Bitcoin Languishes as ETF Optimism Subsides; PEPE Takes the Lead in Altcoin Profits

Spurious PayPal USD Tokens Surprisingly Appear Across Multiple Blockchains

First Mover Asia: Bitcoin Tempts $30K as Investors Eagerly Await ETF Approval

Bitcoin Pizza Day has taken a somber twist, as meme coin creators have managed to make a profit of over $200,000 through rug pulls involving pizza-themed tokens. This unfortunate occurrence took place on the 13th anniversary of what is believed to be the initial commercial transaction made with bitcoin.

Based on the data provided by the "live new pairs" section of Dextools, it has come to light that within the last 24 hours, a total of 14 meme coins associated with pizza have been launched. Unfortunately, four of these coins have been verified as rug pulls, which involve deceptive schemes resulting in the theft of investors' funds through various techniques. Moreover, at least five other coins are suspected of being honey pots, a term used to describe assets that can only be sold back to the contract creator, leaving purchasers stranded with worthless tokens they are unable to dispose of.

Bitcoin Pizza Day, celebrated on May 22nd, commemorates a significant event from 2010. It was on this day that computer developer Laszlo Hanyecz made history by purchasing two pizzas in exchange for 10,000 bitcoins.

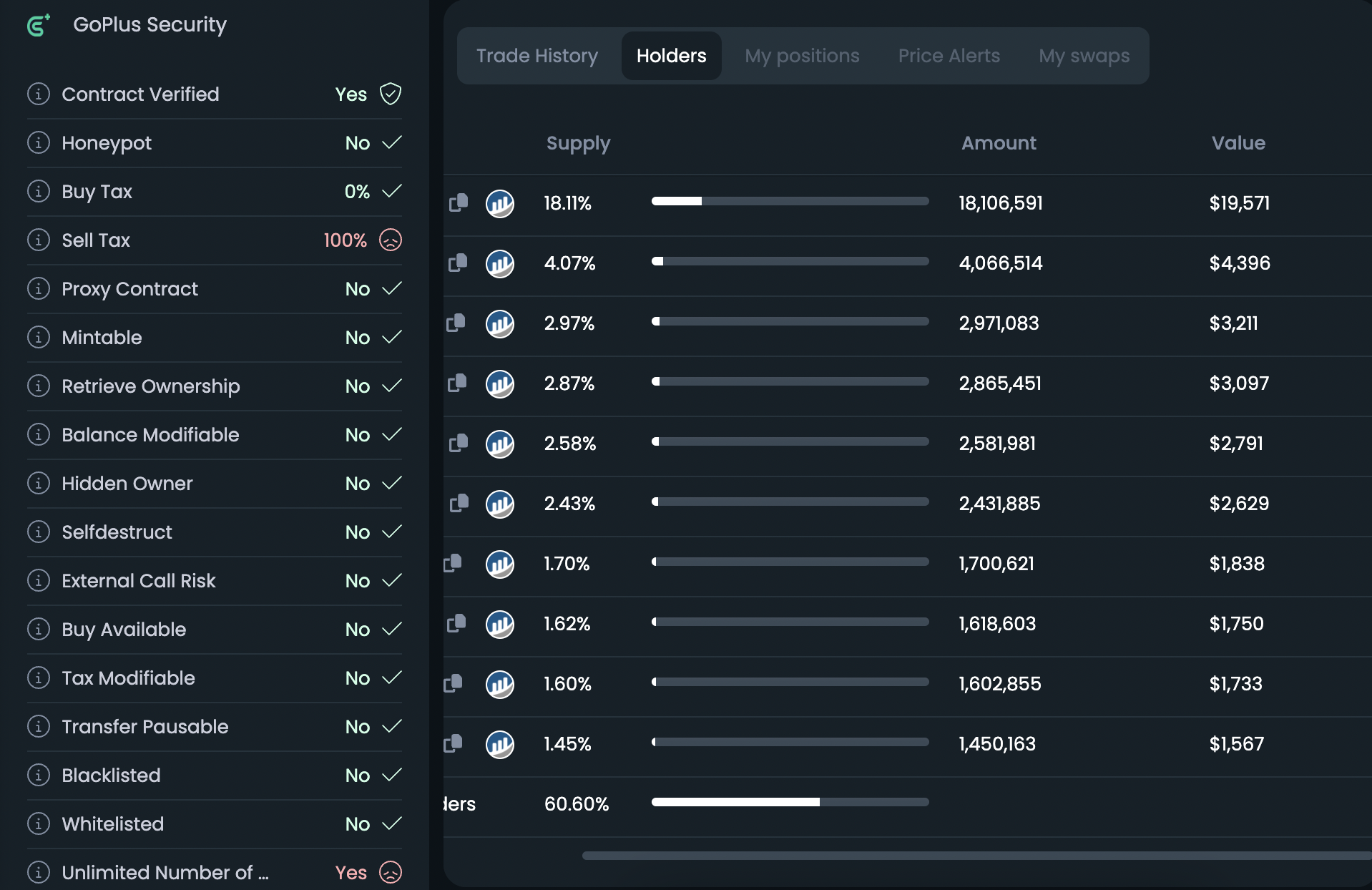

The inaugural meme coin to emerge was Pizza Coin (PIZZA). However, its existence was fleeting, lasting a mere eight minutes, as the developers swiftly modified the sell tax rate, effectively preventing investors from liquidating their assets. A total of 34 traders purchased the token, resulting in a collective loss of 0.9892 ETH ($1,800).

Undeterred, investors subsequently gravitated towards tokens named Bitcoin Pizza and Pizza Inu, only to incur losses exceeding $12,000 in aggregate.

Ethpizza and Bpizza soon followed suit, with Ethpizza attaining a market capitalization of $40,000, while Bpizza skyrocketed to over $100,000. However, both tokens faced an unexpected obstacle as the contract owner intervened by suspending transfers and sales, rendering them unsellable.

There are several methods through which developers can undermine projects. One such method involves incorporating a flexible sales tax into the smart contract, allowing the contract owner to increase the tax to such an extent that it renders the tokens unmarketable. Another, which is more prevalent, is for the owner of a smart contract to retain the majority of tokens and wait for their price to surge before selling them into newly formed liquidity, thereby taking advantage of unsuspecting investors.

The enthusiasm among investors to purchase tokens, none of which possess any intrinsic value, originated from the recent surge in "meme coin mania" after pepe achieved a remarkable market cap of $1 billion. Investors appear to be seeking the next sensationalized token in a market that carries boundless potential for losses.