First Mover Asia: Bitcoin Holds Firm Below $30K as Sam Bankman-Fried Returns to Incarceration

First Mover Asia: Bitcoin Demonstrates Resistance to CPI Effects

First Mover Asia: Bitcoin Tempts $30K as Investors Eagerly Await ETF Approval

Good morning. Here’s what’s happening:

Prices: BitBull Capital suggests that Bitcoin is currently in a phase of consolidation as it prepares for a potential retest of the $30,000 level.

Insights: While the crypto industry's expenditure on lobbying is comparatively lower than other industries, there might be a need for a shift in this approach.

Prices

|

$26,593

−517.1 ▼ 1.9%

|

$1,798

−24.0 ▼ 1.3%

|

1,179.39

−18.1 ▼ 1.5%

|

|

S&P 500 daily close

4,191.98

−6.1 ▼ 0.1%

|

Gold

$1,981

+2.6 ▲ 0.1%

|

Treasury Yield 10 Years

3.69%

▲ 0.0

|

BTC/ETH prices per CoiCryptoUs Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Good morning Asia,

Bitcoin and Ether are continuing their gradual decline as the Asian trading week begins. Bitcoin has opened with a 1.3% decrease, now trading at $26,779, while Ether is down 0.8% at $1,806.

Over the past month, Bitcoin has predominantly been in a phase of consolidation, gradually decreasing in value but still managing to retain its stability. With just a 2% decline over the last 30 days, this period serves as a welcome respite for investors after the tumultuous roller-coaster ride experienced last year.

“Bitcoin has corrected to levels between $27k and $25k. This is where we’d like to see some consolidation before a retest of $30k in the coming days,” Joe DiPasquale, CEO of BitBull Capital, said to CoinDesk in a note. “While the market may not rally in the near term, the price action is following expectations as we witness consolidation during bearish sentiment.”

In the meantime, Tornado Cash's TORN token is making a comeback following an incident of vote fraud targeting the protocol's DAO over the weekend. This attack, which was not characterized as an exploit or hack, involved the perpetrator submitting a seemingly harmless proposal that concealed malicious code, granting them unauthorized access to all governance votes.

Following the incident, the TORN token of the protocol experienced a significant decline of 40%, plummeting from $5.76 to $3.59. However, it has since shown signs of recovery and currently stands at $4.66.

The Tornado Cash community is actively exploring remedies to revert the unauthorized code modifications and contemplating the possibility of developing a fresh contract that includes airdropped tokens for current holders.

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | −6.0% | Entertainment |

| Terra | LUNA | −4.5% | Smart Contract Platform |

| Solana | SOL | −4.3% | Smart Contract Platform |

Insights

The Crypto Industry's Lobbying Deficit

A recent report by Open Secrets, a political watchdog based in Washington, D.C., reveals that federal lobbying expenditures in the first quarter have once again exceeded $1 billion, marking the second consecutive year of surpassing this significant milestone.

Leading the charts in lobbying expenditures are the anticipated sectors of healthcare, finance, real estate, and energy.

In the year 2022, a total of $4.1 billion was invested in federal lobbying endeavors by industries and advocacy groups of various sizes and types.

Regarding cryptocurrencies? Despite facing growing regulatory opposition from Washington D.C, the cryptocurrency industry's expenditure on lobbying amounted to $21.6 million for the year, as per data from Open Secrets. Undoubtedly, this represents an increase compared to previous years, but considering the industry's market capitalization slightly surpasses $1 trillion, it wouldn't even rank among the top 20 in terms of lobbying expenses.

By contrast, the pharmaceutical industry allocated a staggering $375.2 million towards lobbying efforts in 2022. In the same year, the automotive sector dedicated $82 million, while commercial banks disbursed $64.6 million to lobbyists.

Open Secrets recently revealed that the industry's political contributions to election campaigns experienced a tenfold growth from 2020 to 2022, reaching a remarkable total of $2.3 million in the latter year. Standing out among the major contributors was Coinbase, which single-handedly allocated an impressive $3.4 million towards lobbying initiatives.

Open Secrets' data reveals a notable surge in lobbying activities by prominent players in the crypto industry during the initial quarter of the year.

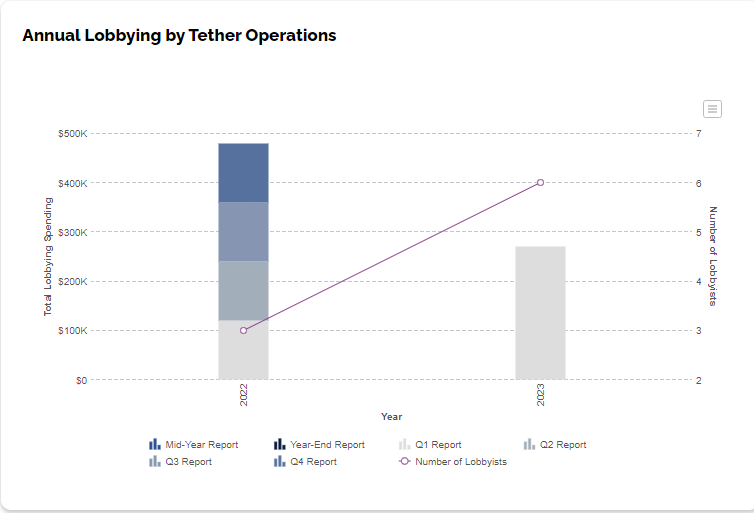

In the first quarter of 2023, Tether allocated $270,000 towards lobbying efforts, a significant increase compared to their expenditure of $100,000 in the same period of 2022. Despite seeming modest, this surge in spending demonstrates a substantial growth.

The Blockchain Association has also experienced an increase in its lobbying expenditures, reaching $490,000 for the current quarter, compared to $460,000 during the corresponding period last year. Additionally, stablecoin issuer Paxos witnessed a significant surge, with its lobbying spending escalating from $50,000 in Q1 2022 to $80,000 in the most recent quarter.

Naturally, the lobbying expenditures of TradFi overshadow all of this. The American Bankers Association allocated a staggering $2 million during the previous quarter, while Citigroup devoted $1.4 million to their lobbying efforts.

Regrettably, in today's political landscape, lobbying has become an essential aspect for the success of businesses. This holds true for the crypto industry as well, as it appears they must engage in even greater lobbying efforts to further their achievements.

Important events.

Bitcoin Pizza Day

9:15 a.m. HKT/SGT(1:15 a.m. UTC): People's Bank of China interest rate decision