U.S. Fed's Vice Chair Barr Suggests CBDC Decision Remains a ‘Long Way’

MicroStrategy's Significant Bitcoin Impairment Losses May Mislead: Berenberg

Bitcoin Approaches Formation of Death Cross as Dollar Index Hints at Golden Crossover

Good morning. Here’s what’s happening:

Prices: A recent report by K33 highlights the increased volatility witnessed in Bitcoin and Ether during 2023, even though the year began slowly.

Insights: Some observers argue that the market requires a fresh catalyst to propel prices to greater heights. Could ether potentially serve as that catalyst?

Prices

|

$27,686

−54.0 ▼ 0.2%

|

$1,901

+8.4 ▲ 0.4%

|

1,198

+0.9 ▲ 0.1%

|

|

S&P 500

4,205.52

+0.1 ▲ 0.0%

|

Gold

$1,978

+33.7 ▲ 1.7%

|

Nikkei 225

31,328.16

+94.6 ▲ 0.3%

|

BTC/ETH prices per CoinCryptoUs Indices, as of 7 a.m. ET (11 a.m. UTC)

Volatility is Expected, But Was it Missed?

Good morning Asia,

Bitcoin is commencing the East Asia trading day with a value of $27,686, reflecting a slight decline of 0.2%. On the other hand, Ether is currently priced at $1,901, indicating a modest increase of 0.4%.

2023 has proven to be an unusual year for the cryptocurrency market. In December, amidst the challenging period known as crypto winter, bitcoin price predictions were quite gloomy. VanEck anticipated a range of $10,000 to $12,000 for bitcoin during the first quarter of 2023.

However, significant events have unfolded since that time. We have witnessed ordinals, bank failures, and a liquidity crisis.

From March to mid-May, the market remained relatively stagnant, and there was minimal movement in the price of bitcoin.

A new report by K33 Research indicates that a transformation is underway.

Bitcoin's trading range experienced notable fluctuations between $25,800 and $28,000 throughout the previous week, reflecting heightened volatility in the market. The surge in price variation can be attributed to several factors, most notably the potential debt ceiling agreement. This development not only triggered market rallies but also led to increased Bitcoin dominance and trading volumes. Furthermore, the report by K33 highlights the potential for even more market activity due to upcoming regulatory changes in Asia and the re-election of Recep Erdogan as Turkey's president. These factors combine to create an environment of increased anticipation and potential opportunities within the Bitcoin market.

K33 stated that this surge was partially magnified due to over-leveraged short positions, leading to a decline in open interest. Simultaneously, advancements in U.S. debt ceiling negotiations sparked a rally in both the cryptocurrency and U.S. stock markets.

According to experts, these developments, coupled with the evolving structure of the cryptocurrency market where stablecoins and ether are gaining prominence, and bitcoin's relatively reduced dominance, bear striking similarities to the previous bear market, potentially suggesting an inadequate de-risk rotation.

The remedy for all of these issues is increased liquidity, but unfortunately, there is no sign of it in the foreseeable future.

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| XRP | XRP | +4.6% | Currency |

| Solana | SOL | +3.4% | Smart Contract Platform |

| Stellar | XLM | +1.8% | Smart Contract Platform |

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Dogecoin | DOGE | −1.3% | Currency |

| Polygon | MATIC | −0.8% | Smart Contract Platform |

| Chainlink | LINK | −0.6% | Computing |

Could Ether Be the Next Market Driver?

Ether is expected to close the month of May with minimal changes, declining by 0.3%. On the other hand, bitcoin has experienced a significant decrease of almost 7% when compared to ether.

Bitcoin is currently heading towards its first monthly decline since December, as reported earlier by CoinCryptoUs. This downturn can primarily be attributed to the growing probability of the U.S. central bank maintaining higher interest rates, which has resulted in a strengthened U.S. dollar and a subsequent downturn in the cryptocurrency market.

According to experts, the market requires a fresh catalyst to propel prices to a higher level.

Ether has that driver.

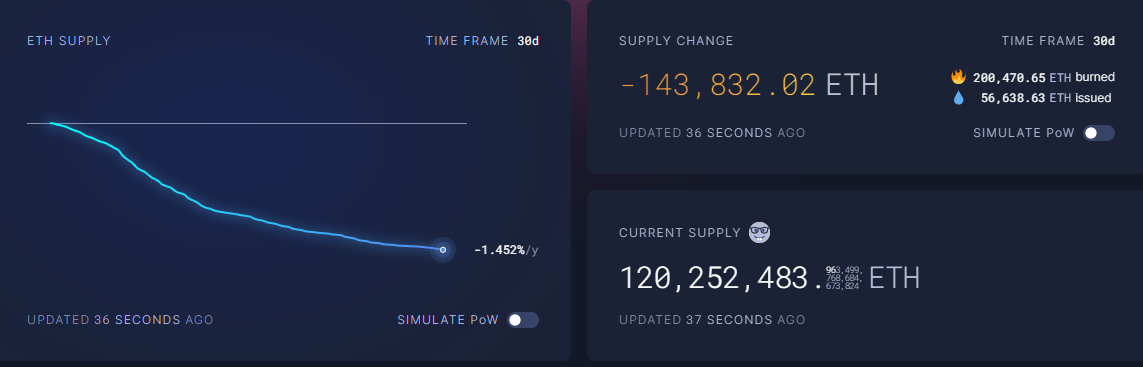

In the past month, an astonishing sum of 143,830 ether, valued at a staggering $275 million, has been consigned to flames, as reported by the ultrasound.money tracker.

Ether is firmly entrenched in its deflationary phase, experiencing a yearly negative supply growth rate of 1.46%. According to projections from the tracker, the network is anticipated to burn a substantial amount of 2,441,000 ether this year, equivalent to approximately $4.5 billion in value.

In stark contrast, the tracker reveals that if Ethereum had remained a Proof of Work protocol, it would be on course for a supply growth rate of 2%.

Data indicates that due to Ethereum's deflationary position, there is a divergence in the correlation between ether and bitcoin.

This year, the once-strong positive correlation between ether and bitcoin has significantly weakened, indicating a profound market shift where they are increasingly operating independently. This divergence can be attributed to the distinct supply-demand dynamics of each asset.

"What we are seeing could be the beginning of a long-term regime change. As Ethereum has shifted from PoW to PoS, the economics of supply and demand underlying the two tokens will continue to diverge," Pulkit Goyal, Vice President of trading at OrBit Markets, previously told CoinDesk.

Based on data from CryptoQuant, more than 13% of the total ether supply has been staked, resulting in record-low balances of ether on exchanges.

Ether has experienced a 2.8% surge in the past week, whereas bitcoin has shown slower progress, with a modest 2% increase over the same timeframe.

9:30 a.m. HKT/SGT(1:30 UTC) Australia Monthly Consumer Price Index (YoY/April)

8:30 p.m. HKT/SGT(12:30 UTC) Canada Gross Domestic Product Annualized (Q1)