Bitcoin Languishes as ETF Optimism Subsides; PEPE Takes the Lead in Altcoin Profits

Donald Trump Possesses Crypto Holdings Valued Up to $500K

Coinbase Ventures' Strategic Investment Propels Rocket Pool Token to Soaring Heights

A report by blockchain analytics company Nansen suggests that the selling pressure on Ethereum's native token, ether (ETH), was not significant after the Shanghai upgrade that allowed staking redemptions for the first time, indicating that it was a "non-event" in hindsight.

It has been over a month since the Shanghai upgrade, which signaled Ethereum's complete shift to a proof-of-stake blockchain. As of now, the number of staked ETH has reached a new all-time high of 19.55 million, with staking deposits surpassing withdrawals. As a result, the May 8 report stated “that the elimination of unstaking risks has thus far offset selling pressure from withdrawals.”

In the weeks leading up to the Shanghai upgrade, both crypto bulls and bears engaged in extensive debates about the potential market response to the upgrade. According to CoinDesk data, since the upgrade went live on April 13th, the price of ETH has decreased by about 8%, currently sitting at $1,851. Additionally, the CoinDesk Market Index, which aims to track the overall performance of the digital asset market, has fallen by nearly 10% during the same time period.

“Ultimately, withdrawals have been minimal and have thus far been matched with inflows, signaling strong overall confidence from investors in the network and the asset itself,” according to the Nansen report.

Kraken, a cryptocurrency exchange that followed the regulations set by the Securities and Exchange Commission (SEC) and ceased its crypto staking-as-a-service platform for customers in the United States in February, had the highest number of withdrawals at more than 646,000 ETH. Its competitor, Coinbase, had a lower number of withdrawals with over 376,000 ETH.

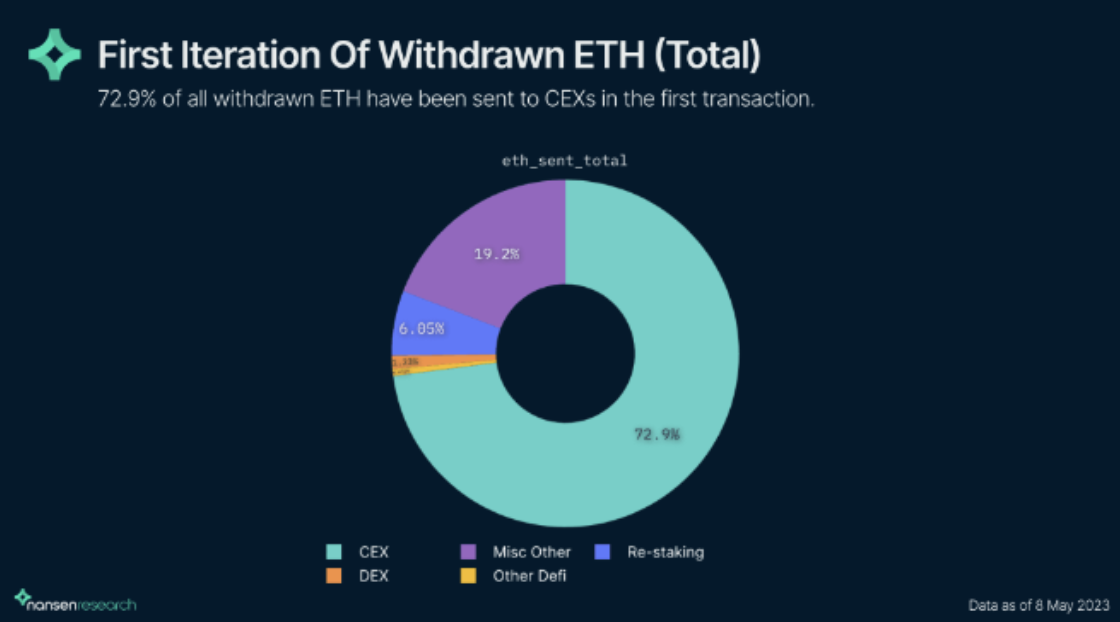

The majority of ETH withdrawn from staking is being transferred to centralized exchanges (CEXs) like Kraken and Coinbase, accounting for around 73% of the total withdrawals. However, it's worth noting that most of the withdrawn ETH involves CEXs moving the cryptocurrency to their own wallets, rather than it being sent to external addresses.

“This means that the majority ETH being sent to CEXs is not primarily for selling, but for the exchange’s internal operations,” according to Nansen.

Source Coindesk