stated that DWF Labs predominantly stores their funds and investments on centralized exchanges (CEXs), and that the act of transferring tokens to an exchange does not necessarily imply that the company intends to sell them.

“We keep all of our inventory, almost all of our inventory, not only our investments but our own funds on exchanges,” he said.

Nonetheless, the act of retaining investments that are purportedly intended for the long-term on exchanges has caused some industry experts to become concerned. This practice can conceal information from knowledgeable blockchain analysts and traders, making it difficult to determine whether DWF is selling tokens or utilizing them for market-making activities.

“It’s a red flag,” a founder, who asked to remain anonymous, of a crypto analytics firm with former market-making experience told CoinDesk. “They [DWF Labs] market them as an investment, and then claim to do ‘market making’ so they can keep funds on exchanges and just dump.”

It is difficult to determine the appropriate boundary between venture capital (VC) and market-making for a firm like DWF. One possible solution could be to adopt a page from traditional finance (TradFi) by establishing a so-called Chinese wall that separates investment banking from trading/research. However, it remains uncertain where this boundary should be drawn for crypto investment firms.

In the interview, Grachev admits his “biggest mistake” was not properly explaining his firm’s operating philosophy and investment process. “We need to be more open. I want [the community] to know how we work and then let people decide who is right and who is not right,” he said.

Source Coindesk