Bitcoin Bulls Encounter Headwinds as Monthly Stochastic Indicator Trends Downward: Analyst

Bitcoin's Most Oversold Levels Since Covid Crash Indicated by Key Metrics

Bitcoin and U.S. Real Yields Forge Strongest Inverse Link Since April

If the impending arrival of summer has you in the mood for an exhilarating roller coaster ride, look no further than the current state of the cryptocurrency markets.

To begin with, Bitcoin and Ether experienced a surge in value following a mildly positive U.S. inflation report. However, the price of the largest cryptocurrency by market capitalization plummeted in response to rumors circulating on the internet that the U.S. government was selling $324 million worth of Bitcoin. Nonetheless, BTC rebounded once again as investors regained their composure.

The fluctuations in the cryptocurrency markets are a reflection of the ongoing uncertainties surrounding crypto assets and broader macroeconomic conditions. Throughout the spring, investors have exercised caution, searching for catalysts that could push Bitcoin's price beyond its current range of $25,000 to $30,000. However, the timing of these catalysts remains uncertain. In the meantime, BTC appears vulnerable to minor shifts in market sentiment and isolated events, although its recent rebound on Wednesday serves as further evidence of its resilience.

On Wednesday morning, investors were uplifted by an unforeseen drop in the U.S. Consumer Price Index (CPI) to 4.9% in April, resulting in a 2% increase in bitcoin and a 1.4% increase in ether's prices within the hour after the Labor Department published the data. These gains put an end to a four-day losing streak for these assets. Notably, economists had projected a 5% CPI, which was the same as March's index. It's worth noting that almost a year ago, the CPI had surged past 9%.

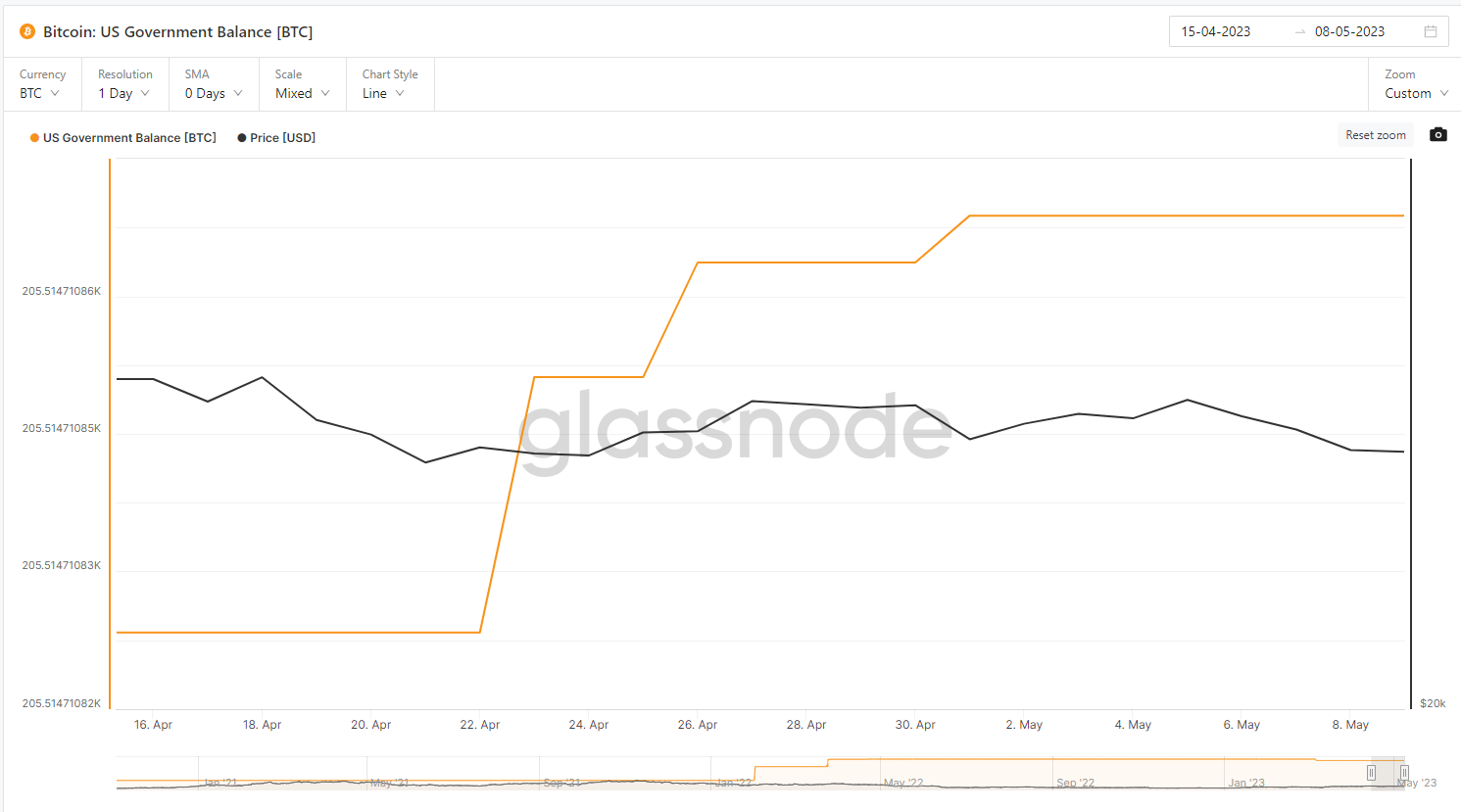

Afterward, bitcoin experienced a sharp decline due to rumors circulating that the U.S. government had sold over 11,800 bitcoin. On-chain data revealed that BTC had been transferred between two wallets at around 1:06 PM ET. Interestingly, the recipient wallet had a balance of roughly $633 million in BTC, but only three transactions were recorded on the Bitcoin blockchain.

It should be noted that Glassnode, the on-chain data provider, indicated no movement in the U.S. Government's bitcoin holdings. However, as often is the case, perceptions can have a more significant impact than reality. In this scenario, the mere possibility - even if it lacked factual basis - seemed to have rattled investors.

Bitcoin's value started to climb again in the early afternoon as doubts about the rumor's credibility grew. BTC had dropped to as low as $26,900 before recovering to trade at around $27,900, similar to its opening price for the day.

Bitcoin's current value is approximately 2.5% lower than its 20-day moving average, which is at $28,520. Notably, there appears to be growing support for BTC at its current levels due to previous instances of high trading volume occurring around this price point.

Ether is exhibiting a comparable pattern, as its value is also returning to its 20-day moving average.

On Tuesday, there are two significant economic indicators scheduled for release in the United States: the jobless claims report and the producer price index (PPI), which have the potential to impact the economy.

In June, the U.S. central bank will make a significant decision on whether to raise interest rates, and they will receive assistance from various parties, including those who will have a major influence on crypto and other asset markets. While this is happening, the value of bitcoin, along with other volatile assets, remained relatively unchanged and experienced a roller coaster-like ride, ending up roughly where it started.

Source Coindesk