Bitcoin Bulls Encounter Headwinds as Monthly Stochastic Indicator Trends Downward: Analyst

JPMorgan Anticipates Minimal Downside for Cryptocurrency Markets in the Short-Term

Bitcoin's Most Oversold Levels Since Covid Crash Indicated by Key Metrics

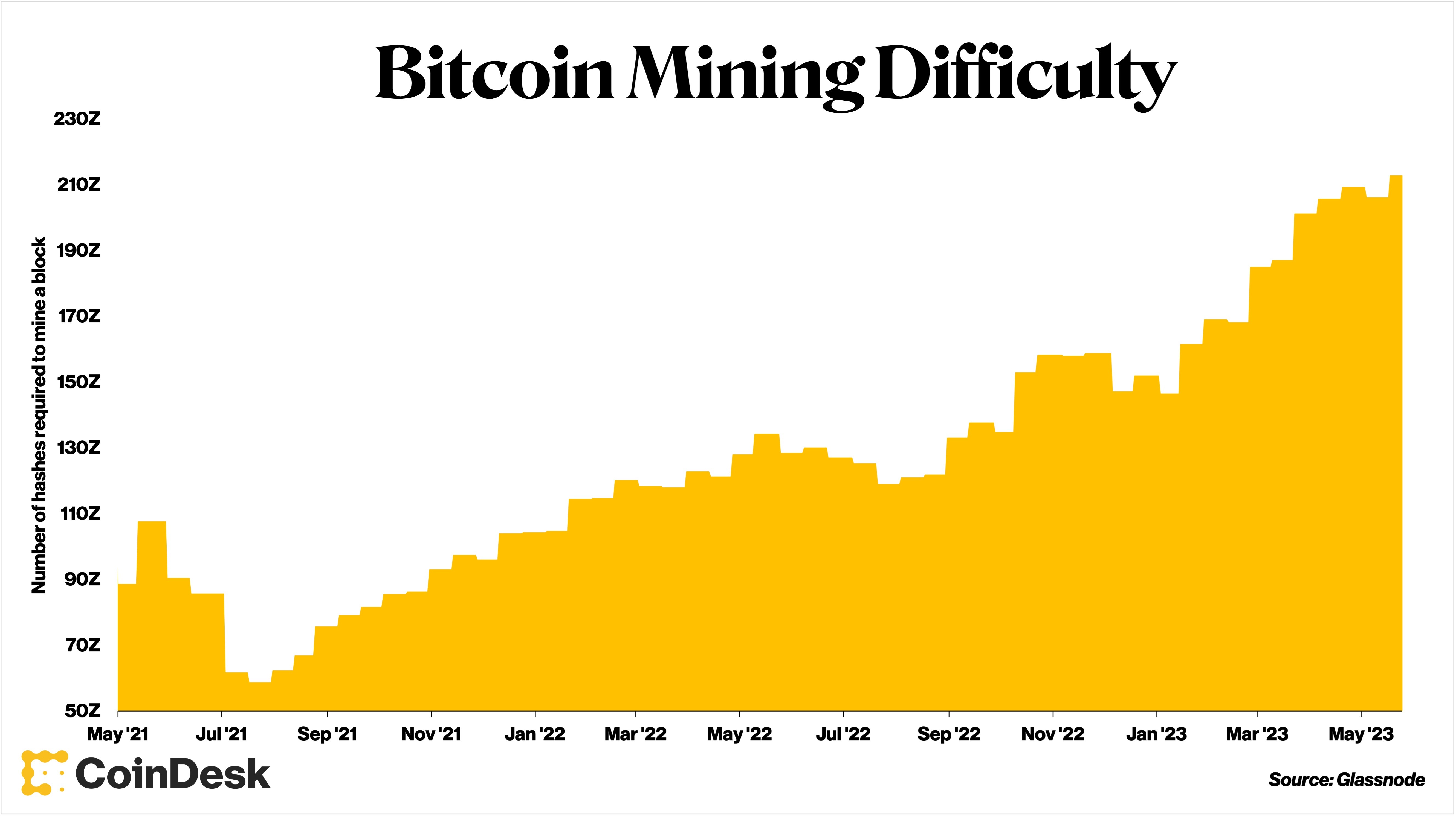

The bitcoin mining difficulty, which indicates the level of ease with which miners can uncover a bitcoin block, is poised to exceed the 50T milestone on Wednesday, establishing a groundbreaking record, with the potential for further growth in the future.

The surge in bitcoin this year and the increasing adoption of the Ordinals protocol have resulted in enhanced profitability for miners. Consequently, miners are actively deploying additional mining machines as per their plans. These factors collectively contribute to a significant increase in computing power, consequently leading to record-breaking levels of mining difficulty.

The bitcoin mining difficulty automatically adjusts to accommodate the increasing computing power, known as hashrate, being added to the network. This adjustment ensures that the average time required to mine a block remains approximately 10 minutes, maintaining stability in the mining process.

“New-generation machines will continue to get plugged in as rack space is made available,” said Ethan Vera, chief operating officer at mining services firm Luxor Technologies.

Vera stated that as the ordinals protocol gained popularity, transaction fees increased threefold, thereby contributing to miners' revenue.

The ordinals protocol unlocks supplementary capabilities on the Bitcoin blockchain, including non-fungible tokens and other cryptocurrencies. Consequently, this expands the volume of transactions, ultimately enhancing the profitability of mining a block.

The difficulty of mining a bitcoin block is set to hit 50T on Wednesday, doubling in two years

As mining difficulty increases, miners experience a decrease in profitability since their likelihood of winning any individual block and generating revenue diminishes. Marathon Digital Holdings (MARA), a major mining company, reported a decrease in their monthly mined bitcoin in April, attributed to the rise in difficulty. Likewise, Canadian miner Bitfarms (BITF) incurred losses in the fourth quarter as a result of the heightened difficulty level.

Nevertheless, there are a few factors that could impede the growth of the hashrate.

Tim Rainey, Treasurer at Greenidge Generation Holdings (GREE), suggests that the absence of upward momentum in bitcoin prices and the constraints within the current infrastructure could potentially act as catalysts for change.

Charles Chong, senior manager of business development at Foundry, highlights that the uncertainty surrounding the upcoming Bitcoin halving event could potentially impede the acceleration of mining difficulty.

The ownership of Foundry rests with Digital Currency Group, which is the parent company of CoinDesk.

Furthermore, an excessive concentration of hashrate in a single region can potentially impact the expansion of bitcoin mining difficulty, as it could necessitate alterations in the deployment of mining rigs.

“Given the concentration of hashrate in North America, we are seeing new seasonal trends,” said Colin Harper, head of content and research at Luxor Technologies. Previously, the hashrate would increase during China’s rainy season, when cheap hydropower was plentiful.

However, in the current scenario, when summer heatwaves hit the United States, miners opt to shut down their machines in order to conserve energy used for cooling purposes.

Source Coindesk