NounsDAO on the Brink of Treasury Division Split Amidst 'Rage Quit' Uprising by NFT Holders

U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Bitcoin and Ether followed slightly different trajectories during the final week of May. While ether experienced a 1.5% increase, bitcoin remained relatively stable and was trading at approximately $26,700, just slightly below its value from the previous Friday.

Ether has been closing the performance gap with Bitcoin this year, with a year-to-date gain of 52% compared to Bitcoin's 60% increase. Since May, the ETH/BTC ratio has seen a notable increase of 6.7%. Despite these positive developments, both assets are currently heading towards their first losing month of 2023.

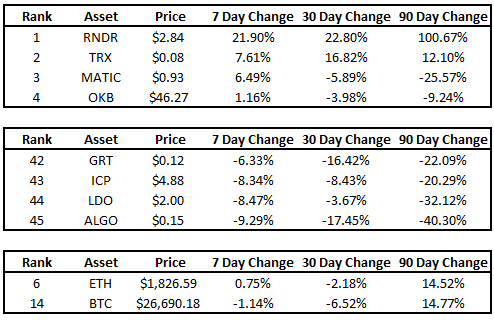

BTC and ETH ranked sixth and 14th, respectively, in terms of their seven-day performance among cryptocurrencies with a market capitalization of $1 billion or higher.

The top performers of the week were Render Token (RNDR) and Tron (TRX), experiencing gains of 21.9% and 7.6% respectively. On the other hand, LDO and ALGO struggled, with declines of 8.5% and 9.3% respectively.

Investors have been closely monitoring the debt ceiling negotiations between President Joe Biden and U.S. House Speaker Kevin McCarthy. Although it is widely anticipated that a deal will be reached before the June 1 deadline, the two parties had not yet reached an agreement as the Memorial Day weekend approached.

In addition, market participants were analyzing the Friday report on Personal Consumption Expenditure (PCE), which revealed higher-than-expected price increases in the United States during April. The core PCE, excluding the volatile food and energy sectors, recorded a 0.4% rise, surpassing the projected 0.3% increase.

The unforeseen surge diminishes the probability of the Federal Open Market Committee (FOMC) pausing the upward adjustments in interest rates during its scheduled meeting on June 14.

Based on the CME Fedwatch tool, the likelihood of interest rates staying at the current target rate of 5%-5.25% dropped from 83% to 38% this week. Meanwhile, the probability of a 25 basis point hike increased from 17% to 62%.

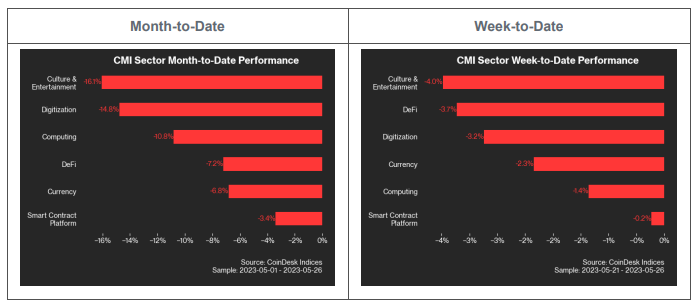

Several sectors experienced significant drawdowns.

This week witnessed a decline across all six sectors of the CoinDesk Market Index. Among them, the Smart Contract Platform sector experienced the smallest drop, with a decrease of only 0.2%. On the other hand, the Culture and Entertainment sector had a challenging week, enduring a significant decline of 4%.

Out of the 156 individual assets comprising the base of CMI sectors, a mere 20 managed to conclude the week with positive gains. One noteworthy standout, despite having a market capitalization of less than $1 billion, was the decentralized computation token ARPA, which surged by an impressive 88%. Moreover, ARPA has exhibited strong performance in recent periods, trading 167.2% higher over the course of the month and over 200% higher compared to the past 12 months.