Bitcoin Decline Sparks Trader Concerns as USDT Faces Selling Pressure on Curve and Uniswap

Crypto Global Bid and Ask Metric Plunges 20% Over Weekend, Indicating Extremely Low Liquidity Levels

Robinhood's Crypto Trading Volume Plummets by 68% in May, Reaching $2.1 Billion

The crypto markets experienced a sudden drop on Wednesday afternoon, causing the gains from the previous 24 hours to disappear in less than an hour.

The broader crypto market took a severe hit, as reflected in the 5.6% drop of the CoinDesk Market Index (CMI) within an hour. At present, the market index continues to show a 1.3% decline from its position 24 hours earlier.

Bitcoin (BTC), the most prominent cryptocurrency based on market capitalization, was trading at approximately $28,275 recently, marking a slight increase of less than one percent, but still lower than its peak of over $30,000 earlier on Wednesday. The price of BTC later dropped to as low as $27,264 during the day.

Ether (ETH) was trading at $1,855, experiencing a slight decrease. The cryptocurrency with the second-largest market value reached a peak of $1,984 before dropping to a Wednesday afternoon low of $1,789 - its lowest point since the beginning of April.

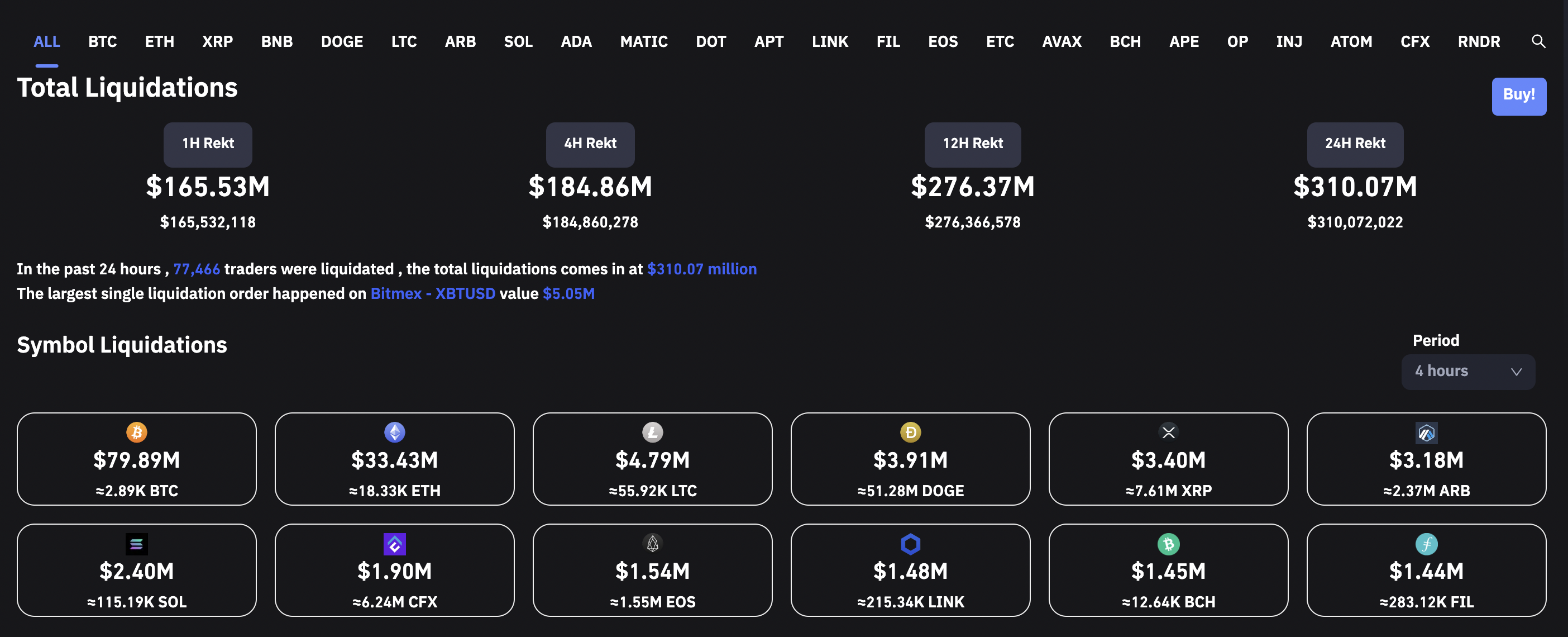

Coinglass data reveals that in the past 24 hours, traders were hit with losses totaling around $310 million from liquidations caused by the extreme swings in cryptocurrency prices, which resulted in the liquidation of both long and short positions.

Arkham Intelligence, a blockchain analysis firm, reported that Jump Trading, one of the largest crypto traders, deposited $26.6 million worth of BTC into exchanges prior to the recent price decline. This action is often seen as an indication of an intention to sell, as traders typically deposit assets onto exchanges in preparation for executing sell orders.

Source Coindesk