First Mover Asia: Bitcoin Holds Firm Below $30K as Sam Bankman-Fried Returns to Incarceration

First Mover Asia: Bitcoin Demonstrates Resistance to CPI Effects

First Mover Asia: Bitcoin Tempts $30K as Investors Eagerly Await ETF Approval

Good morning. Here’s what’s happening:

Prices: Bitcoin remained steady at approximately $27,300.

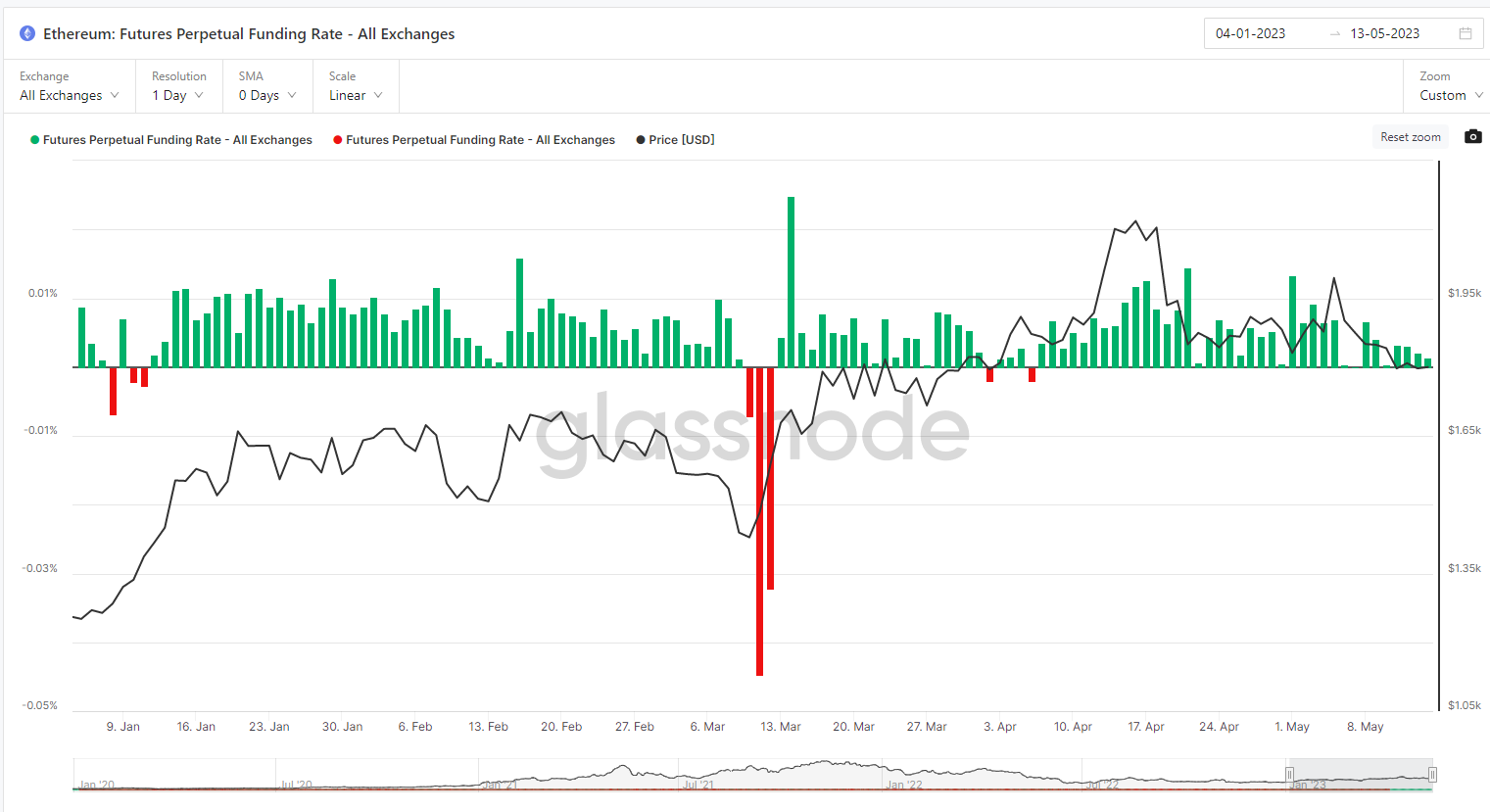

Insights: Funding rates on bitcoin and ether perpetual futures continue to display a positive sentiment, serving as a reliable indicator.

Prices

|

$27,170

+253.1 ▲ 0.9%

|

$1,817

+17.0 ▲ 0.9%

|

1,169

+12.5 ▲ 1.1%

|

|

S&P 500

4,136.28

+12.2 ▲ 0.3%

|

Gold

$2,020

+5.7 ▲ 0.3%

|

Nikkei 225

29,626.34

+238.0 ▲ 0.8%

|

BTC/ETH prices per CoincryptoUs as of 7 a.m. ET (11 a.m. UTC)

Quiet market translates to less bullish energy

The cryptocurrency markets experienced a period of calmness as both bitcoin (BTC) and ether (ETH) traded below their 20-day moving average.

Both bitcoin (BTC) and ether (ETH) were trading below their 20-day moving averages in a tranquil crypto market.

As stated by Glenn Williams Jr., a markets analyst at CoinDesk, monitoring trading volumes will be crucial as they have the potential to magnify or dampen the sentiment driving a specific market direction.

Jeff Dorman, the chief investment officer at digital-asset manager Arca, highlights that bid/ask spreads, which indicate the disparity between the buying price and the selling price, have widened significantly, particularly due to the departure of several market makers from the cryptocurrency space.

"The prices of most digital assets are stuck in a wind tunnel," Dorman in a newsletter.

Insights

Funding rates remain positive in crypto markets

The perpetual futures funding rates for both bitcoin and ether continue to remain in the positive territory, indicating that market sentiment remains optimistic at the present moment.

Funding rates on bitcoin perpetual futures.

Perpetual funding rates reflect the payments made within futures markets between participants who hold either long or short positions on the asset. Positive funding rates indicate that long position holders pay fees to short position holders, while negative funding rates imply the opposite scenario.

Funding rates can serve as an indication of either bullish or bearish sentiment. Positive rates typically reflect a bullish sentiment, while negative rates generally indicate a bearish sentiment.

In the past 10 trading days, Bitcoin has experienced positive funding rates for 8 days. On the other hand, Ether has had positive funding rates for 7 days, with 3 instances of rates declining to zero. However, since April 6, Ether's funding rates have not fallen below zero.

Important events.

10:00 a.m. HKT/SGT(2:00 UTC) China Retail Sales (YoY/April)

2:00 p.m. HKT/SGT(6:00 UTC) United Kingdom Claimant Count Change (April)

8:30 p.m. HKT/SGT(12:30 UTC) Bank of Canada Consumer Price Index Core (YoY/April)

Source Coindesk