NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

CFTC Initiates Enforcement Sweep Targeting Opyn and Other DeFi Operations

Binance Supercharges Bitcoin and Ether Trading in Argentine, Brazilian, and South African Currencies with Exciting Fee Promotion

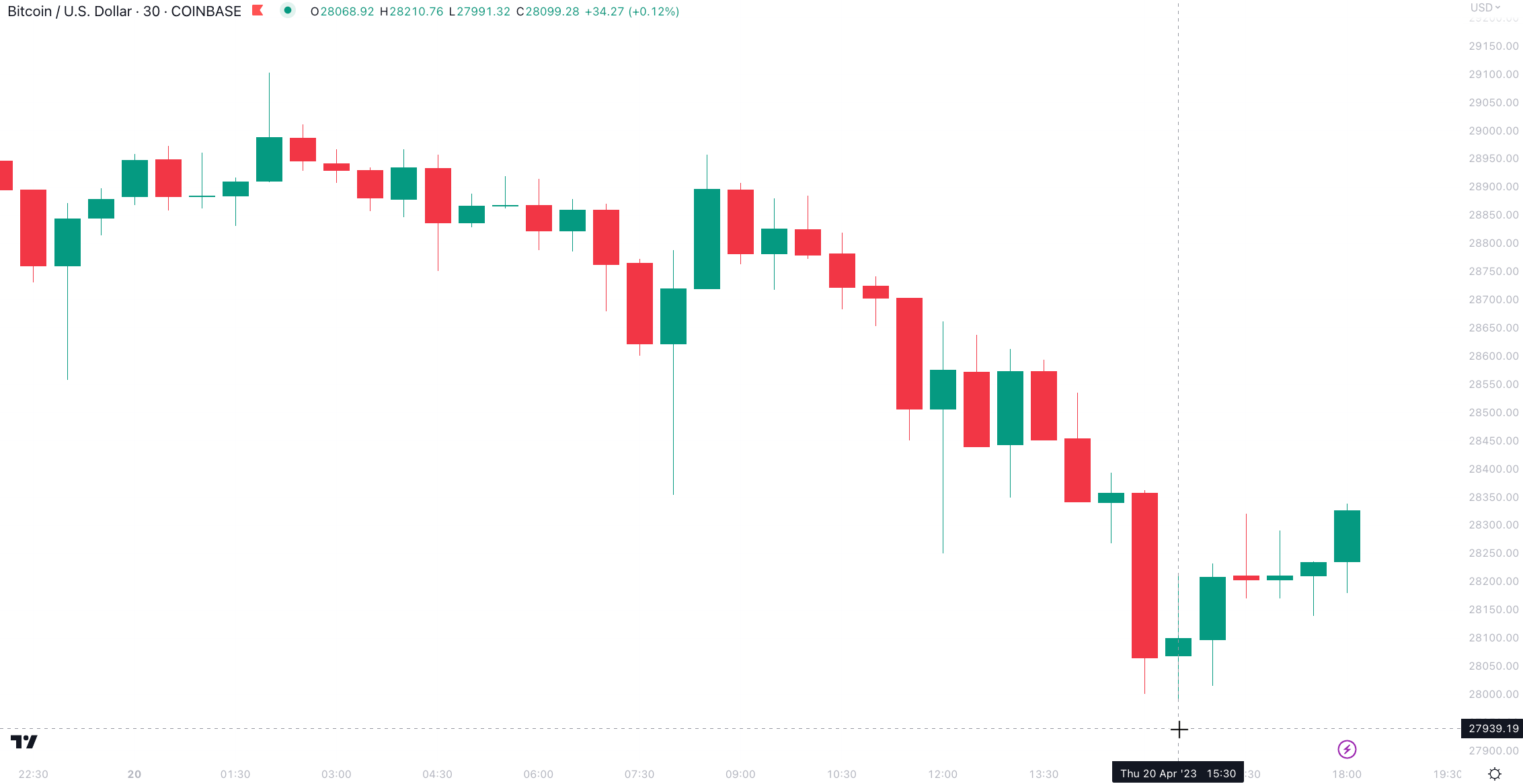

On Thursday, Bitcoin experienced a two-day decline, with its value dropping below $28,000 at one point. This marked a continuation of the largest cryptocurrency by market capitalization's recent slump.

Based on market data from CoinDesk, Bitcoin (BTC) was trading at approximately $28,325, marking a 2.7% decrease over the last 24 hours. However, TradingView data revealed that the BTC/USD trading pair on the Coinbase exchange briefly dropped to $27,991 before rebounding, shortly before U.S. equity markets closed.

According to an email from Edward Moya, a senior market analyst at Oanda, the recent drop in the value of Bitcoin was triggered by comments from Brian Armstrong, CEO of Coinbase, who suggested that the major cryptocurrency exchange may exit the U.S. market.

"Coinbase was able to secure a license to operate in Bermuda, in what is being considered a part of their global push," Moya wrote. "If Coinbase leaves the U.S. market, a lot of U.S. traders will be gone because they probably won't feel confident trading on decentralized exchanges, which means the global crypto market will shrink significantly."

He added: "Bitcoin will struggle here until we have any regulatory clarity which means prices seem poised to drift lower."

The value of Ether (ETH), the second largest cryptocurrency by market capitalization, has recently declined by almost 1%, trading at approximately $1,948. At one point, ETH dropped to as low as $1,917, marking its lowest point in the past week.

Over the last seven days, BTC and ETH have both experienced a decline in value, with BTC down by 7% and ETH down by 3%.

The majority of other major cryptocurrencies were experiencing a decrease in value, with XRP and Litecoin (LTC) both down over 5% due to their focus on payment transactions. The CoinDesk Market Index (CMI), which provides an overview of the overall performance of the cryptocurrency market, showed a decline of 3.9% for the day.

The equity markets experienced a decline due to a series of disappointing first-quarter earnings reports, including Tesla, which saw its revenues fall slightly short of consensus estimates, and Blackstone, the world's largest alternative asset manager. The S&P 500 and Nasdaq Composite both fell 0.6% and 0.8%, respectively, during the day, while the Dow Jones Industrial Average (DJIA) was down 0.3%.

Source Coindesk