First Mover Asia: Bitcoin Holds Firm Below $30K as Sam Bankman-Fried Returns to Incarceration

First Mover Asia: Bitcoin Demonstrates Resistance to CPI Effects

First Mover Asia: BTC and ETH Maintain Stability, While COMP and AAVE Experience Losses

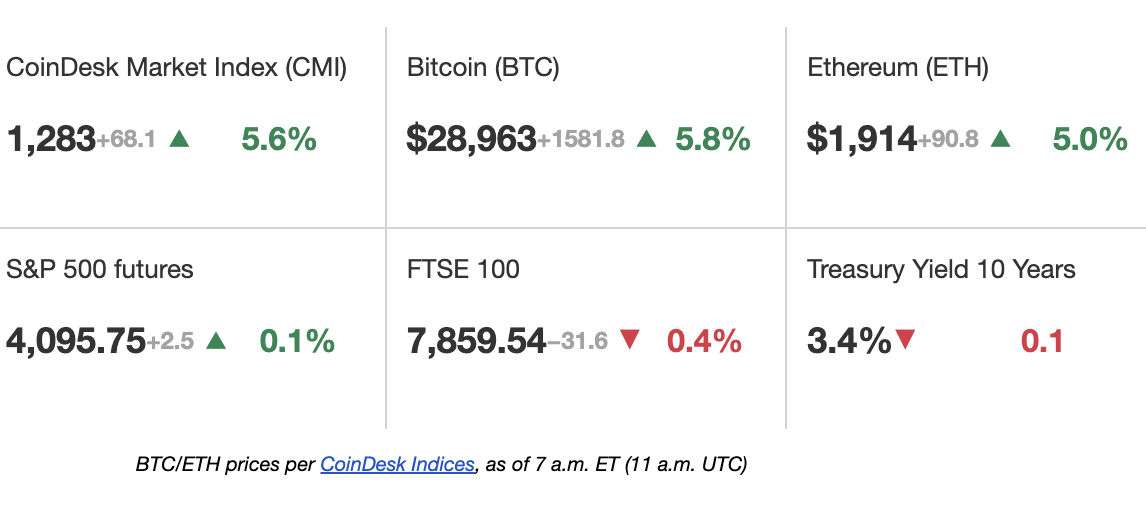

Latest Prices

Top Stories

Bitcoin saw a 6% increase on Wednesday, putting an end to its five-day losing streak and reaching a week-high of $29,000. Ether, the second largest cryptocurrency by market capitalization, also saw a 4.5% rise. The uptick in prices coincides with renewed concerns over the stability of U.S. banks, particularly following First Republic Bank's announcement that over $100 billion had been withdrawn from their accounts in the previous month, leading to a 50% drop in the bank's shares on Tuesday. This development caused a ripple effect in the U.S. markets, with the Dow Jones Industrial Average losing 1% and the tech-heavy Nasdaq 100 falling nearly 2% on the same day.

Joseph Seibert, formerly the head of digital assets at Signature Bank, along with four members of his Signet team, have joined Fortress Trust, a chartered trust company based in Nevada that specializes in cryptocurrency and Web3. Signature Bank, known for its crypto-friendly policies, was forced to close down in March after large sums of money were withdrawn by depositors following the collapse of Silicon Valley Bank, another institution with ties to the cryptocurrency industry. Signet, a payments platform that was popular among Signature's institutional crypto clients, was part of the bank's digital assets division led by Seibert.

Talos, a trading platform for institutional investors in the cryptocurrency space, has teamed up with Coinbase Prime to enhance access to digital assets for clients of both companies. As the demand for secure and efficient trading platforms continues to rise among institutional investors, the partnership will provide Talos customers with access to Coinbase Prime for spot liquidity and custody services, as stated in a press release. In return, Coinbase Prime clients will gain access to Talos' trading and connectivity products.

Chart of the Day

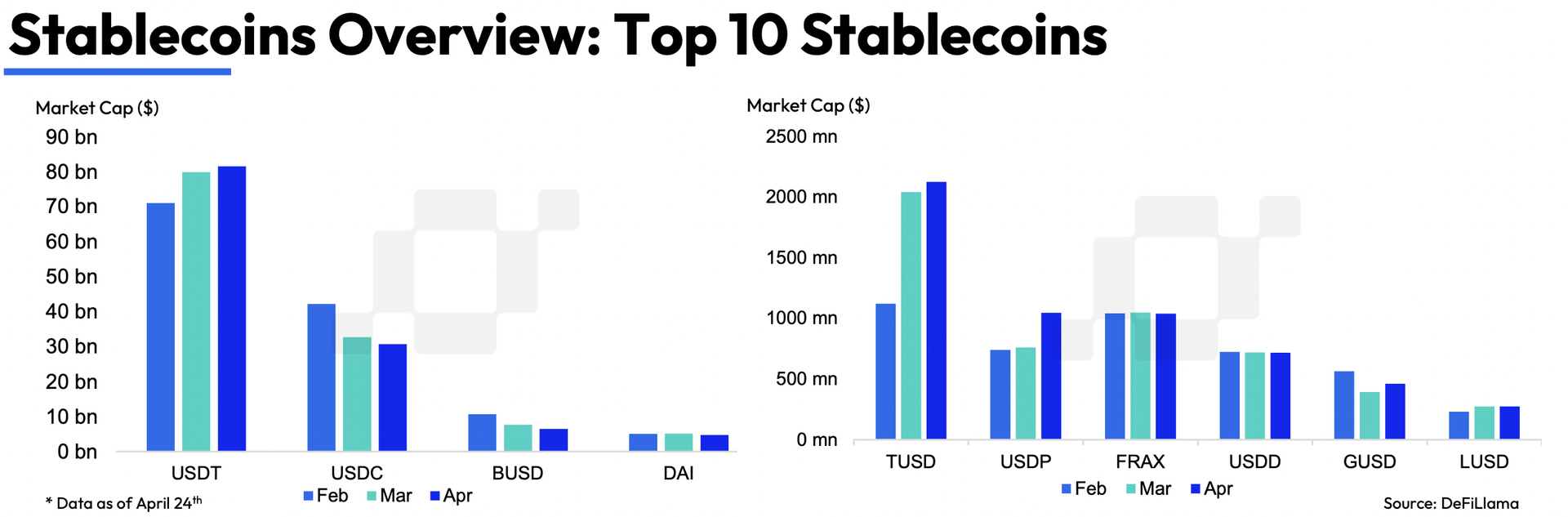

- This chart depicts the fluctuations in the market value of the leading 10 stablecoins since February.

- Tether (USDT) has further solidified its position as the dominant stablecoin for the third consecutive month in April, as its market capitalization increased by 2.03% to reach $81.5 billion. Meanwhile, BUSD and USDC continued to lose market share in comparison.

- The market capitalization of TUSD has grown by 4.19% and reached $2.13 billion.

- Although TUSD is gaining popularity, trading pairs denominated in tether and bitcoin remain the most liquid.

Source Coindesk