NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

Coinbase's Pursuit of Regulatory Clarity Shapes its Global Expansion Strategy

CryptoQuant, a cryptocurrency data firm, reported that in the four days following the launch of Ethereum's Shanghai upgrade, crypto exchanges saw a net inflow of 179,500 ether (ETH), which is equivalent to approximately $375 million.

According to data from CryptoQuant, between April 13 and April 16, traders deposited 1,101,079 ETH to exchanges while only withdrawing 921,579 tokens. This resulted in the largest net inflow in a month over a four-day period.

Typically, when investors transfer their tokens to exchanges, it signals that they are getting ready to sell, which could potentially result in a decline in price.

Ethereum accomplished a highly anticipated technical upgrade, referred to as Shanghai, on April 12. With this upgrade, the proof-of-stake blockchain of Ethereum, which has around 18 million ETH worth $36 billion locked in staking contracts, has enabled withdrawals for the first time.

Prior to the upgrade, some observers in the crypto space were concerned that the event would result in the flooding of millions of unlocked ETH into the market, leading to a price crash for the second largest cryptocurrency. However, others predicted that the impact would be minimal or even lead to a price increase. Following news of a successful and smooth implementation, ETH's price surged to over $2,100 the next day, marking its highest level since May 2022. In the 24-hour period following the upgrade, ETH outperformed bitcoin (BTC). As of late, ETH is trading at around $2,070, reflecting a decrease of over 2% in the past 24 hours.

Data indicates that a number of traders have sold their ETH during the price surge that occurred after the Shanghai upgrade.

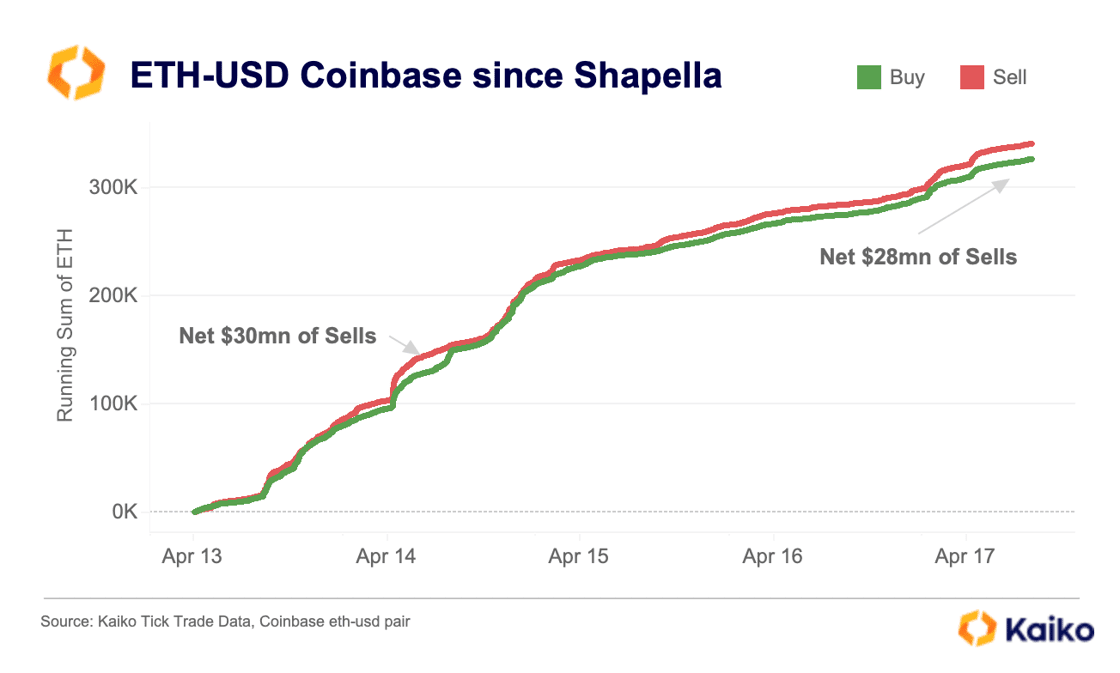

According to a report by Kaiko, a cryptocurrency market research platform, the ETH-USD trading pair on Coinbase has seen $28 million more sell orders than buy orders since the implementation of the Shanghai upgrade.

Coinbase was among the initial exchanges to allow users to immediately unlock and withdraw their staked ETH via its platform after the implementation of the Shanghai upgrade. However, Binance, the world's biggest cryptocurrency exchange in terms of trading volume, is set to follow suit on April 19. According to Kaiko, this move by Binance "could result in more sell pressure for ETH."

ETH has slightly decreased from its earlier gains and is currently trading at $2,079 according to data from CoinDesk.

Source Coindesk