Coinbase Ventures' Strategic Investment Propels Rocket Pool Token to Soaring Heights

DeFi Protocol Maverick Secures $9 Million Funding Round Led by Peter Thiel's Founders Fund

Crypto Global Bid and Ask Metric Plunges 20% Over Weekend, Indicating Extremely Low Liquidity Levels

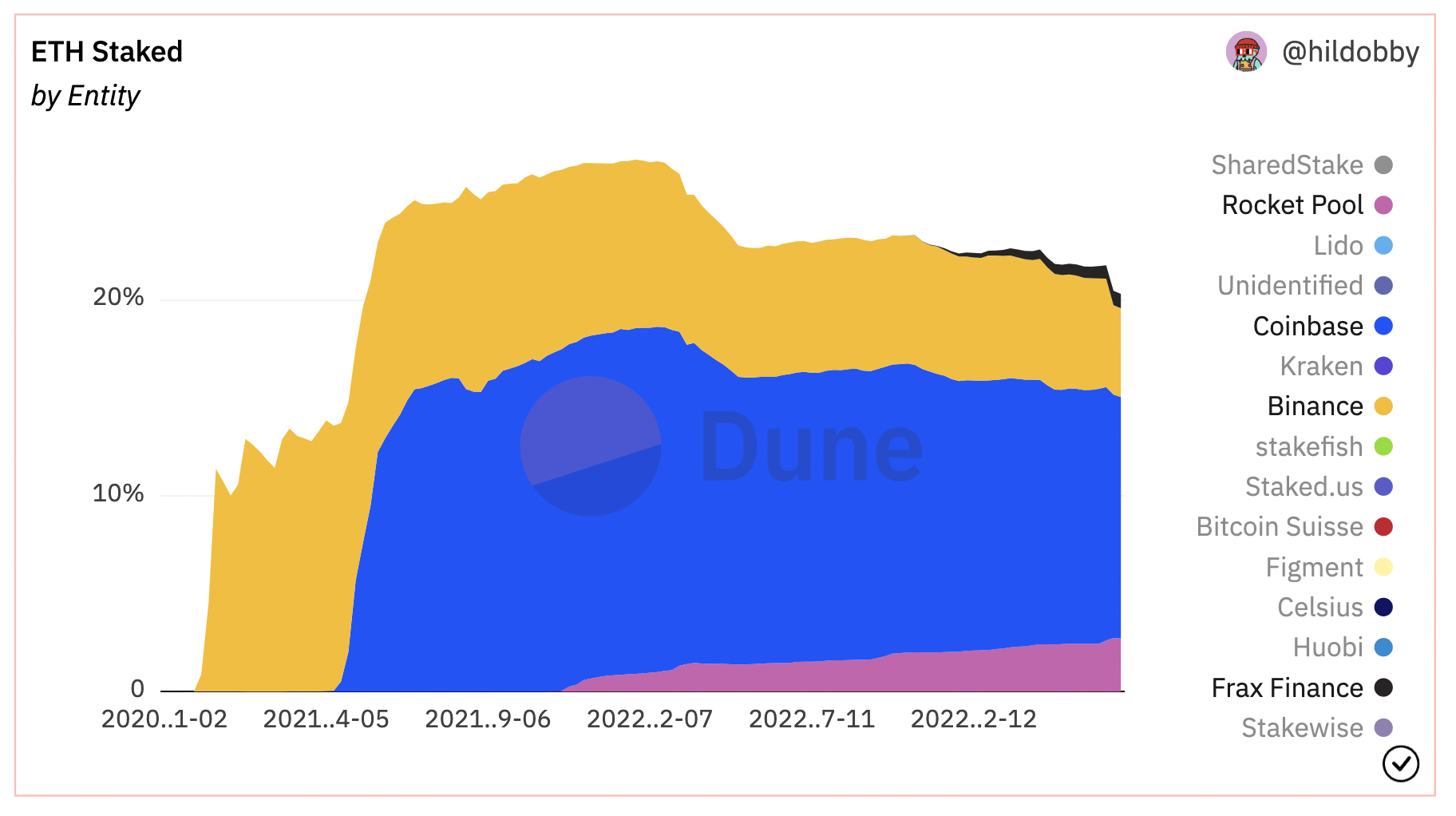

Blockchain data indicates that Binance and Coinbase, the centralized giants of the cryptocurrency exchange market, have experienced significant outflows of staked ether (ETH) following Ethereum's Shanghai upgrade, as investors turn to decentralized competitors.

A Dune Analytics data dashboard reveals that Coinbase's staking platform has experienced a net outflow of $367 million in staked ETH since April 12. Withdrawal requests, which include both reward withdrawals and full exits, have exceeded new deposits. Similarly, Binance, the world's largest cryptocurrency exchange, has seen a net outflow of $340 million from its staking service.

In contrast, decentralized liquid staking protocols have experienced a significant surge in deposits. Two of the biggest beneficiaries, Frax Finance and Rocket Pool, have seen net inflows of $56 million and $68 million, respectively.

The recent development can be attributed to Ethereum's eagerly anticipated Shanghai upgrade on April 12, which enabled investors to withdraw roughly $35 billion worth of tokens previously held in staking contracts. Experts anticipated that the upgrade would represent a significant milestone for the $225 billion network, with the potential to increase staking participation, draw in institutional investors, and reshape the competitive landscape for staking services.

Ahmed Ismail, the founder and CEO of FLUID Finance, has described the upgrade as a crucial catalyst that has greatly accelerated the progress of decentralized liquid staking solutions.

Liquid staking protocols create a derivative token that represents the quantity of locked tokens, which enables investors to access decentralized finance (DeFi) services like lending and borrowing.

DefiLlama data indicates that the quantity of ETH staked on Frax and Rocket Pool has increased by 32.5% and 31%, respectively, over the past 30 days, primarily due to the influx of new deposits.

Since April 12th, Lido Finance, which is currently the leading decentralized liquid staking protocol with around $11 billion in deposits, has registered a net increase of $28 million (15,208 ETH) in deposits after accounting for withdrawals.

Regulatory concerns, higher yields

In a note, Tom Wan, an analyst at 21Shares, a digital asset investment firm, suggested that investors are turning to decentralized staking protocols due to a combination of regulatory risks and reluctance to use centralized crypto platforms in the aftermath of last year's high-profile bankruptcies.

In February of this year, Kraken, a cryptocurrency exchange, decided to close down its staking service following charges by the U.S. Securities and Exchange Commission (SEC) for offering unregistered securities. The settlement resulted in a surge in the value of liquid staking tokens, as the SEC seemed to be targeting staking service providers, which in turn benefited decentralized liquid staking.

According to John "Omakase" Lo, the head of digital assets at Recharge Capital, there is a possibility that centralized entities will face ongoing regulatory pressure.

“The uncertainty isn’t good for retaining deposits,” he added.

Investors may also be attracted by the higher staking rewards offered by decentralized protocols. Currently, Coinbase and Binance provide approximately 4% annualized rewards for staking ETH, while decentralized protocols such as Lido Finance and Frax Finance offer rates of 5-7%.

“Centralized liquid staking usually has a lower yield profile. Compliance and staffing all add up,” Omakase said.

Despite experiencing some outflows, Binance and Coinbase are still considered to be major players in the ETH staking market. However, recent data shows that Binance's market share has declined from 5.7% to 4.5% over the last month, while Coinbase's share has dropped from 13% to 12.3%.

Recent data provided by blockchain intelligence firm Nansen indicates that both Binance and Coinbase are experiencing additional outflows. As of now, Coinbase is holding around $191 million worth of staked ETH that is yet to be withdrawn, while Binance has $41 million worth of withdrawal requests in its queue.

Source Coindesk